Limited Liability Company Agreement Example

Description

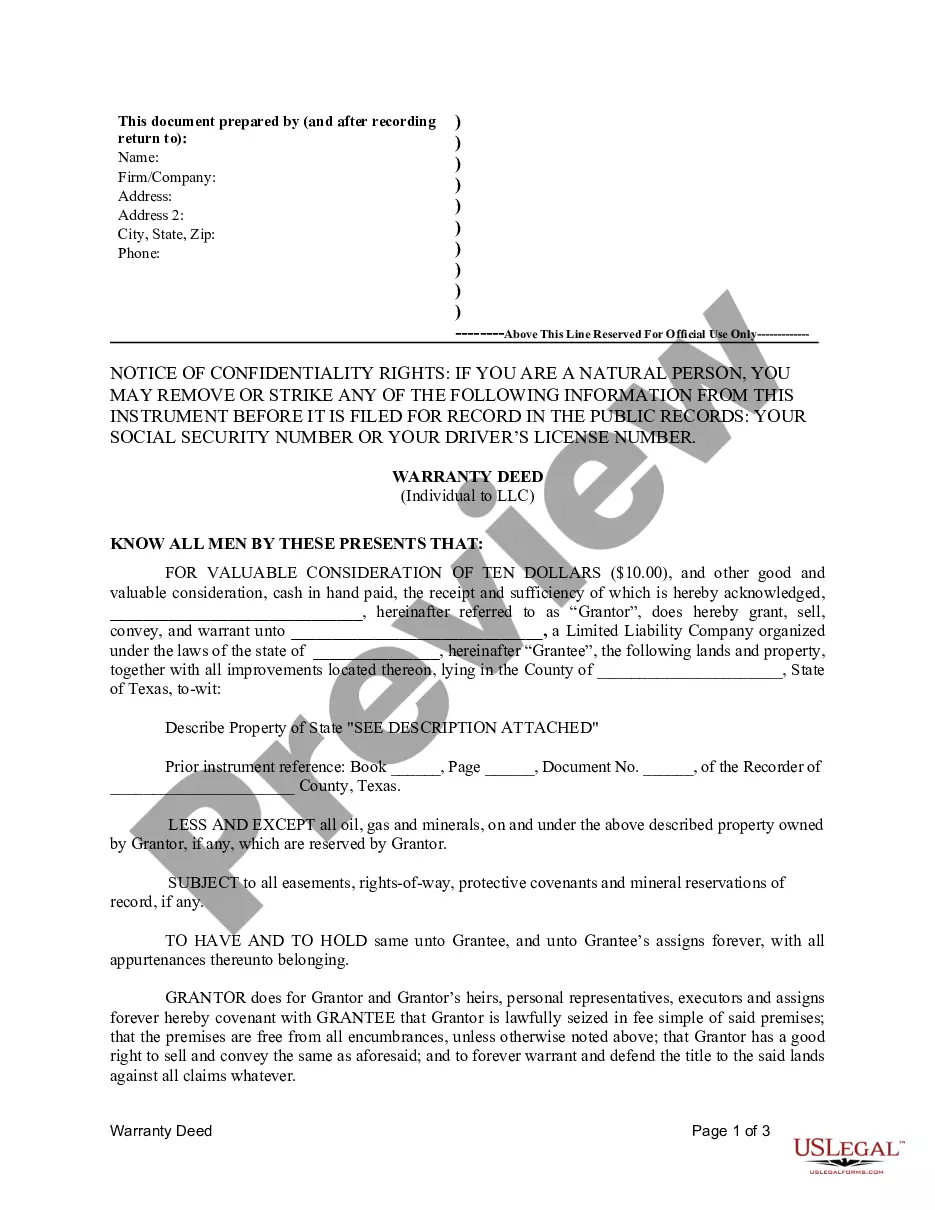

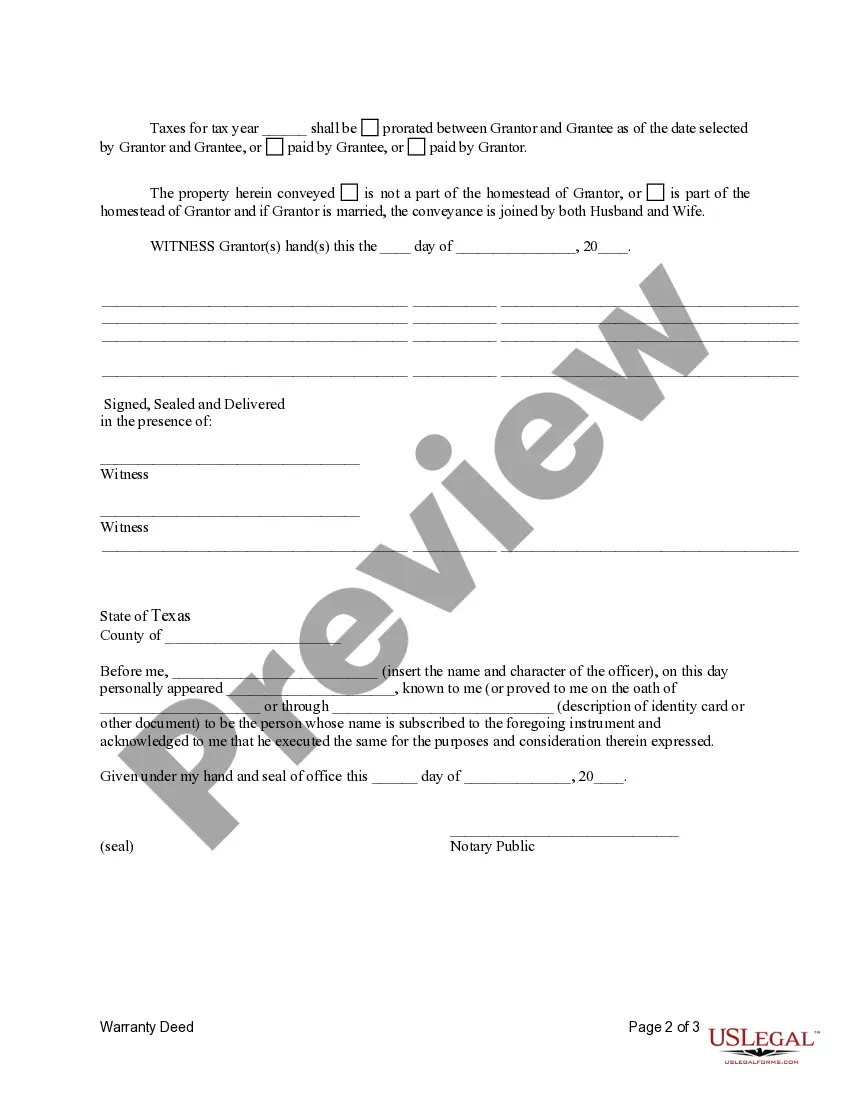

How to fill out Texas Warranty Deed From Individual To LLC?

- If you're a returning user, log in to your account and navigate to your document library. Check your subscription status to confirm it's active. If necessary, renew your plan.

- For new users, start by browsing the extensive collection. Use the Preview mode and check the description of the limited liability company agreement example to ensure it meets your specific needs.

- In case the selected template isn't a perfect fit, utilize the Search tab above to find a more suitable option that aligns with your jurisdiction's requirements.

- Once you find the right document, click on the Buy Now button and select a subscription plan that best fits your needs. Registration is required to gain full access to the library.

- Proceed to make your purchase by entering your payment details via credit card or PayPal.

- After completing your transaction, download the document to your device for completion. You can also rediscover this form anytime via the My Forms section of your profile.

US Legal Forms provides an extensive selection of over 85,000 editable and fillable legal templates, ensuring you have the necessary resources at your fingertips. With access to premium experts, you can confidently complete your forms, ensuring they're accurate and legally compliant.

Don't wait any longer; empower your business today. Start your journey with US Legal Forms and create your LLC agreement efficiently!

Form popularity

FAQ

To obtain an LLC operating agreement, you can start by researching a limited liability company agreement example online. Many resources provide templates that you can customize to fit your business's specific needs. Additionally, U.S. Legal Forms offers comprehensive documents that can guide you through the process of creating a tailored operating agreement. This way, you ensure all essential elements are included, helping you establish a solid foundation for your LLC.

An example of a limited liability company includes a technology startup that adopts this structure for operational flexibility and liability protection. The LLC functions under an operating agreement that outlines the management and ownership terms clearly. Looking at a limited liability company agreement example can provide guidance on crafting your own agreement tailored to your needs.

An example of a limited liability partnership (LLP) is a law firm where the partners share profits and liabilities while protecting personal assets from business debts. Each partner remains liable for their actions, but the LLP structure limits financial exposure. If you need more insight into forming an LLP, a limited liability company agreement example can further clarify the concepts.

