Complaint Repossession Document For Lease In California

Description

Form popularity

FAQ

Evidence Can Prove a Wrongful Repossession Case From detailed written statements to visual documentation of property damage, illegal access, and proof of timely payments, the types of evidence required may vary depending on the circumstances.

Dispute Inaccurate Information Initiate a formal dispute with all necessary credit reporting agencies (CRAs) that issued the report containing the repossession. You can dispute a repossession online with all three credit reporting agencies, and this is the most efficient way to pursue removal: Experian. Equifax.

You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale. A sale could include a lease or license.

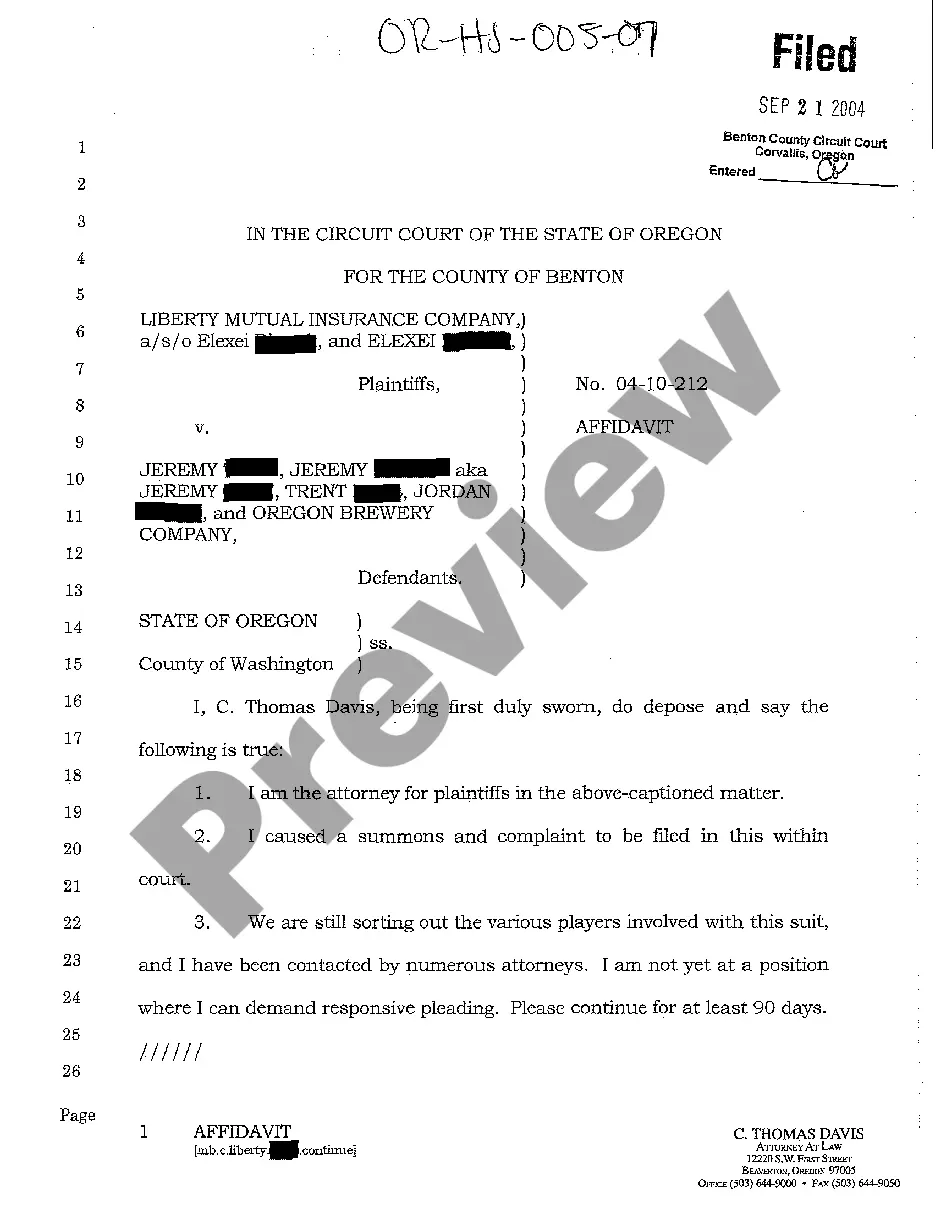

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

In California, a consumer's vehicle can be taken from them if they miss payments on their loan or if they violate any terms of their agreement. This process is known as repossession and the creditor has the right to repossess the consumer's vehicle if it holds a valid security interest in it.

Wrongful repossession can have long-lasting effects on your reputation and creditworthiness. A repossession record on your credit report can negatively impact your credit score, making it difficult to secure loans, obtain favorable interest rates, or even find suitable housing in the future.

You can also use websites like Carfax, Auto Trader, Buy It Now, eBay and CarsDirect. All these websites provide information about repossessed cars.

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

Start the letter by identifying yourself and the property. The lender will need to identify your loan, so include an account number. Give them your name, address and contact information. Tell the lender that you are voluntarily giving the item back because you can no longer make the payments.