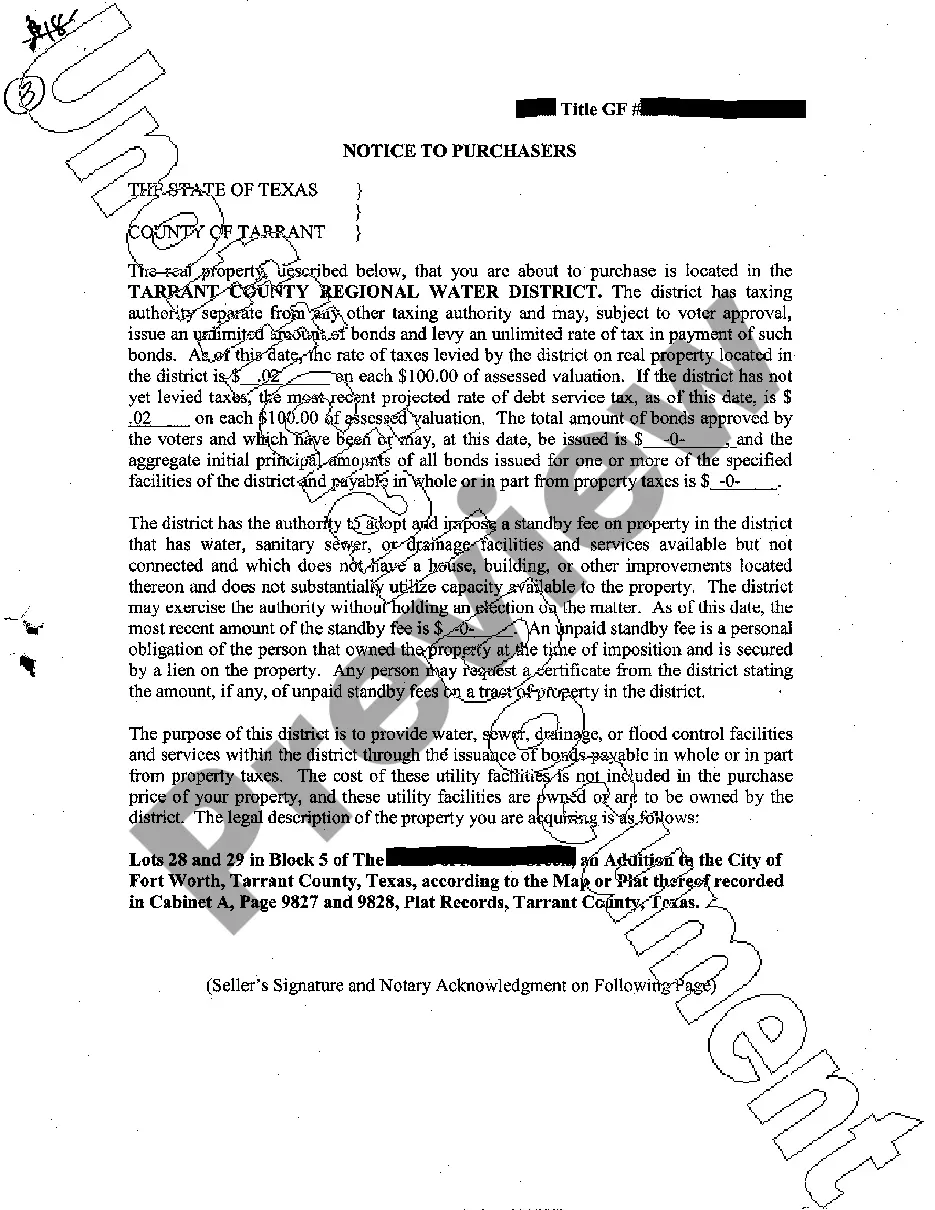

Trec Mud Notice Form For Providing A Service

Description

How to fill out Texas Notice To Purchasers?

Managing legal documents can be exasperating, even for experienced professionals.

If you're searching for a Trec Mud Notice Form For Providing A Service and lack the opportunity to invest time finding the correct and current version, the process can be overwhelming.

US Legal Forms caters to all your requirements, from personal to corporate documentation, all in a single location.

Utilize advanced features to fill out and manage your Trec Mud Notice Form For Providing A Service efficiently.

