Affidavit Amend Form With Irs In Travis

Description

Form popularity

FAQ

You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Login on the CDTFA's secure website with your Username and Password. Select the account for which you want to submit an amended return for under the "Accounts" tab. Select the period for which you want to submit an amended return for under "Recent Periods" tab.

File Form IL-1040-X, Amended Individual Income Tax Return, for tax years ending on December 31, 2021, and December 31, 2020, on MyTax Illinois. Use MyTax Illinois to electronically file your Amended Individual Income Tax Return.

You can file Form 1040-X, Amended U.S. Individual Income Tax Return electronically with tax filing software to amend your Form 1040, 1040-SR, 1040-NR, or 1040-SS/PR for the current or two prior tax periods. If amending a prior year return originally filed on paper, then the amended return must also be filed on paper.

But, one thing is clear: Unlike an original Form 1040 – 90% of which are e-filed – amended returns are processed by an actual person at the IRS. That means the IRS doesn't automatically accept amended returns. However, the IRS won't open an audit (or, “examination”) simply because you file an amended return.

Use Form 1040X, Amended U.S. Individual Income Tax Return, to file an amended tax return. Be advised – you can't e-file an amended return. A paper form must be mailed in. You should consider filing an amended tax return if there is a change in your filing status, income, deductions or credits.

Login on the CDTFA's secure website with your Username and Password. Select the account for which you want to submit an amended return for under the "Accounts" tab. Select the period for which you want to submit an amended return for under "Recent Periods" tab.

You can check the status of an amended return around 3 weeks after you submit it. You should generally allow 8 to 12 weeks for your Form 1040-X to be processed. However, in some cases, processing could take up to 16 weeks. You can visit our processing status dashboard for more information on our timeframes.

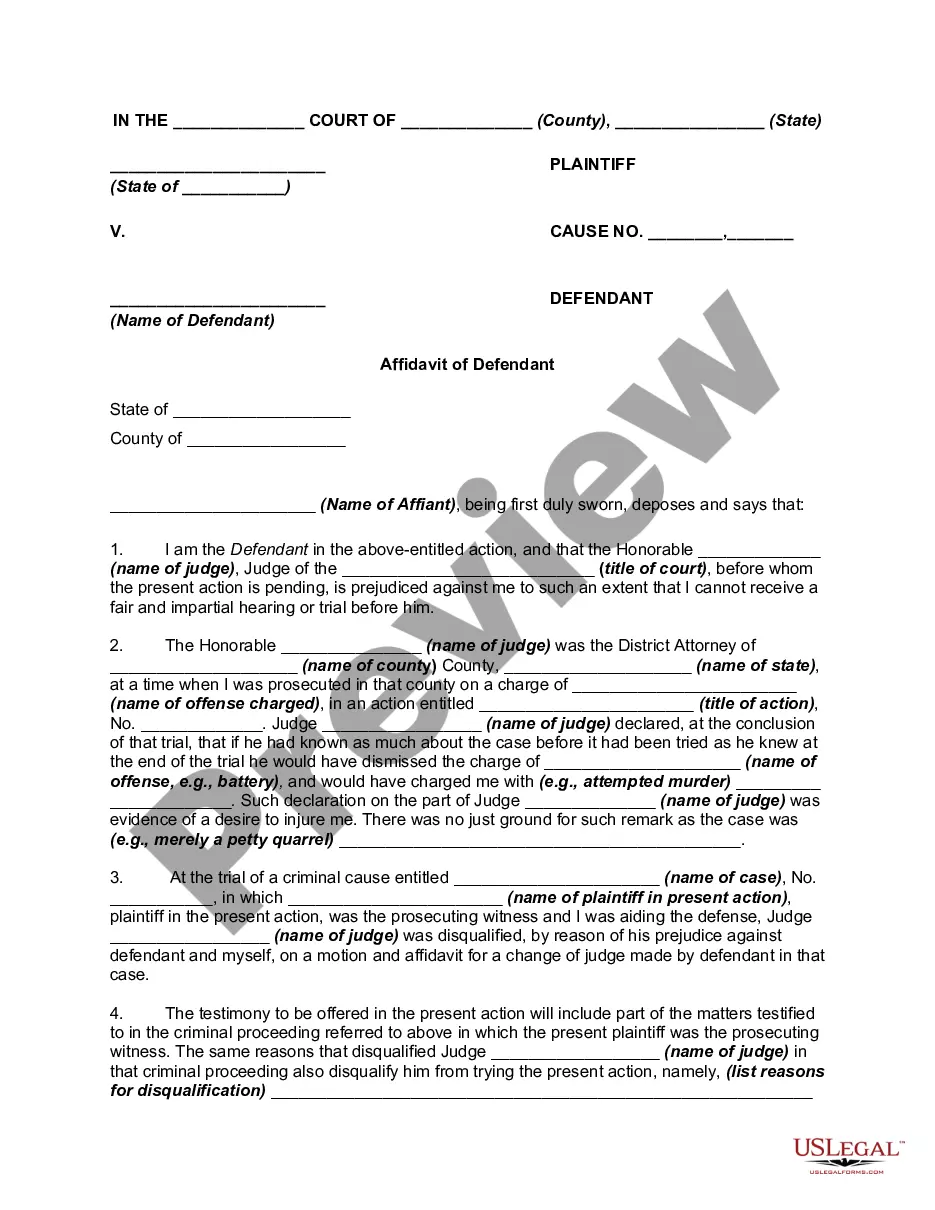

This affidavit has two parts: • Part One — the ID Theft Affidavit — is where you report general information about yourself and the theft. Part Two — the Fraudulent Account Statement — is where you describe the fraudulent account(s) opened in your name.

Form 14039 can also be completed online at . The IRS process for assisting victims selecting Section B, Box 1 below is explained at irs/victimassistance.