Towit Adverse Levied For The

Description

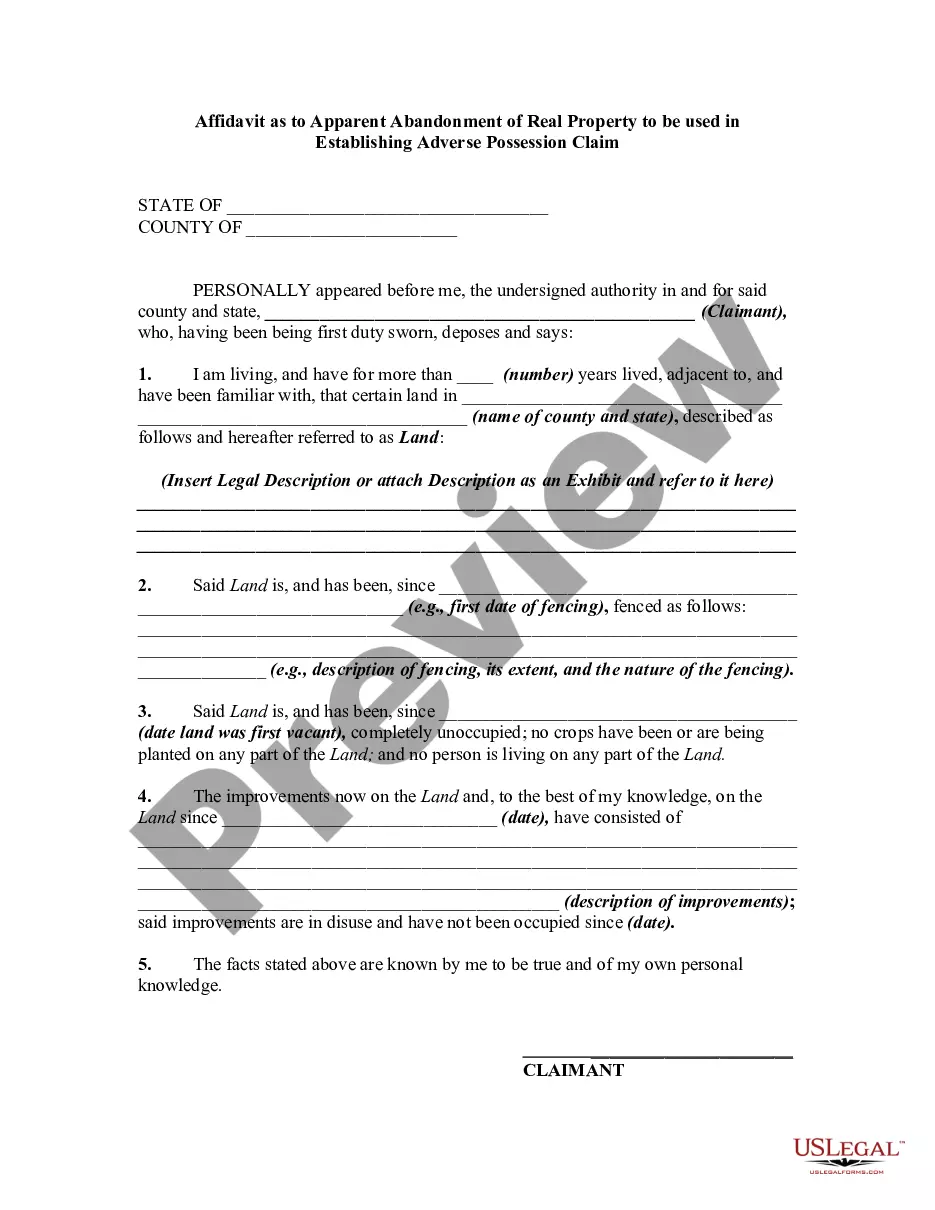

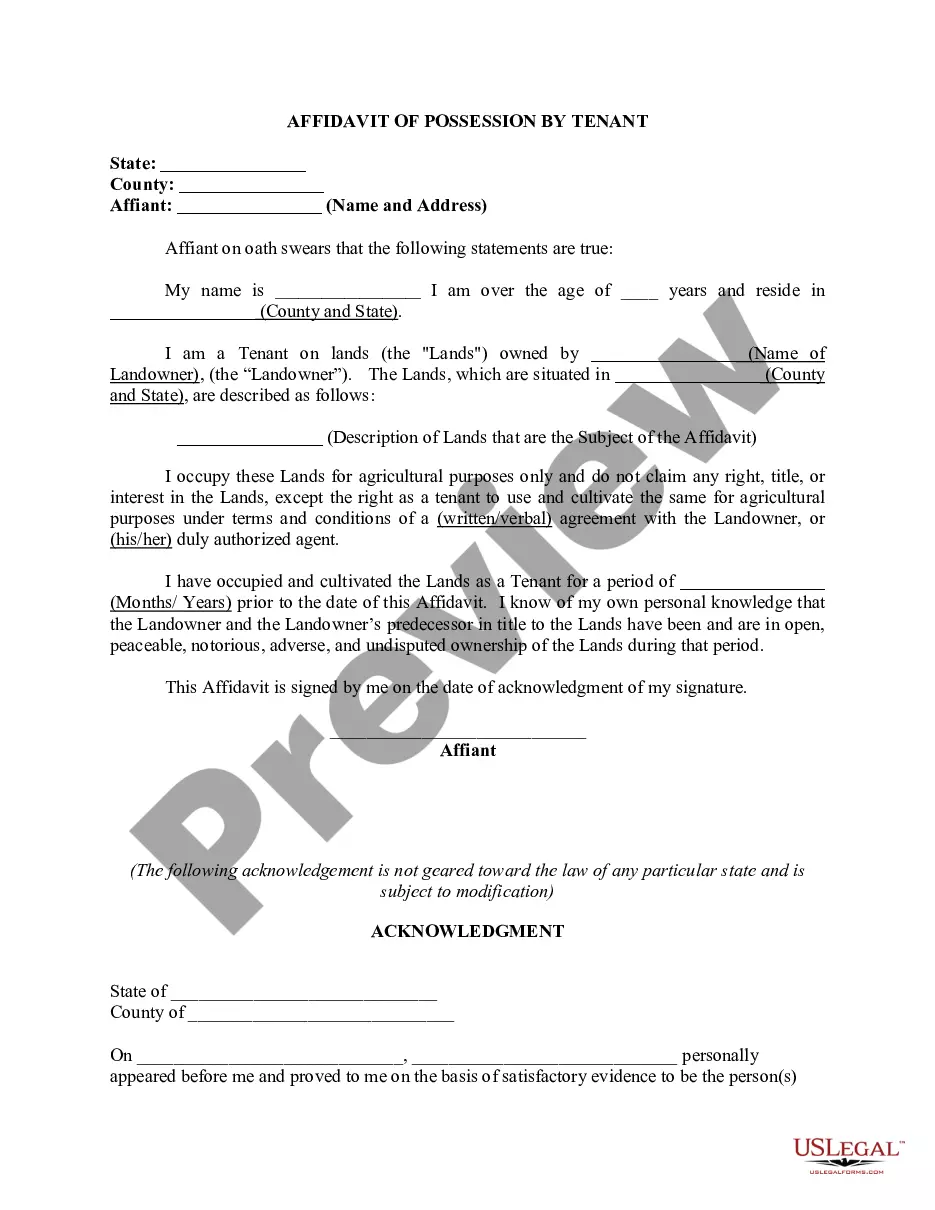

How to fill out Texas Adverse Possession Affidavit - Squatters Rights?

- If you've used US Legal Forms before, log into your account and ensure your subscription is active. Click the Download button to save the required form template.

