Promissory Note Template Texas With Solutions

Description

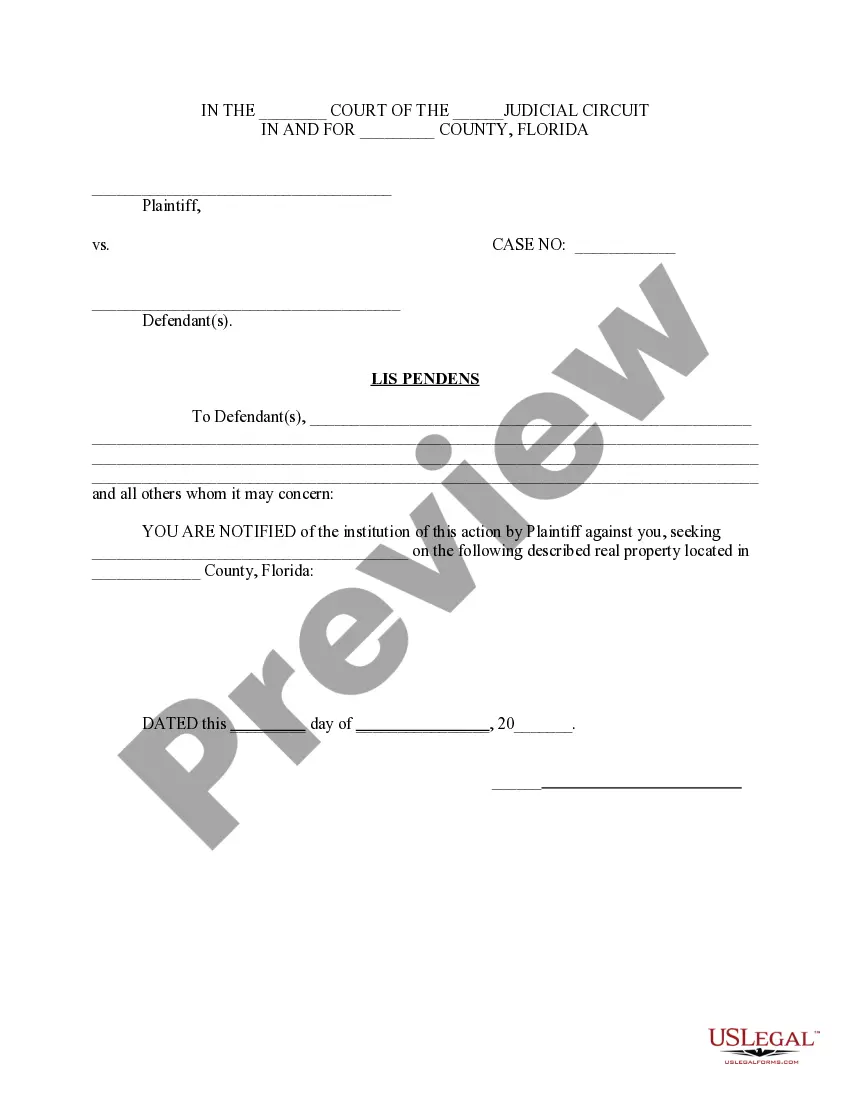

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Managing legal documents can be perplexing, even for seasoned professionals.

If you are looking for a Promissory Note Template Texas With Solutions and don’t have the opportunity to spend time finding the suitable and updated version, the process can be overwhelming.

Obtain state- or county-specific legal and business documents. US Legal Forms fulfills any needs you might have, ranging from personal to business paperwork, all in one spot.

Utilize cutting-edge tools to complete and manage your Promissory Note Template Texas With Solutions.

Here are the steps to follow after obtaining the form you need.

- Access a valuable collection of articles, guides, manuals, and resources related to your circumstances and requirements.

- Save time and energy searching for the documents you need, and use US Legal Forms’ advanced search and Review tool to locate the Promissory Note Template Texas With Solutions and download it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to see the documents you’ve previously saved and manage your folders as you see fit.

- If it’s your first time with US Legal Forms, create an account and get unlimited access to all the advantages of the library.

- A robust online form repository can be transformative for anyone who aims to tackle these issues efficiently.

- US Legal Forms is a leader in online legal documents, boasting over 85,000 state-specific legal forms accessible whenever needed.

- With US Legal Forms, you can.

Form popularity

FAQ

Names of all Parties Involved ? Such a document must include the names of the payee, drawee, and holder. Address and Contact Details ? Should include the residential address and phone number of all parties involved. Promissory Note Amount ? It must show the sum that is outstanding and must be repaid as per the note.

Texas Secured Promissory Note The date of inception of the note. The names and addresses of all the parties involved as well as the information of the witness that gives the document validity. The loan amount and the details of how and when payment will occur.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.