Equity Forward Agreement In Fairfax

Description

Form popularity

FAQ

Key Morningstar Metrics for Fairfax Financial Holdings We see shares as materially overvalued, and we think the market is extrapolating favorable market conditions too far into the future.

Fairfax Financial Holdings Limited is the controlling shareholder of Fairfax India. Fairfax Financial Holdings Limited is a Toronto based financial services holding company with a global presence in insurance and reinsurance and a portfolio of assets invested worldwide.

Prem Watsa. Prem Watsa CM (born 5 August 1950) is an Indian-Canadian billionaire businessman who is the founder, chairman, and chief executive of Fairfax Financial Holdings, based in Toronto.

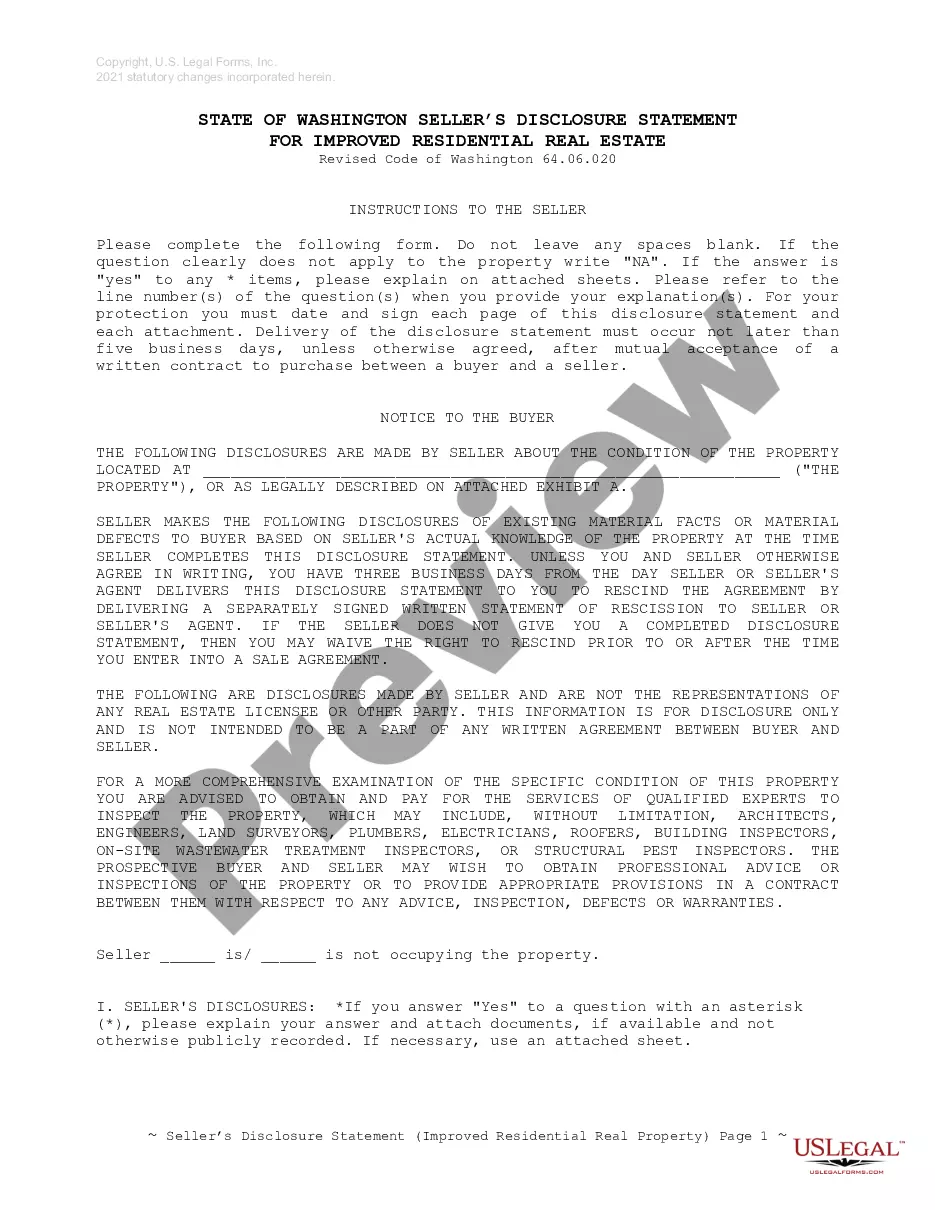

When are my real estate taxes due? Real estate taxes are due in two equal installments. The due dates are July 28 and December 5 each year.

You may obtain the deed book and page number by searching for the document in the Court Public Access Network (“CPAN”) on one of the public computers in the Land Records Research Room or through a subscription. Subscribers to CPAN are able to make non-certified copies from their own computer.

Fairfax County provides real estate tax relief and car tax relief to citizens who are either 65 or older, or permanently and totally disabled, and meet the income and asset eligibility requirements. Qualified taxpayers may also be eligible for tax relief for renters.

The tax period for the first half of real estate taxes is from January 1 to June 30. The tax period for the second half of personal property taxes is from July 1 to December 31. The second half of business tangible personal property taxes are due on October 5. The second half of real estate taxes are due on December 5.

Zoning Ordinance and Safety Rules In general, no more than one family, plus two renters, may live in one house, or no more than four unrelated people may live in one house.

The County Executive's Office focuses on strategic planning, ensuring and valuing excellence in public service, fostering partnerships with our residents and community leaders, preparing the annual budget and executing all resolutions and orders of our elected Board of Supervisors.

In 2022, Fairfax County, VA had a population of 1.15M people with a median age of 38.6 and a median household income of $145,165. Between 2021 and 2022 the population of Fairfax County, VA declined from 1.15M to 1.15M, a −0.128% decrease and its median household income grew from $133,974 to $145,165, a 8.35% increase.