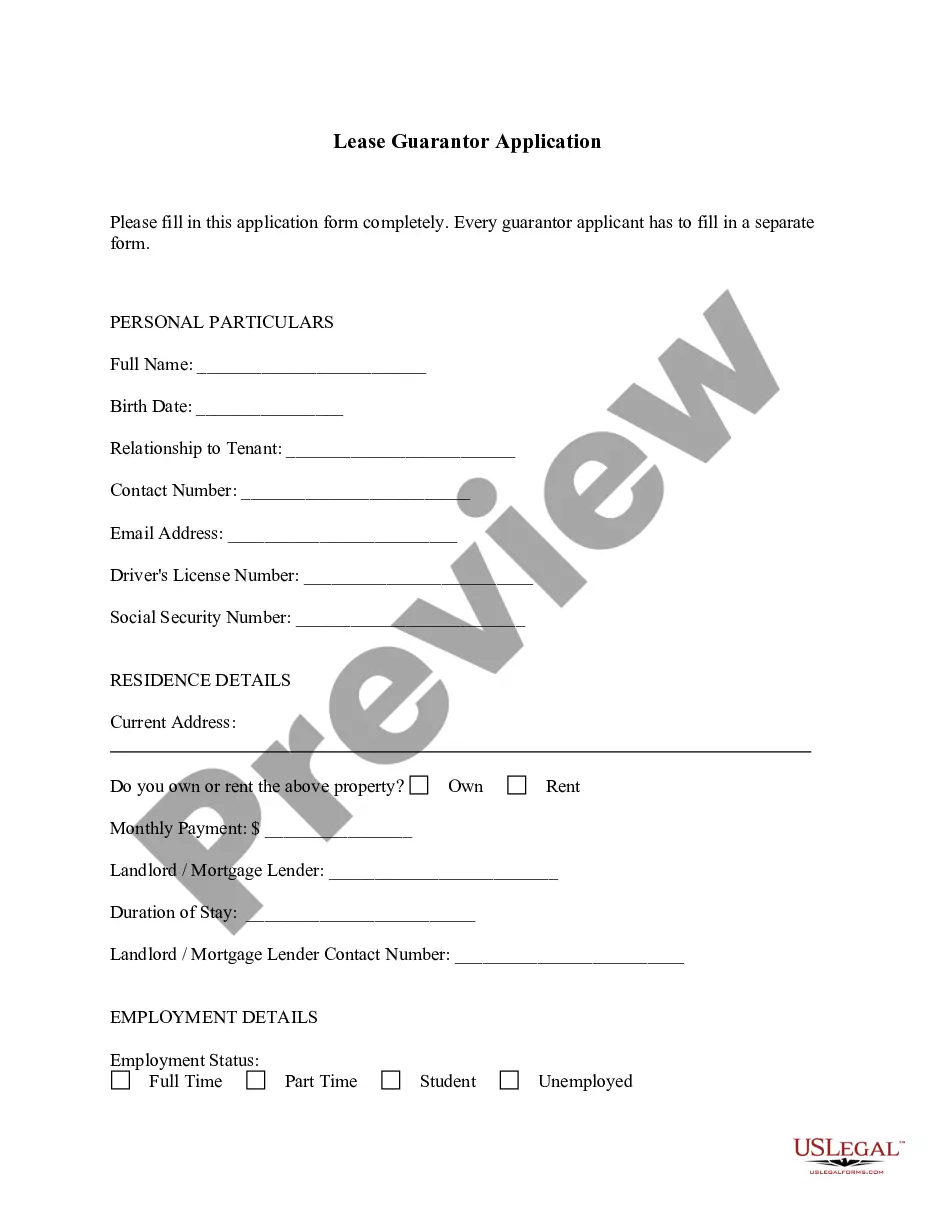

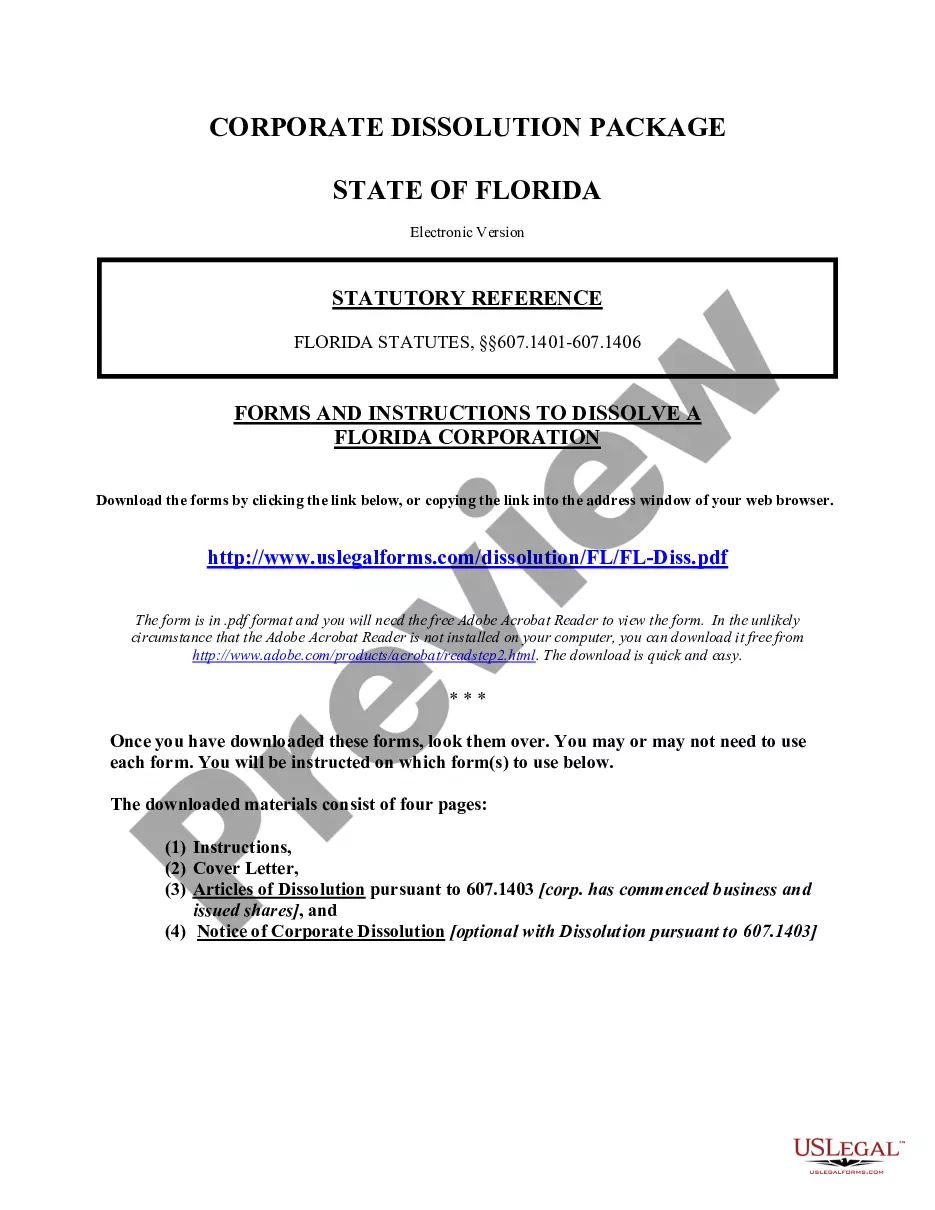

- If this is your first time, start by previewing the form. Check the description to confirm it meets your local jurisdiction's requirements.

- In case of inconsistencies, utilize the Search tab to find the right document that suits your needs.

- Purchase the document by clicking the Buy Now button. Select your subscription plan and register for an account to access the full library.

- Complete your transaction by entering your payment details via credit card or PayPal.

- Finally, download your form. Save it to your device for easy access, and you can always find it later in the My Forms section of your profile.

By leveraging US Legal Forms, you ensure that your legal documents are not only comprehensive but also tailored to your unique needs. The platform's user-friendly design and vast collection empower you to take control of your legal requirements.

Start experiencing the benefits today! Visit US Legal Forms and explore their extensive library to find the perfect legal solution for you.

Form popularity

FAQ

A writ of possession is specifically used to reclaim property, while a writ of execution is aimed at enforcing a monetary judgment. The former allows landlords or creditors to regain possession of moved or withheld property, while the latter focuses on collecting payment. Understanding this distinction can clarify legal strategies when facing matters related to Towit adverse levied for the.

Ignoring a writ of execution can lead to significant consequences, such as wage garnishment or property seizure. Courts may view non-compliance as contempt, potentially resulting in additional legal penalties. It is essential to address the writ promptly to avoid complications. Utilizing platforms like USLegalForms can provide you with necessary resources and guidance related to Towit adverse levied for the.

A writ of execution serves as a court order to enforce a judgment. It directs a sheriff or other authorized officer to carry out specific actions, which may include seizing assets or garnishing wages. Essentially, it acts as a tool for the creditor to reclaim owed amounts from the debtor. Familiarizing yourself with the process can simplify matters when dealing with Towit adverse levied for the.

In the context of the IRS, abatement refers to the cancellation or reduction of tax penalties and interest. It allows taxpayers relief when specific circumstances warrant forgiveness of penalties. Understanding the nuances of how Towit adverse levied for the plays into these scenarios can help you successfully navigate the process.

