Declaratory Judgment Insurance Coverage In Illinois

Description

Form popularity

FAQ

A declaratory judgment is a legally binding judgment where a court declares the rights and obligations of the parties to a written agreement, such as an insurance policy or other contract.

You are in compliance with the law if you have liability insurance in the following minimum amounts: $25,000 for injury or death of one person in a crash. $50,000 for injury or death of more than one person in a crash. $20,000 for damage to property of another person.

Illinois Diminished Value Law Illinois is a diminished value state meaning there is case law supporting your legal right to compensation when another party is at-fault. If the other driver was uninsured, your insurance policy may include coverage for diminished value as well.

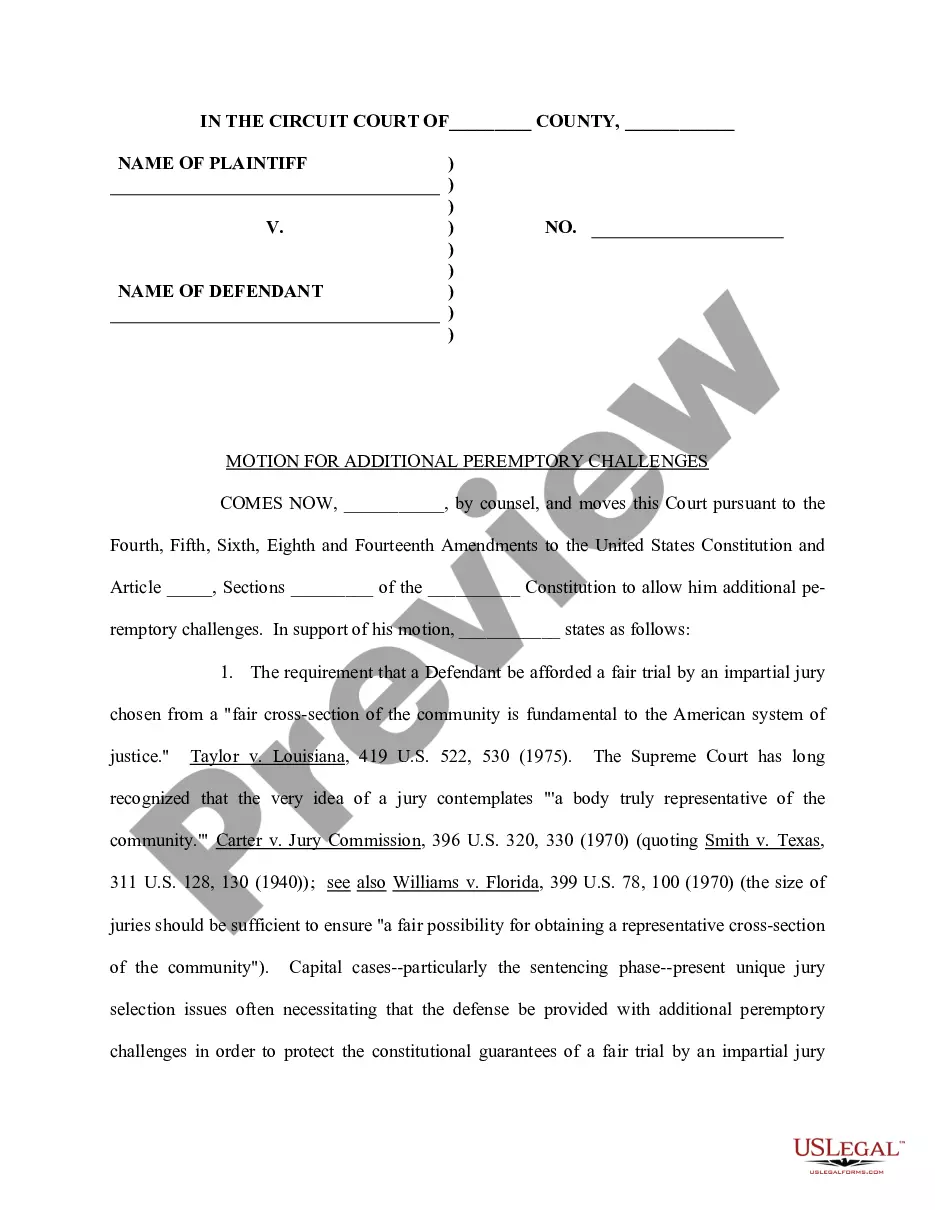

“Actions for declaratory judgment are also governed by the same six-year statute of limitations and accrue when a plaintiff receives a judicially cognizable injury.” See Baroudi v.

Failing to add your teenager to your auto insurance can lead to coverage denial, legal penalties and policy cancellation. Lack of driving experience and perceived higher risk contribute to higher car premiums for teen drivers.

