Repossession Form Agreement With Insurance Company In Maryland

Description

Form popularity

FAQ

Illinois Requires Repossession Agents to Clear Personal Data from Vehicles. A new Illinois data privacy law specifically tailored to motor vehicle-secured financing transactions becomes effective on January 1, 2024, and is likely to lead to similar laws in other states.

Falling behind on car payments affects your credit, and this can make it harder or more expensive to get loans in the future. A repossession could also stay on your credit reports for up to seven years. Repossession can also mean paying higher insurance rates.

With replevin, the car lender files a lawsuit seeking an order from the court requiring you to give the car back. If you fail to abide by the court order, you might be subject to both civil and criminal penalties.

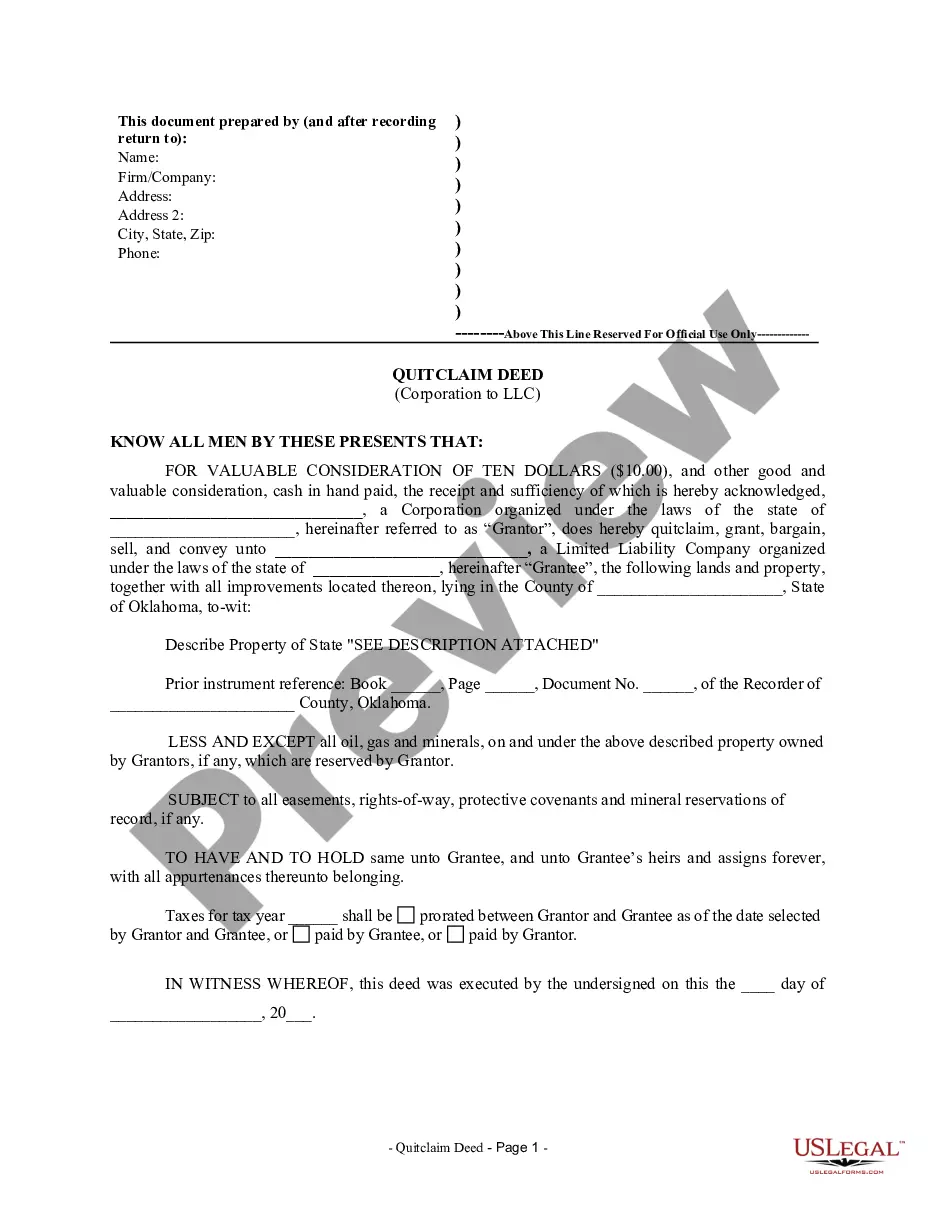

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

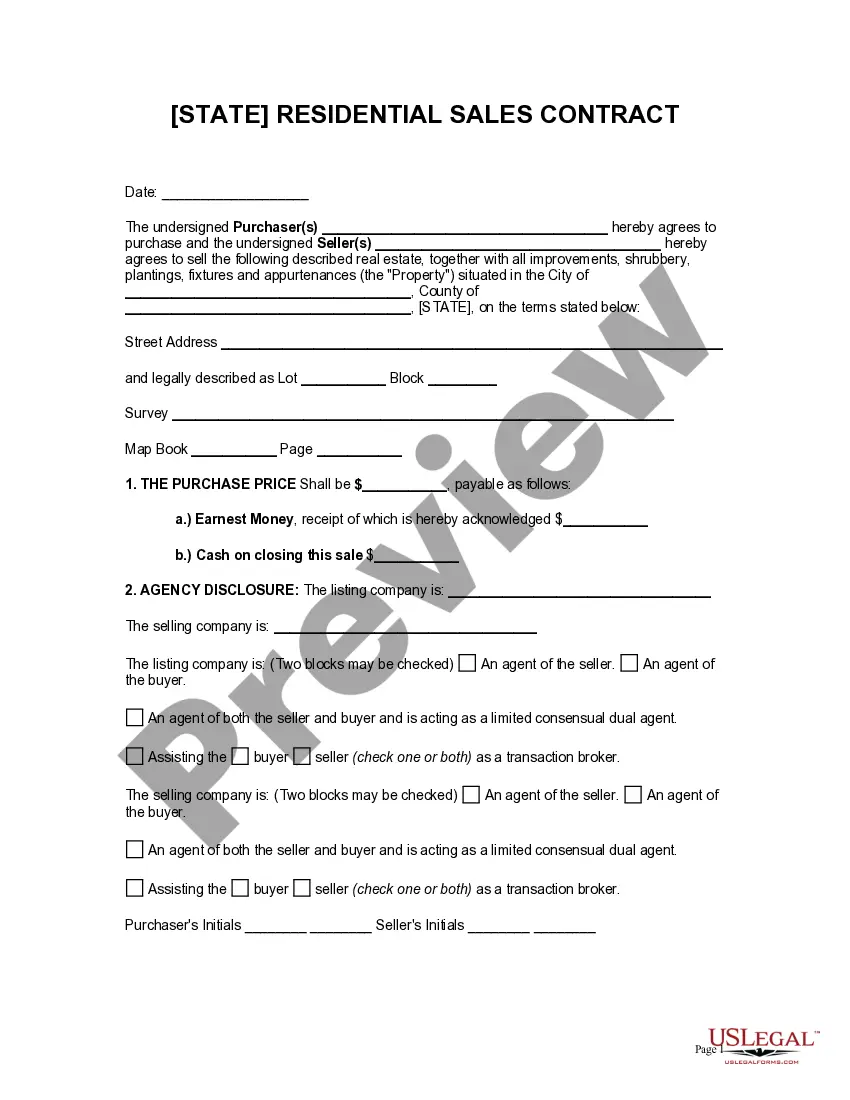

FR-19 is an insurance form, considered as a proof of insurance in the states of Delaware and Maryland. It can be issued only by a car insurance company and certifies that you at least carry the state minimum liability coverage on your registered vehicle.

Can a repo man move another car to get yours? No, a repossession agent may not do that. But, if the repossession company can't access your car because it is hidden, blocked, or locked up, your lender goes to court to get a replevin. Replevin is a court order compelling the collection of the vehicle.

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

Repossession, colloquially repo, is a "self-help" type of action in which the party having right of ownership of a property takes the property in question back from the party having right of possession without invoking court proceedings.

In Maryland, a car lender has the right to take your car without first having to sue you in court as long as the person repossessing the car does not breach the peace. Other lenders may sue you in court for a replevin action, which is an action to take back the item(s) securing their liens.