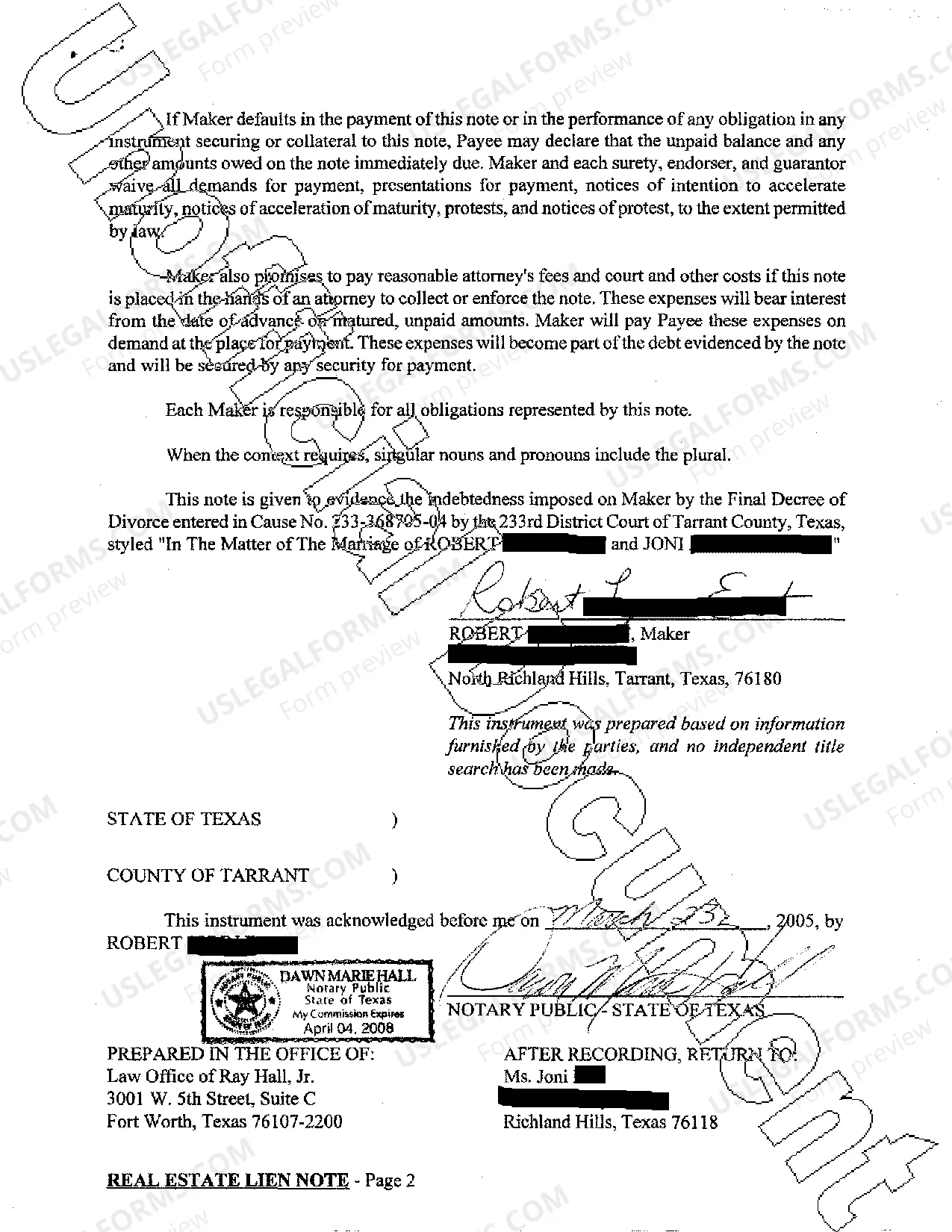

Real Estate Lien Note With Mortgage

Description

How to fill out Texas Real Estate Lien Note?

Managing legal documents and procedures may be a lengthy addition to your entire day.

Real Estate Lien Note With Mortgage and similar forms often require you to locate them and comprehend how to fill them out correctly.

Therefore, if you are addressing financial, legal, or personal issues, utilizing a well-rounded and functional online library of forms readily available to you will greatly assist.

US Legal Forms is the leading online platform for legal documents, providing over 85,000 state-specific forms and multiple resources to expedite your paperwork.

Simply Log In to your account, find Real Estate Lien Note With Mortgage, and obtain it immediately from the My documents section. You can also access previously downloaded forms.

- Explore the collection of suitable documents at your convenience with just one click.

- US Legal Forms provides you with state- and county-specific forms accessible anytime for download.

