Template For Bonus Structure In Utah

Description

Form popularity

FAQ

The typical bonus amount can range from 1% to 15% of an employee's salary, usually depending on a number of factors such as industry, company performance, and individual or team accomplishments. The average bonus for employees continues to rise over time. In 2020, the average employee bonus was only 8.1%.

The typical bonus amount can range from 1% to 15% of an employee's salary, usually depending on a number of factors such as industry, company performance, and individual or team accomplishments. The average bonus for employees continues to rise over time. In 2020, the average employee bonus was only 8.1%.

One of the most common types of bonus is an annual bonus, which employers give out once a year. Annual bonuses are usually based on your overall performance, although companies who use profit-sharing rewards may distribute bonuses based on company success and profits.

Simply put, these bonuses are awarded based on how well the company performs as a whole. A typical profit-sharing bonus would be 2.5% to 7.5% of payroll, and bonuses might be given across the board or in larger proportions of compensation for high earners within your organization.

Be straightforward, be sincere and don't be afraid to ``toot your own horn''. Be respectful and let them know how much you love your job and what you do. Then, simply ask for your bonus (or raise). You can either leave out the amount, or if you do state an amount, be ready to negotiate.

The 9.6% average is a good bonus percentage benchmark, but it isn't one-size-fits-all. You should shift this percentage based on industry factors and what's feasible for your company.

To submit the Utah Corporation Franchise Tax Return, you can send it by mail to the Utah State Tax Commission at 210 North 1950 West, Salt Lake City, UT 84134-2000. You may also submit the tax return electronically through approved e-filing services.

All payments by the hour, by the job, piece rate, salary, or commission are wages.

Bonuses are not explicitly addressed in Utah wage laws. Generally, discretionary bonuses are not considered wages, while nondiscretionary bonuses can be considered wages and protected under wage laws. A nondiscretionary bonus is one where the amount and criteria for getting the bonus are announced in advance.

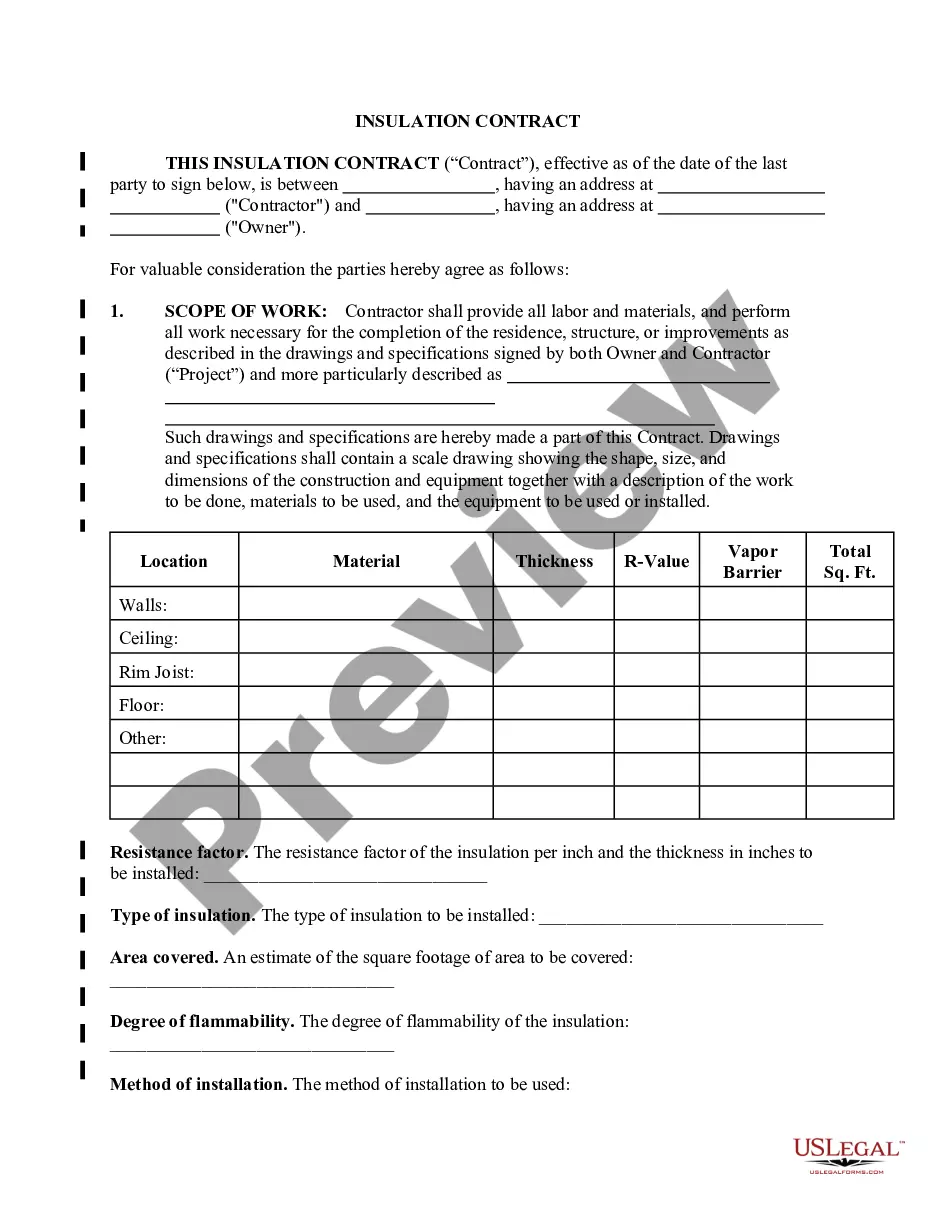

Base your bonus structure on quantifiable results (excluding discretionary bonuses). Create specific, identifiable bonuses matched to measurable performance standards. Incentivize employees. Creative incentives that connect the bonuses to employees' individual financial goals.