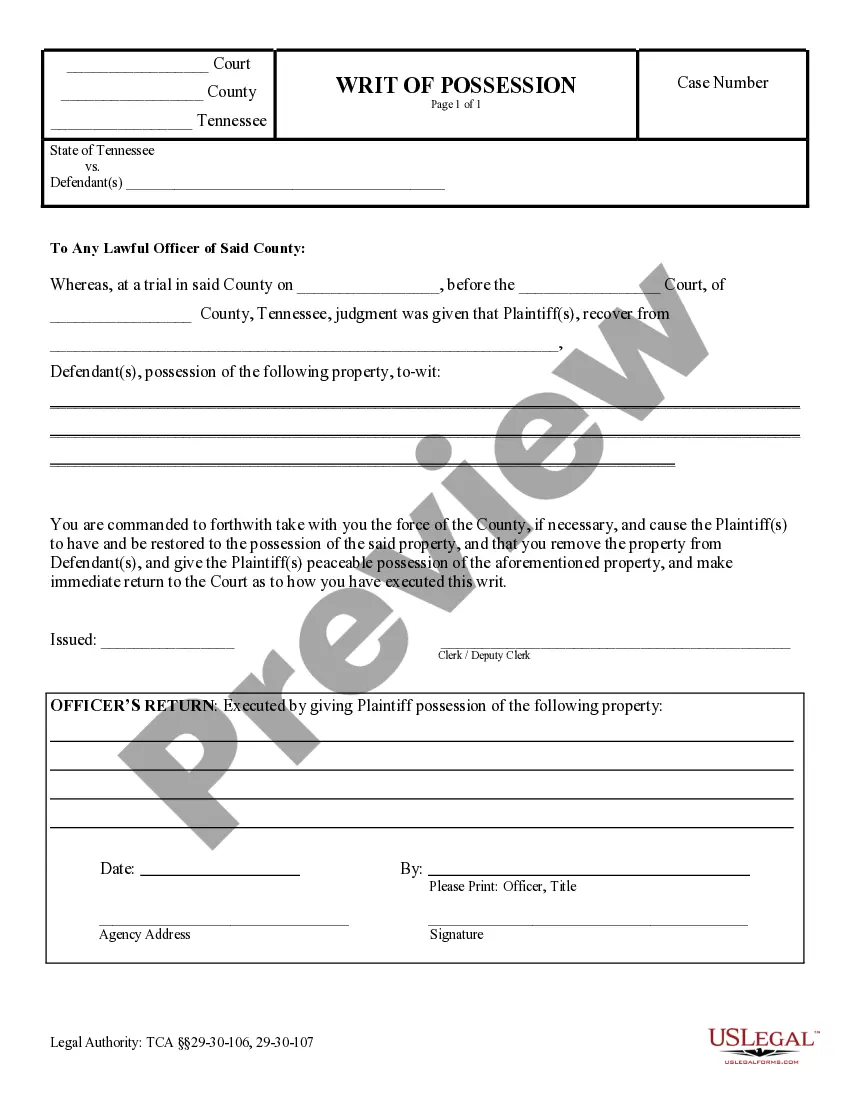

Here are the steps to follow after downloading the form you require: Ensure the form is correct by previewing it and reviewing its description.

- Access a rich resource base of articles, tutorials, and manuals that relate to your situation and requirements.

- Save time and effort in locating the documents you need, and leverage US Legal Forms' advanced search and Preview feature to find and secure Trec Mud Notice Form For Providing A Service.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you've previously obtained and manage your folders as necessary.

- If it's your initial experience with US Legal Forms, create an account to gain unlimited access to all features of the library.

- Utilize a comprehensive web form repository that can transform the way you tackle these issues effectively.

- US Legal Forms stands as a leading provider of online legal forms, featuring more than 85,000 state-specific legal documents accessible at any time.

- With US Legal Forms, you gain access to a wide range of state- or county-specific legal and business forms.

Form popularity

FAQ

The requirement for mud flaps in Texas generally pertains to vehicles rather than real estate. However, if you are discussing MUDs and their obligations, it's essential to ensure proper disclosures are made. Using the Trec mud notice form for providing a service can streamline this process while maintaining compliance with Texas law.

Mud notices can be actually found in Chapter 49 of the Texas Water Code, which outlines the regulations governing Municipal Utility Districts. This section provides the legal framework for required disclosures, including the Trec mud notice form for providing a service. Understanding where these notices are located empowers both buyers and sellers to comply with Texas laws effectively.

To determine if a property is in a MUD district, you can check the official assessments or property records available through local government offices. Another effective method is to review the disclosures provided by the seller, often utilizing the Trec mud notice form for providing a service. This form explicitly identifies whether a property lies within a MUD district, ensuring clarity during the purchasing process.