- Safeguard your document management tasks by utilizing a premium service that enables you to prepare any form in mere minutes without any extra or hidden charges.

Form popularity

FAQ

States that allow you to use a Deed of Trust: StateDocuments allowedArkansasBoth Mortgage Agreements and Deeds of TrustCaliforniaDeeds of TrustColoradoDeeds of TrustConnecticutMortgage Agreements47 more rows

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

?Connecticut is considered a 'title theory' state wherein the mortgagor [debtor] pledges property to the mortgagee [creditor] as security for a debt and conveys 'legal title' to the mortgaged premises; the mortgagor retains 'equitable title' or the 'equity of redemption'?.

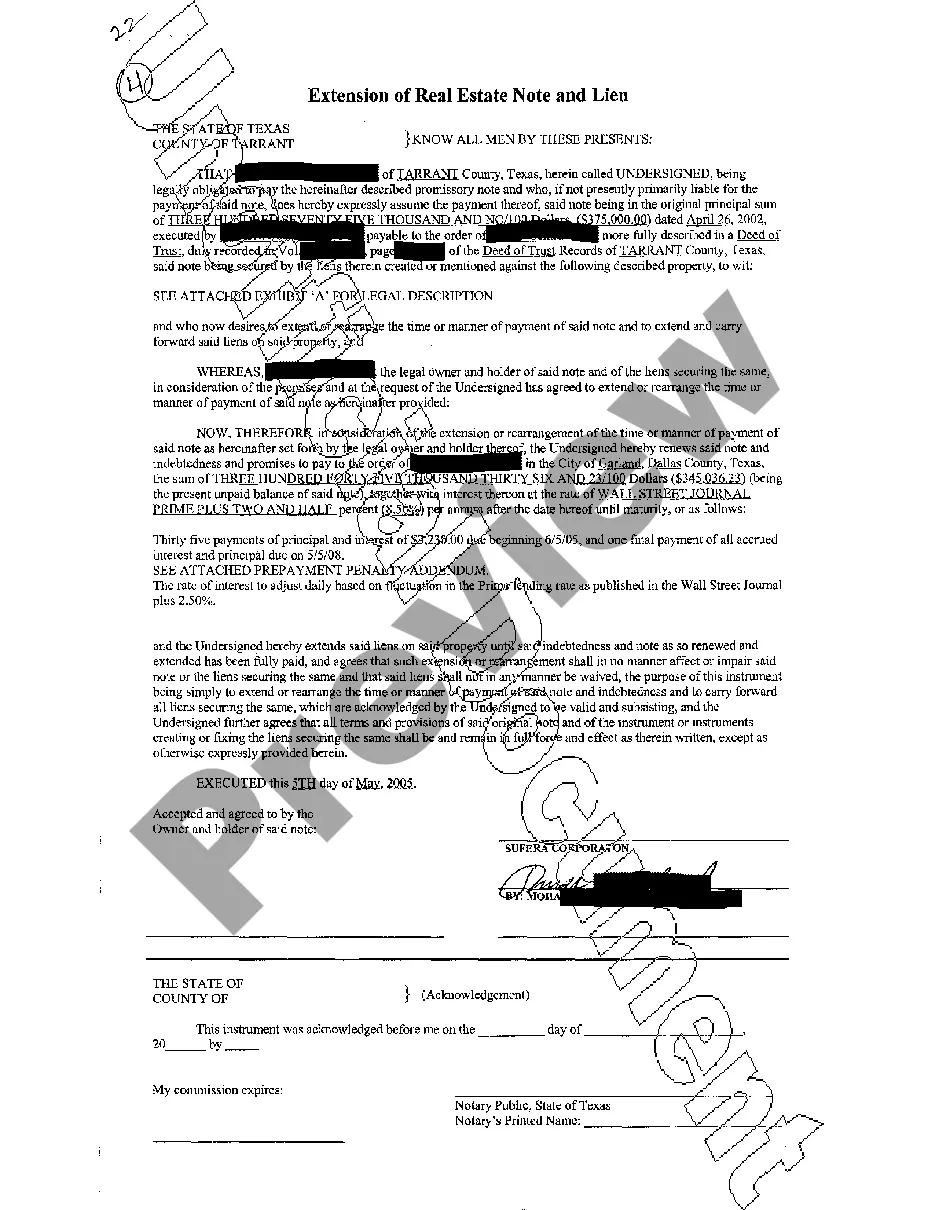

Definition of 'Master Mortgage' The Master Mortgage is a document created when a property is purchased for the first time. It is filed in the public land records and its purpose is to keep track of the initial mortgage and of any liens that might be associated with the property.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.