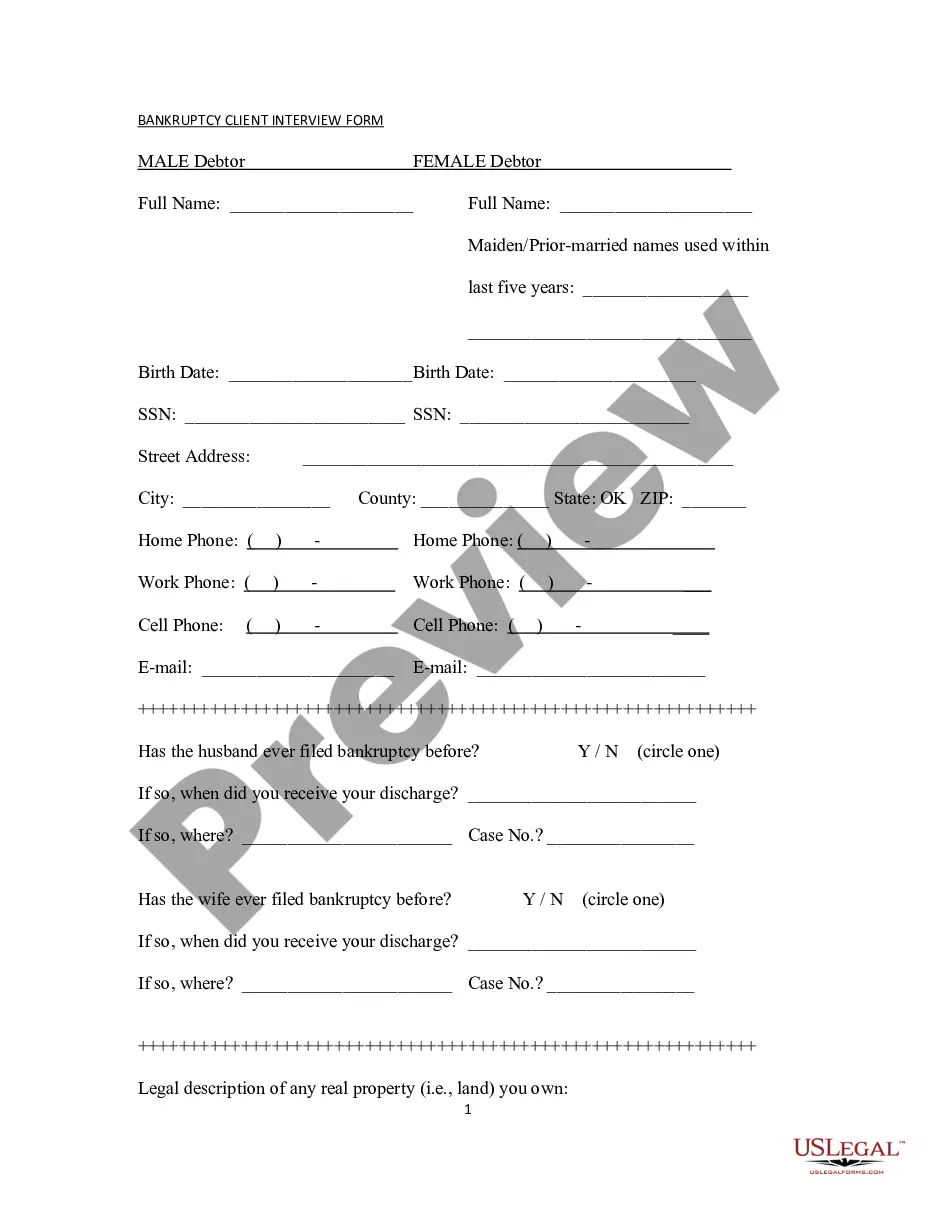

However, there is another type of compensation that you may receive – punitive damages. Punitive damages are not available for all Illinois personal injury or wrongful death claims. They can be appropriate when the defendant you are making a claim against has done something very wrong.

As a general rule, punitive damages are not insurable under Illinois law. Bernier v. Burris, 113 Ill.

Typically, when filing a declaratory judgment action, insurers seek an adjudication of both their duty to defend and their duty to indemnify, because the duty to defend is broader than the duty to indemnify and, if insurers do not have the former duty, then they typically do not have the latter duty, either.

While most states allow an insured to shift punitive damage awards to the insurer, a few prohibit this outright. Some states cap punitive damage awards and are generally considered more defendant-friendly, while others are deemed more plaintiff-friendly.

In Illinois, there are no caps or limits on the amount of punitive damages that can be awarded.