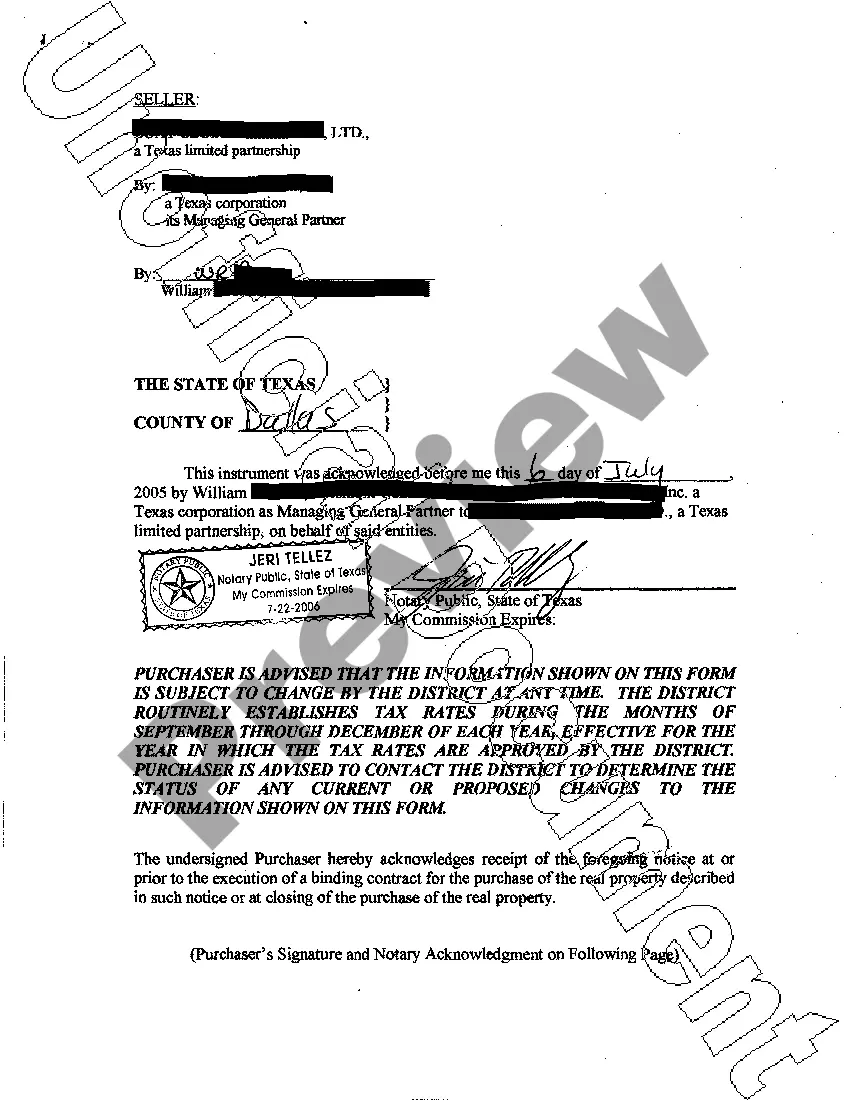

Yes, Texas law requires a mud disclosure for properties located within a Municipal Utility District (MUD). This disclosure informs potential buyers about the existence of such districts, which finance local services like water and sewage. The Trec mud notice form for providing a service guarantees that sellers present this crucial information, helping buyers make informed decisions.

To determine if a property is in a MUD district in Texas, you can check local government websites or contact the local appraisal district directly. Additionally, the TREC mud notice form for providing a service will often include this information for properties under its jurisdiction. Being aware of your property's MUD status is important for understanding your tax obligations and what services are available to you. Knowledge is power when navigating property ownership.

MUD tax does not automatically go away in Texas; it remains until the district's obligations are fulfilled. However, as developments progress and districts become self-sufficient, there may be opportunities for tax reductions. The TREC mud notice form for providing a service can help you understand the timeline and implications of these taxes on your property ownership. It's essential to stay informed and proactive regarding these financial responsibilities.

The most common TREC complaint often pertains to issues involving misrepresentation or lack of disclosure in real estate transactions. Buyers and sellers alike rely on accurate information when making decisions, and any failure in this regard can lead to disputes. If you're using the TREC mud notice form for providing a service, make sure to provide all necessary details to avoid misunderstandings. Being transparent is key to a successful transaction.

MUD property tax in Texas refers to the taxes levied by Municipal Utility Districts to fund essential services such as water, sewage, and drainage. These taxes can vary significantly based on the MUD's financial needs and developments in your area. Utilizing the TREC mud notice form for providing a service helps you stay informed about these taxes and their impact on your property. It's important to understand your responsibilities as a property owner within these districts.

The new MUD law in Texas involves changes to how Municipal Utility Districts operate and how they can assess taxes. This law aims to enhance transparency and protect property owners from rising costs. The TREC mud notice form for providing a service gives homeowners crucial information regarding MUD tax obligations and services. By understanding this law, property owners can make informed decisions about their investments.