To claim a refund while requesting an abatement, you typically need to file Form 843. In your submission, clearly outline the reasons for both your refund claim and your request for the abatement of penalties. Ensure to provide relevant documentation that connects your request to the circumstances, especially focusing on how Towit adverse levied for the influenced your tax situation.

To write an abatement letter, begin with your introduction of the issue and clearly state that you are requesting an abatement of penalties. Include your tax identification information and detail the reasons for your request, supporting them with specific facts. Finally, conclude with a polite request for relief, mentioning how Towit adverse levied for the situation affects your case.

Abate payment refers to the reduction, cancellation, or removal of tax penalties or interest that you owe to the IRS. Essentially, when you abate payment, the IRS acknowledges that the penalties may not be justified based on your unique circumstances. Understanding how Towit adverse levied for the can connect with abate payment is crucial for ensuring your appeal gets the attention it requires.

Good reasons to request an abatement of IRS penalties include first-time violations of tax rules, death or disabling illness, and reliance on incorrect advice from a tax professional. Each of these scenarios can significantly impact your ability to meet tax obligations. When you present your case, be clear and concise, and emphasize the relevance of Towit adverse levied for the circumstances you faced.

To request an abatement of penalties and interest, you need to submit a written request, usually by filing Form 843. In your request, explain why you believe the penalties should be abated, using facts that support your case such as first-time compliance. Remember to include any necessary documentation that can support your claim, linking it back to how Towit adverse levied for the situation plays a role.

To write a first-time abatement letter to the IRS, start by clearly stating your request for an abatement of penalties. Include your taxpayer information, such as your Social Security number or Employer Identification Number. Then, present the reasons for your request, ensuring to highlight any circumstances that led to delays. It is essential to mention that you believe you qualify for Towit adverse levied for the abatement as a first-time offender.