Land Trust Documents With Multiple Owners

Description

How to fill out Texas Land Trust Agreement?

Engaging with legal documentation and procedures can be a lengthy addition to your overall day.

Land Trust Documents With Multiple Owners and similar forms typically necessitate searching for them and comprehending how to fill them out effectively.

Thus, whether you are managing financial, legal, or personal issues, having a thorough and accessible online repository of forms at your disposal will greatly assist you.

US Legal Forms is the premier online resource for legal templates, featuring over 85,000 state-specific forms and various tools to help you complete your documents easily.

Is this your first time using US Legal Forms? Sign up and create an account within a few minutes, and you’ll gain access to the form library including Land Trust Documents With Multiple Owners. Then, follow the steps outlined below to fill out your form.

- Explore the collection of suitable documents available to you with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Safeguard your document management processes with a quality service that enables you to prepare any form in minutes without incurring additional or hidden costs.

- Simply Log In to your account, find Land Trust Documents With Multiple Owners, and download it immediately from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

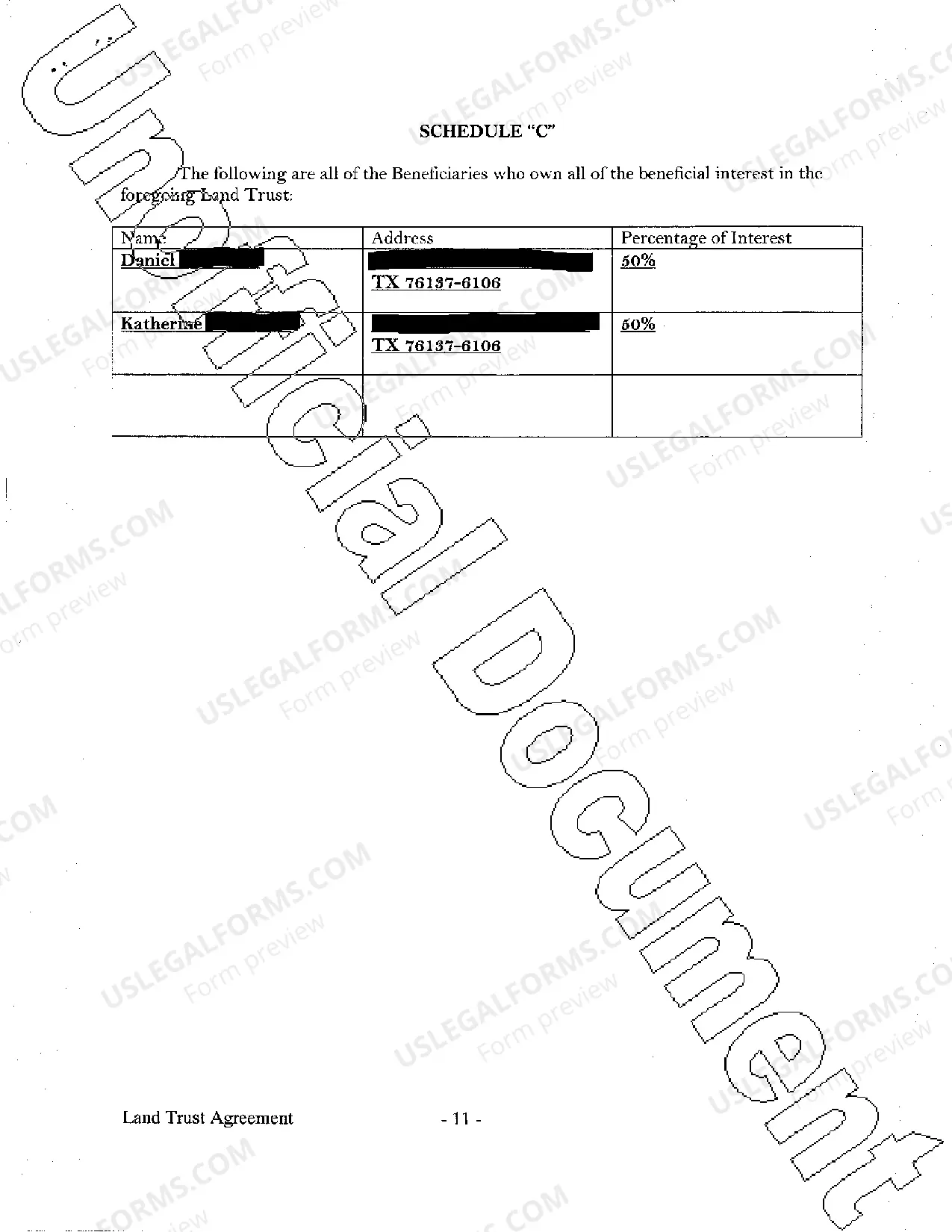

To verify ownership of a trust, start by reviewing the land trust documents with multiple owners. These documents contain essential information regarding the beneficiaries and the management of the trust property. You can also request a copy from the trustee or check with your local government office if public records are available. This process ensures clarity in ownership verification.

Trust property removes tax liability on the assets from the trustor to the trust itself, in some cases. Estate planning allows for trust property to pass directly to the designated beneficiaries upon the trustor's death without probate.

The trustee is the person (or people) who holds legal title to the property that is in the trust. The trustee's job is to manage the property in the trust for the benefit of the beneficiaries in the way the settlor has asked.

When property is ?held in trust,? there is a divided ownership of the property, ?generally with the trustee holding legal title and the beneficiary holding equitable title.? The trust itself owns nothing because it is not an entity capable of owning property.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

Second, most land trusts are automatically disqualified from secondary market loans. The other issue with land trusts is that they give the illusion that there is no liability. Land trusts still have liability, even in Illinois. The real property owner, and not just the trust or trustee, can be found liable for things.