Does A Will Override Community Property

Description

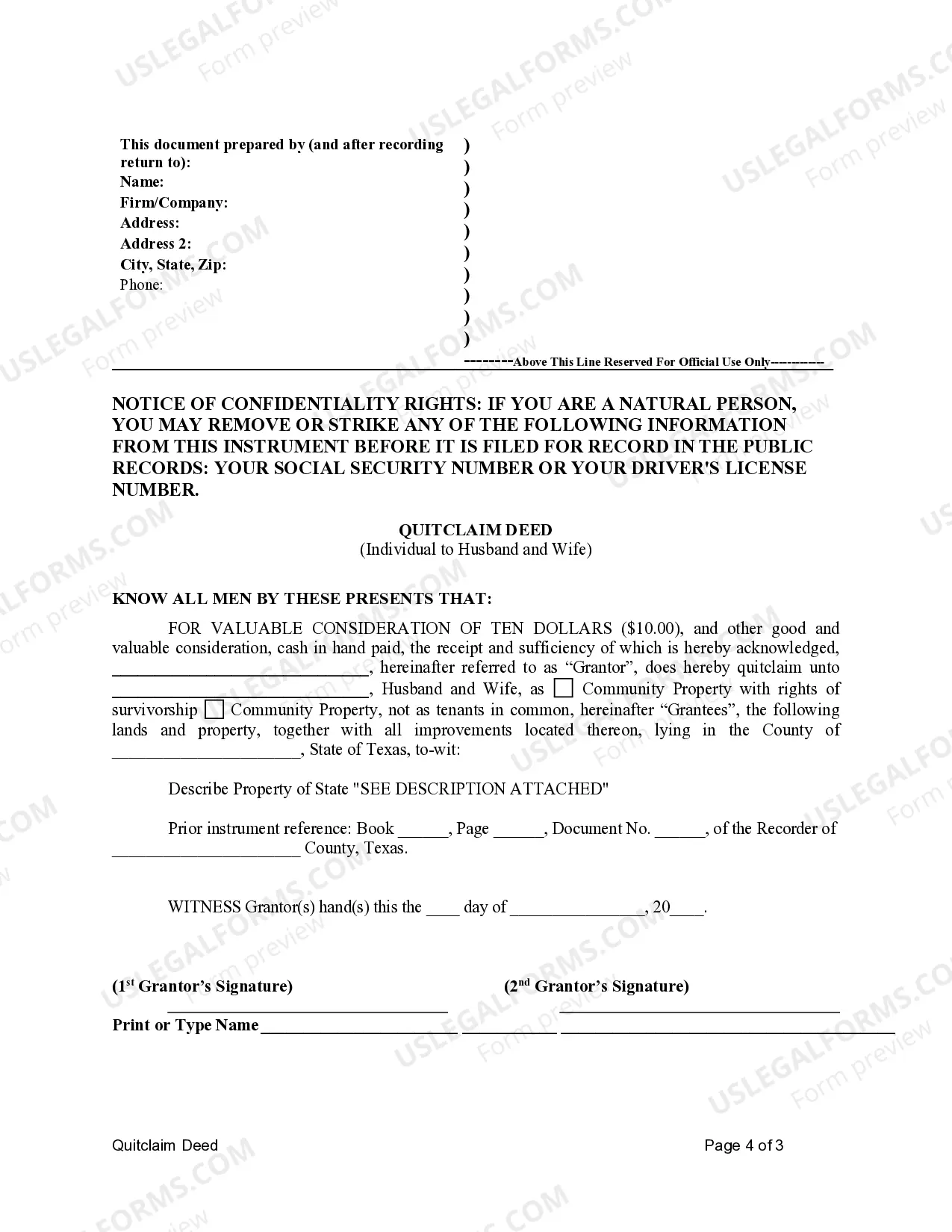

How to fill out Texas Quitclaim Deed For Individual To Husband And Wife As Community Property Or Community Property With Right Of Survivorship?

- Log into your existing US Legal Forms account. Ensure your subscription is active; renew it if necessary.

- Review the available forms in Preview mode. Confirm you've selected the correct document according to your needs and jurisdiction.

- If you need a different template, use the search feature to find the appropriate form.

- Once you have the right template, click 'Buy Now' and select your preferred subscription plan. You'll need to create an account to access the form library.

- Proceed to payment by entering your credit card details or using PayPal.

- Download your form. Save it on your device or access it via the 'My Forms' section of your profile at any time.

By following these steps, you can efficiently obtain the necessary documents while ensuring compliance with legal requirements. US Legal Forms not only facilitates quick access to a vast array of legal documents but also supports users with expert assistance.

Start your estate planning journey today and empower yourself with the right legal tools. Visit US Legal Forms now!

Form popularity

FAQ

To keep inheritance separate from community property, it is essential to record any inheritances distinctly. You should avoid mixing inherited assets with shared resources acquired during marriage. A will can also specify how you wish to allocate your inheritance, thereby clarifying your intentions. Remember, a pertinent question arises: does a will override community property? Understanding these distinctions can help protect your wishes.

A will does not usually override a property deed, especially if the deed specifies a certain form of ownership. If a property is held in joint tenancy or as community property, the ownership remains intact and is not affected by a will. Thus, it’s essential to review both your will and property deeds to understand how they interact. Looking into legal resources, such as US Legal Forms, can help clarify your specific situation.

Beneficiaries do not generally override community property rules. In community property states, assets acquired during marriage belong jointly to both spouses, regardless of beneficiary designations. Therefore, even if a will lists certain beneficiaries, community property rights must be considered. Understanding these regulations can help you plan more effectively.

In most cases, a living trust or any legally binding contract can override a will. For example, if you create a living trust and transfer your assets into it, the terms of the trust will take precedence over your will. In addition, certain beneficiary designations, like life insurance or retirement accounts, can bypass a will altogether. It's important to give careful thought to how these documents work together.

A will can be complicated when it comes to spousal rights, especially in community property states. Generally, a will cannot completely override a spouse's rights to community property unless specific legal arrangements are made. Consequently, both parties should be aware of how a will interacts with community property laws. Consulting with a legal professional ensures that your intentions are clear.

Certain legal documents can override beneficiaries outlined in a will. For example, a trust or a property title can dictate how assets are distributed, sometimes bypassing designated beneficiaries. Additionally, community property laws could affect how much a spouse inherits, regardless of the beneficiary designations. Understanding these nuances is crucial when planning your estate.

Not necessarily. While many people assume that all assets automatically pass to a spouse, this depends on whether assets are designated as community property. In community property states, a spouse may inherit half of the marital property automatically, but wills and trusts can significantly influence asset distribution. It’s essential to consider how your assets are classified and documented.

In most cases, beneficiaries listed in a will or trust can supersede a spouse's rights, depending on state laws. However, community property laws may apply, which means that property acquired during the marriage is owned jointly. Therefore, while a will can direct certain assets to beneficiaries, it does not eliminate community property rights. You should consult with a legal expert to fully understand how your state handles these situations.

Yes, you can choose to refuse property bequeathed to you in a will. This process is known as disclaiming an inheritance and can be beneficial for tax reasons or when considering community property laws. If you have more questions about this, platforms like US Legal Forms offer resources to guide you.

Certain legal obligations and documents can supersede a will. For example, community property laws and previously made trusts can affect how assets are distributed upon death. Utilizing platforms like US Legal Forms can help you navigate these complexities effectively.