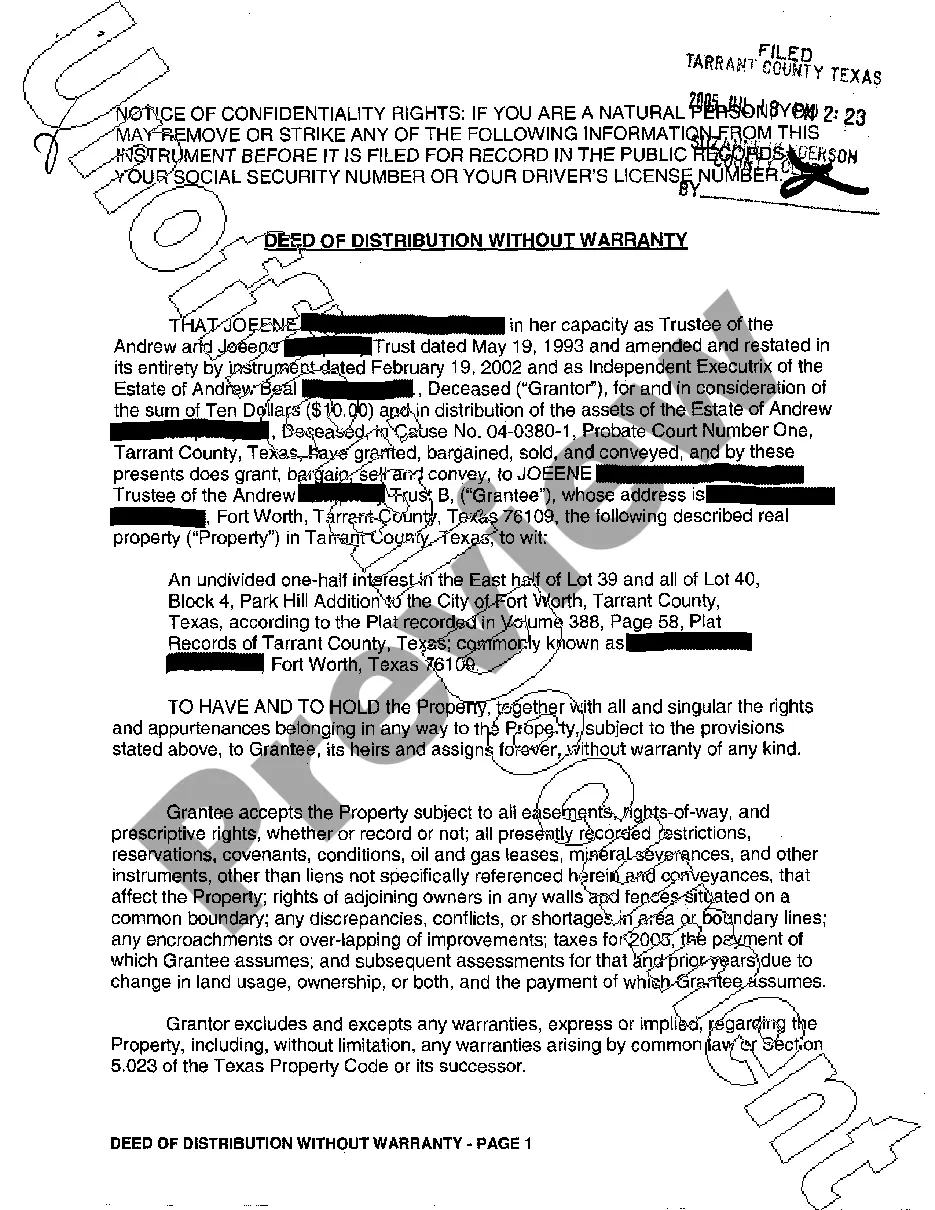

Texas Deed Without Warranty Form With Two Points

Description

How to fill out Texas Deed Of Distribution Without A Warranty?

Securing a primary source for obtaining the latest and pertinent legal templates constitutes a significant portion of navigating bureaucracy.

Locating accurate legal documents necessitates precision and carefulness, which is why sourcing Texas Deed Without Warranty Form With Two Points exclusively from reliable providers, such as US Legal Forms, is crucial. An incorrect template could squander your time and postpone your circumstances.

Once the form is saved on your device, you can edit it using the editor or print it for manual completion. Avoid the frustration that comes with your legal documentation. Explore the extensive US Legal Forms library to discover legal templates, assess their applicability to your situation, and download them instantly.

- Use the library navigation or search bar to locate your sample.

- Check the form's description to verify if it meets the criteria of your state and locality.

- If available, view the form preview to ensure it is the document you need.

- If the Texas Deed Without Warranty Form With Two Points does not match your requirements, go back to the search to find the appropriate document.

- If you are confident about the form's relevance, proceed to download it.

- As an authorized user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Select the pricing option that meets your needs.

- Advance to the registration process to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Texas Deed Without Warranty Form With Two Points.

Form popularity

FAQ

To obtain a copy of a warranty deed in Texas, you can visit the county clerk's office where the property is located. Most counties also offer online access to property records, making it easy to find the information you need. If you need help navigating the process, consider using the uslegalforms platform to find the right forms and procedures tailored to your needs.

New Hampshire charges $100 to file a foreign LLC registration application in New Hampshire.

To register a foreign corporation in New Hampshire, you must file a New Hampshire Application for Certificate of Authority with the New Hampshire Department of State, Corporation Division. You can submit this document online, by mail, or in person.

New Hampshire LLC Formation Filing Fee: $100 Filing your Certificate of Formation has a fee of $100. You can submit the certificate through the mail or in person, or you can do it online through NH QuickStart, though you'll need to add $2 for online filings.

The fees for starting a business in New Hampshire vary depending on the type of business and the number of employees. For example, the fee for an LLC with one employee is $50, while the fee for an LLC with more than one employee is $100.

NH has two corporate taxes: the Business Profits Tax (BPT) and the Business Enterprise Tax (BET). The BPT rate is 8.5% of income for corporations with gross receipts over $50K. The BET rate is 0.75% on the enterprise value tax base (total compensation paid out, including dividends and interest).

You must register as a foreign LLC. We have here a guide on how you can qualify and register for a foreign LLC in New Hampshire.

To register a foreign corporation in New Hampshire, you must file a New Hampshire Application for Certificate of Authority with the New Hampshire Department of State, Corporation Division. You can submit this document online, by mail, or in person.

You can get an LLC in New Hampshire in 7-10 business days if you file online (or 3-5 weeks if you file by mail).