Petition Filing Fee In Nassau

Description

Form popularity

FAQ

Nassau County, located in Eastern New York, has sales tax rates ranging from 8.625% to 8.875%. The sales tax rate in Nassau includes the New York state tax and the district's sales tax rates. Certain jurisdictions levy special district taxes.

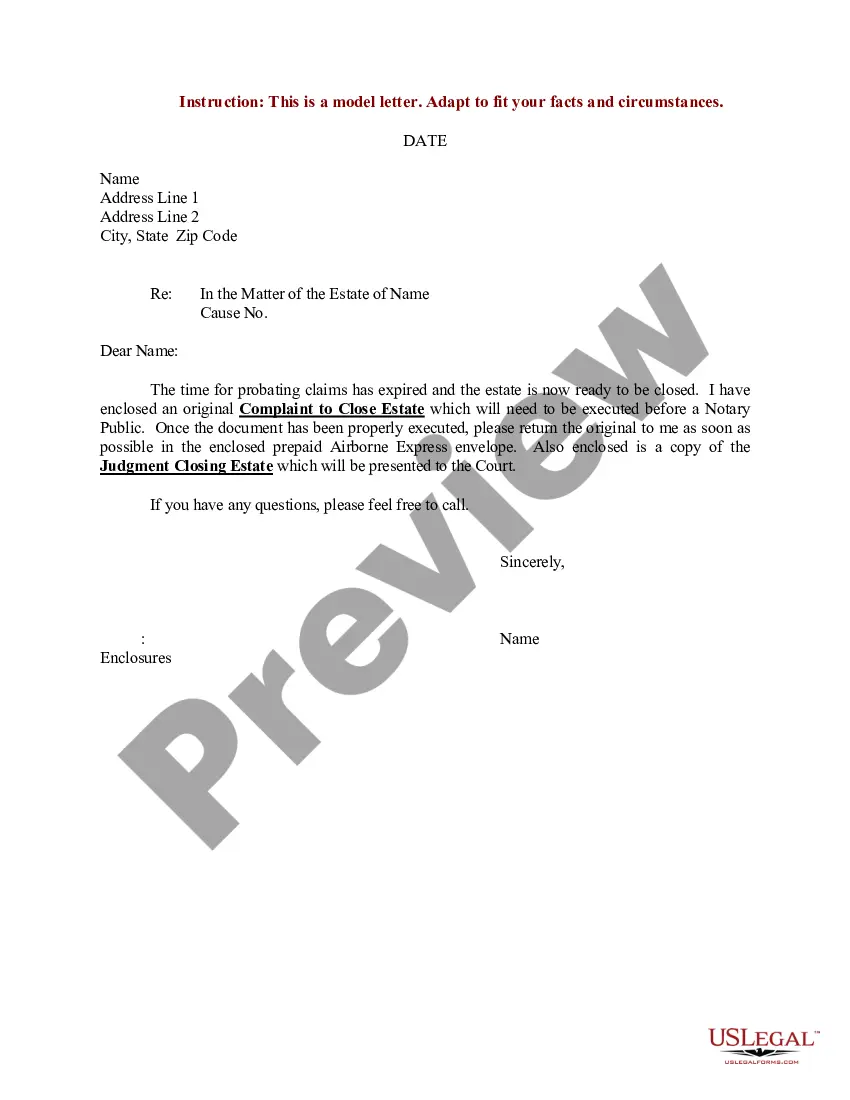

You will not have a trial immediately. A few things will occur before the trial. The IRS attorney will file an “Answer” with the Court and serve a copy on you by mail if you are not yet registered for electronic filing. In the Answer, the IRS will generally admit or deny the statements made in your petition.

Advantages of U.S. Tax Court Taxpayers who sue the IRS in U.S. Tax Court can expect a very high probability of at least partial success. Approximately 80% of tax court cases reach a settlement before even going to trial.

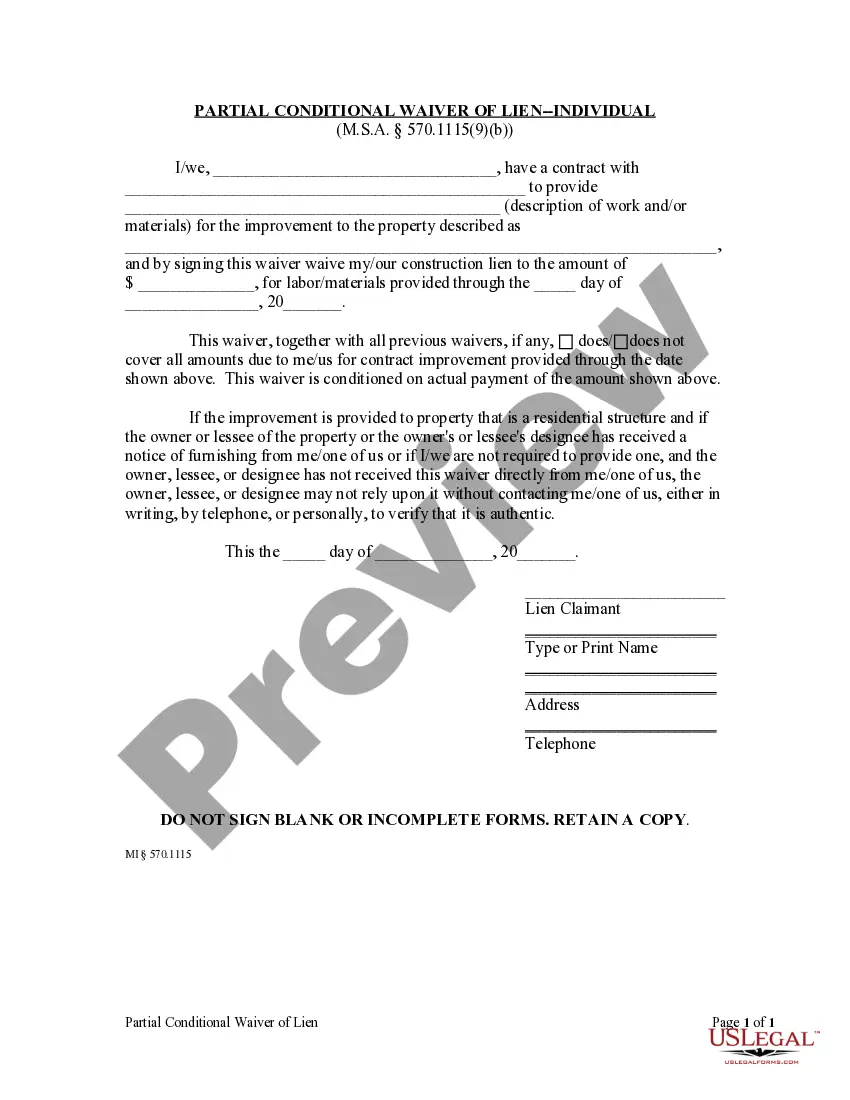

§2402. Fees; amount of. Value of Estate or Subject MatterFee Rate 50 000 but under 100,000 $280.00 100,000 but under 250,000 $420.00 250,000 but under 500,000 $625.00 500,000 and over $1,250.003 more rows