Share Agreement Contract For Construction In Clark

Description

Form popularity

FAQ

A contract can be declared unenforceable if it does not comply with applicable laws, Wolf said. For example, states like California and Florida have extensive and strict licensing laws, and if a contractor takes on a project without being properly licensed, the contract is likely illegal and therefore unenforceable.

Top 10 Common Mistakes that We See in Construction Contracts It's not written down. Both parties haven't signed the contract. Not all of the terms of the agreement are in writing and in the contract. The timeline is unclear. Particular terms aren't defined. There's no written approval of any changes to the contract.

Dispute resolution clauses: These clauses are the most ignored of the 5 key clauses. This is because hope springs eternal at the start of a project and no one thinks a dispute will arise.

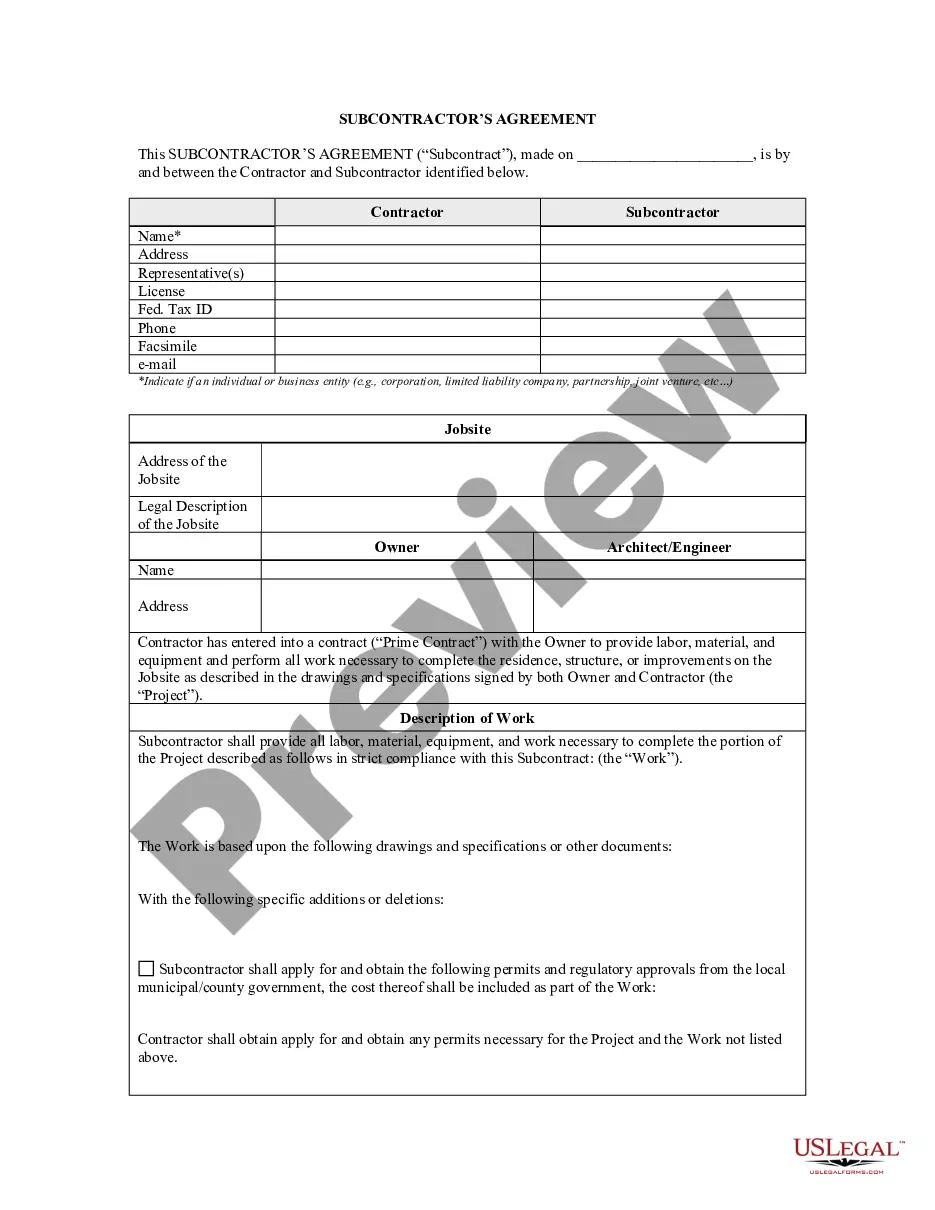

Subcontractor: A specialty contractor hired to complete a certain task on a construction project, such as electrical wiring, drywall installation, or steel framing.

There are 3 kinds of subcontractors in the construction industry Nominated subcontractors. Domestic subcontractors. Named subcontractors.

A subcontractor agreement outlines the business relationship between subcontractors and contractors during a project. It states what work the subcontractor will complete on behalf of the contractor. Ensuring all parties know their responsibilities and obligations is important to any project.

A construction subcontractor is an individual who a contractor or project manager hires to handle a specific aspect of a larger construction project. A subcontractor is a self-employed professional who seeks projects with different teams and organizations.

An MOU between two construction companies is a preliminary document used to note the approach of the granting of a contract to a party. An MOU is typically drawn up between a general contractor and subcontractor or a project owner.

How to draft a contract between two parties: A step-by-step checklist Know your parties. Agree on the terms. Set clear boundaries. Spell out the consequences. Specify how you will resolve disputes. Cover confidentiality. Check the legality of the contract. Open it up to negotiation.

The IRS requires contractors to fill out a Form W-9, a request for a Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.