Certification Of Trust Form Illinois

Description

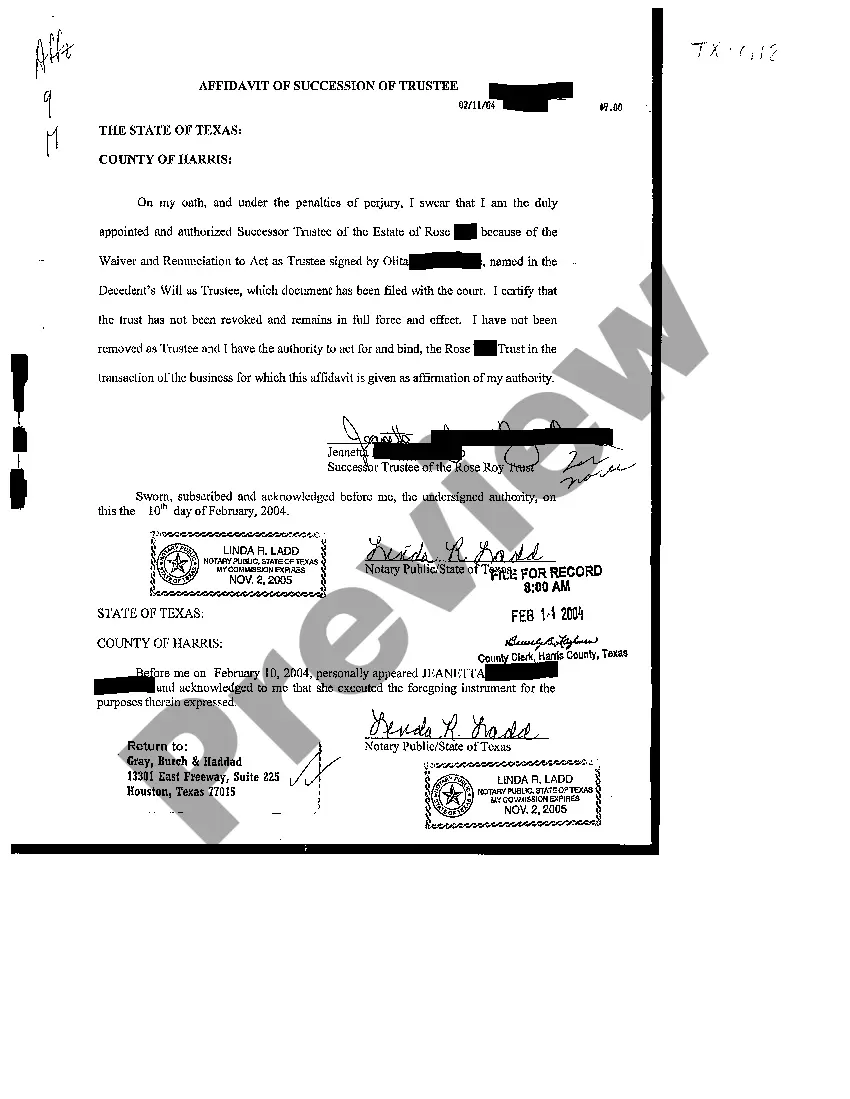

How to fill out Texas Affidavit Of Succession Of Trustee?

Creating legal documents from the ground up can frequently be daunting.

Some situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more affordable method for preparing the Certification Of Trust Form Illinois or any other documents without unnecessary complications, US Legal Forms is always here to assist you.

Our online library of more than 85,000 current legal forms encompasses almost every facet of your financial, legal, and personal affairs.

- With a few clicks, you can swiftly obtain state- and county-specific forms meticulously created for you by our legal professionals.

- Access our site whenever you require dependable and trustworthy services to easily find and download the Certification Of Trust Form Illinois.

- If you’re already familiar with our services and have previously signed up, simply Log In to your profile, find the template, and download it or re-download it anytime from the My documents section.

- No account? No problem. It takes just a few moments to register and browse the catalog.

Form popularity

FAQ

Creating a Trust In Illinois, only attorneys are allowed to assist in this process. If you need help finding a lawyer, you may call Illinois Lawyer Finder at (800) 922-8757 or search online at .IllinoisLawyerFinder.com. The use of a trust is an important estate planning option.

A certificate of trust ? also called a ?trust certificate? or ?memorandum of trust? ? is a legal document that's often used to prove (or ?certify?) a trust exists and to provide information about its important terms.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

There are a variety of reasons that you might wish to use a trust as part of your estate plan, such as: (a) privacy; (b) avoiding probate; (c) providing for an individual with a disability; (d) providing for an individual who cannot be trusted with a lump sum inheritance (e) providing for minor children; and (f) ...

The recipient of a certificate of trust is not liable for any actions they may take based on false representations within the certificate (760(ILCS 5/8.5(f)). While notarization is not obligatory, a third party may require that the certification of trust be acknowledged.