The most common type of LLC is a single-member LLC, which is often formed by individual entrepreneurs. This structure offers liability protection to the owner while allowing for simple taxation. You can understand this model better by looking at a limited liability company agreement example that highlights typical provisions.

No, Amazon is not an LLC; it operates as a corporation. This distinction allows Amazon to raise capital by issuing stock, among other advantages. However, many smaller businesses choose an LLC structure for its flexibility and protection, as outlined in a limited liability company agreement example.

Writing an LLC agreement begins with outlining essential details about the company, such as its name, purpose, and management structure. You should include information about member contributions, profit distribution, and termination procedures. A limited liability company agreement example can serve as a useful template to ensure you cover all necessary aspects.

A limited liability company, or LLC, is a business structure that combines elements of partnerships and corporations. For instance, a small bakery operating as an LLC allows the owner to protect personal assets from business liabilities. Using a limited liability company agreement example can clarify how the business will operate and define roles and responsibilities.

If an LLC has no operating agreement, state laws will dictate the management and operational aspects of the business. This may not align with the founders’ intentions. A limited liability company agreement example emphasizes the importance of having a written document to avoid ambiguity and disputes. It is advisable to draft an operating agreement as soon as possible, even if your LLC is already established.

You can write your own operating agreement for your LLC, and many choose to do so. A limited liability company agreement example can guide you on structuring your agreement properly. However, reviewing state requirements and considering legal advice can enhance the quality of your document. Templates available on platforms like US Legal Forms are great starting points.

Yes, an LLC is indeed a party to its own operating agreement. This document serves as a contract that outlines the terms between the members and the LLC itself. Including your limited liability company agreement example ensures that everyone involved understands their rights and responsibilities. It is important for legal clarity and operational guidelines.