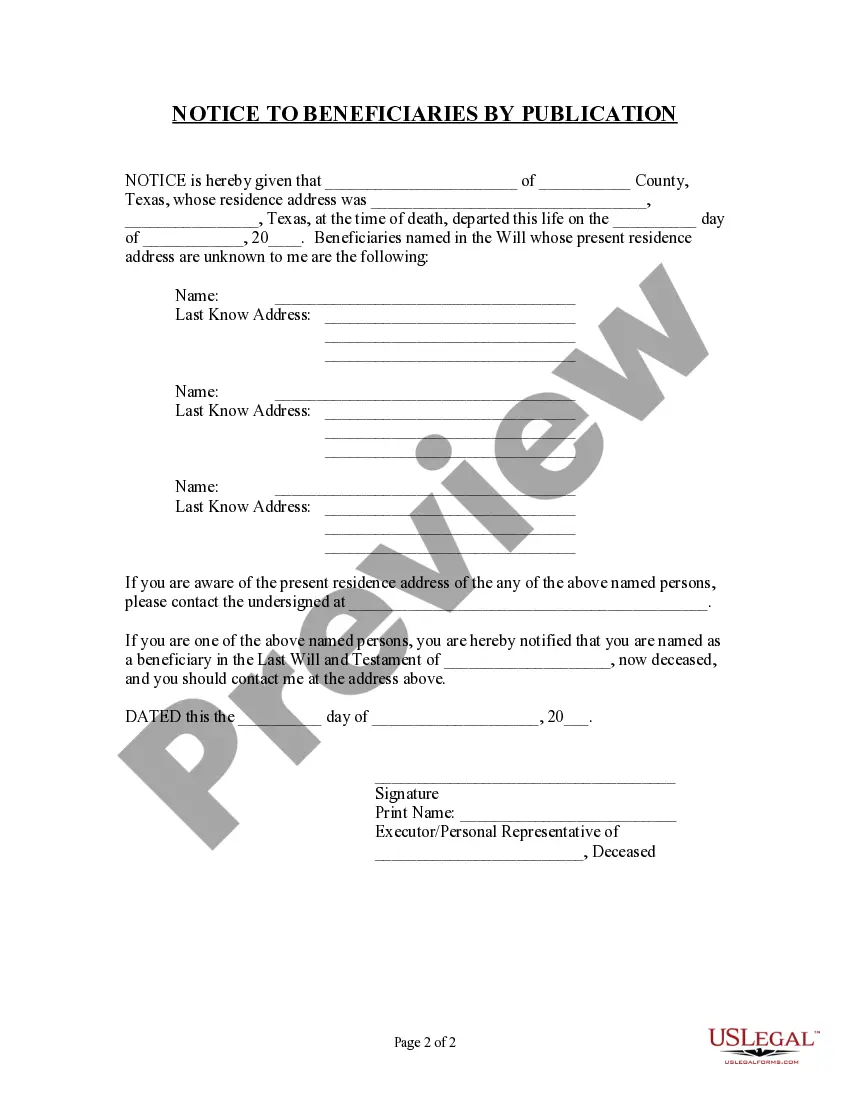

Notice Beneficiaries Form For Trust

Description

How to fill out Texas Notice To Beneficiaries Of Being Named In Will?

It’s clear that you cannot transform into a legal expert in a single night, nor can you quickly learn how to draft a Notice Beneficiaries Form For Trust without having a specialized background. Compiling legal documents is a lengthy process that necessitates particular education and expertise. So why not entrust the development of the Notice Beneficiaries Form For Trust to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can discover anything from judicial documents to templates for internal corporate communication. We recognize the significance of compliance and adherence to federal and state laws and regulations. That’s why, on our platform, all templates are location-specific and current.

Here’s how to begin with our website and obtain the document you need in just minutes.

You can regain access to your forms from the My documents tab at any time. If you’re an existing client, you can easily Log In, and find and download the template from the same tab.

Regardless of the purpose of your documents—whether financial and legal, or personal—our website has you covered. Try US Legal Forms now!

- Find the form you’re looking for by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to see if the Notice Beneficiaries Form For Trust is what you need.

- Start your search again if you require any other form.

- Create a free account and choose a subscription option to purchase the form.

- Select Buy now. After the transaction is finalized, you can acquire the Notice Beneficiaries Form For Trust, complete it, print it, and send or mail it to the required individuals or organizations.

Form popularity

FAQ

Life insurance beneficiaries can be individuals, such as a spouse or adult child, or entities, such as a trust. For example, if you have minor children, you may choose to establish a trust and name it as the beneficiary of your life insurance policy.

Purpose of Form Use Schedule K-1 to report a beneficiary's share of the estate's or trust's income, credits, deductions, etc., on your Form 1040 or 1040-SR. Keep it for your records. Don't file it with your tax return, unless backup withholding was reported in box 13, code B.

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write ?children? on one of the lines; instead write the full names of each of your children on separate lines.

Beneficiary designations allow you to transfer assets directly to individuals, regardless of the terms of your will. Beneficiary designations are often made when a financial account, retirement account, or life insurance policy is established.

Provide the following information on the beneficiary designation: The full name of the trust as it shows on the trust document. The date the trust was created. The name of the trustee, followed by the word ?trustee?, or if you cannot provide a trustee, ETF may accept another contact person. The trustee's address.