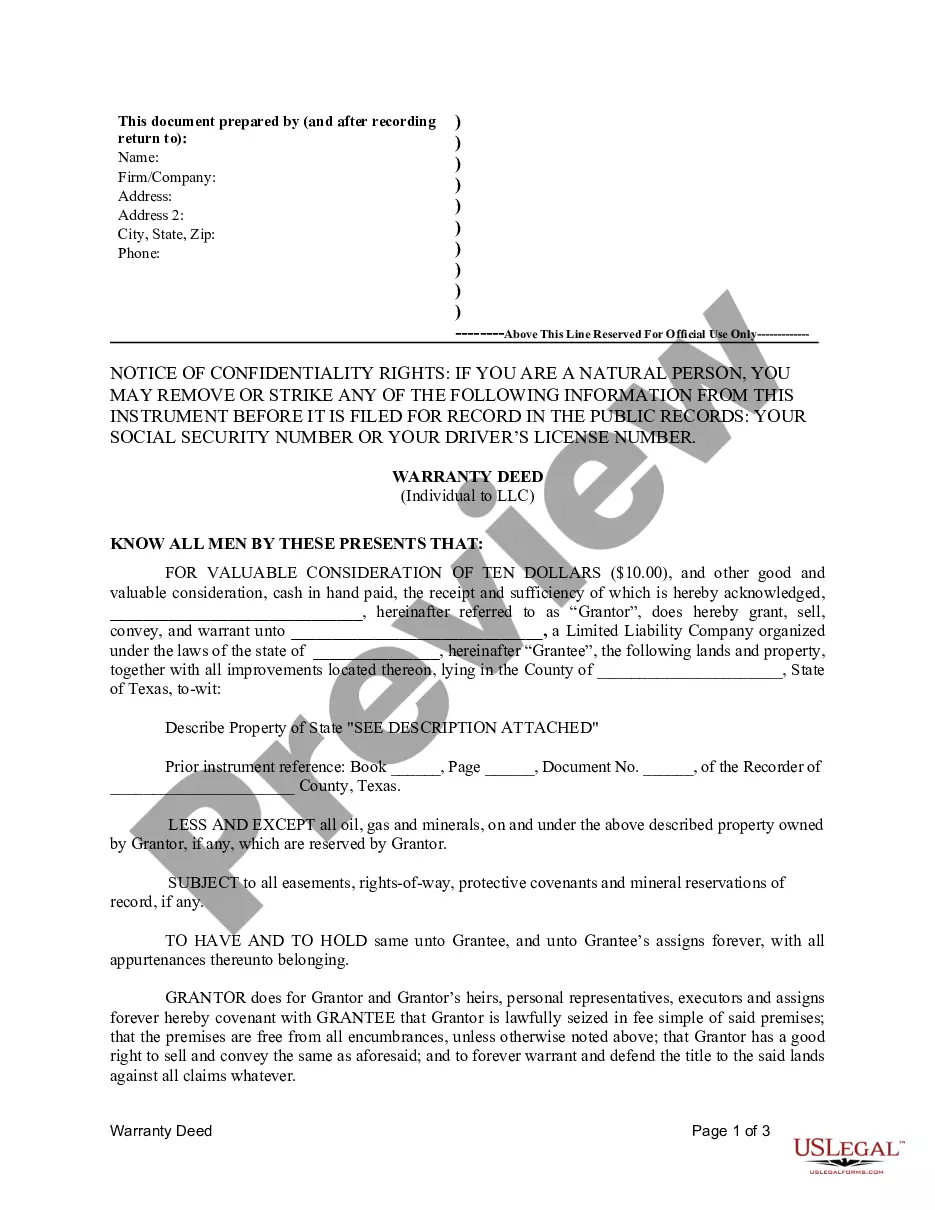

Texas Warranty Deed from Individual to LLC

Understanding this form

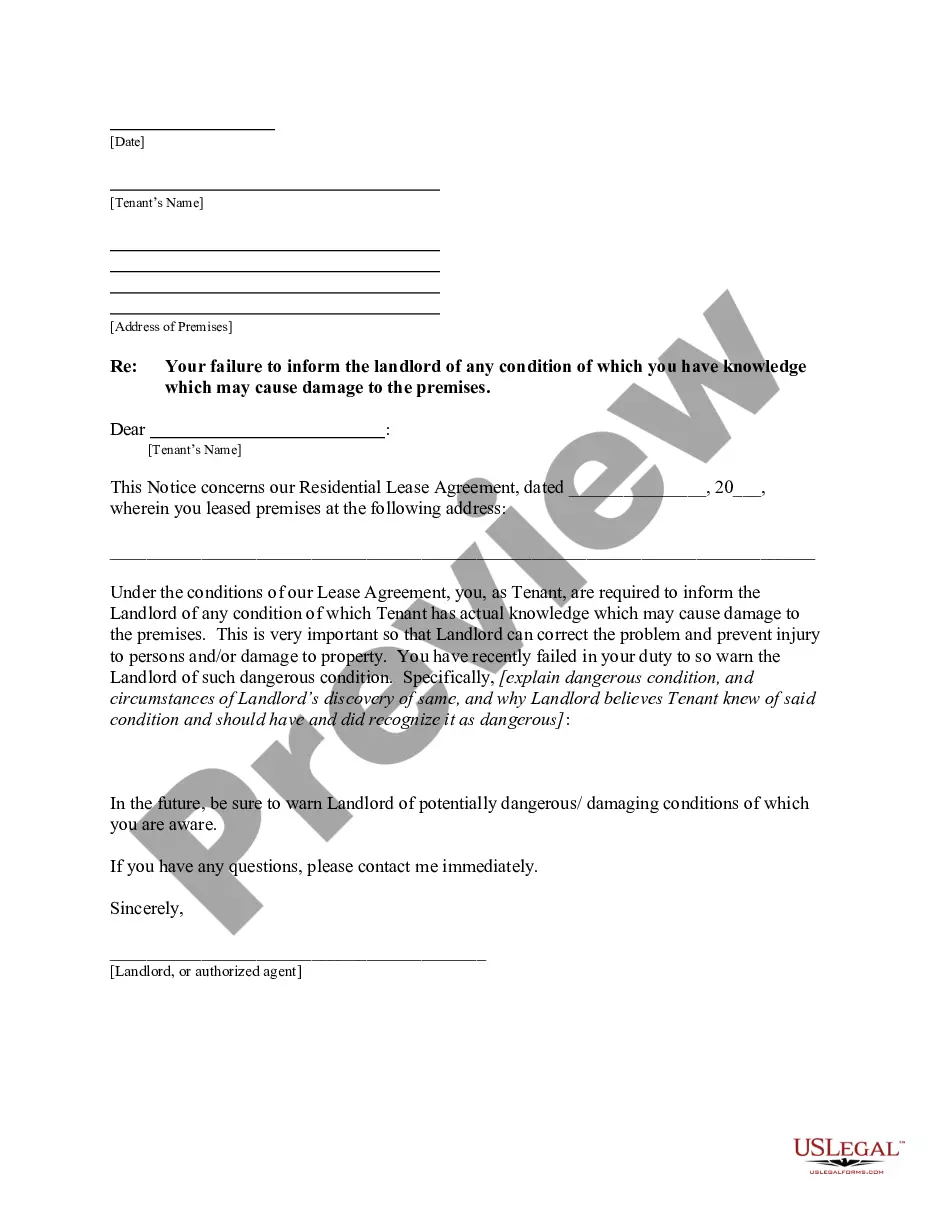

The Warranty Deed from Individual to LLC is a legal document that allows an individual (grantor) to transfer property ownership to a limited liability company (grantee). This form ensures that the property is conveyed with a warranty, meaning the grantor guarantees clear title to the property, except for specific reservations such as oil, gas, and minerals. Unlike other deeds, this form specifically caters to transactions involving LLCs, providing both legal security and clarity in ownership transfer.

What’s included in this form

- Identification of the grantor and grantee, stating their names and roles.

- Specification of the property being conveyed, with a complete legal description.

- Statement of consideration, affirming the payment made for the transfer.

- Reservations clause detailing any minerals, rights, or easements retained by the grantor.

- Covenant assuring the grantee of the grantor's lawful ownership and title free of encumbrances.

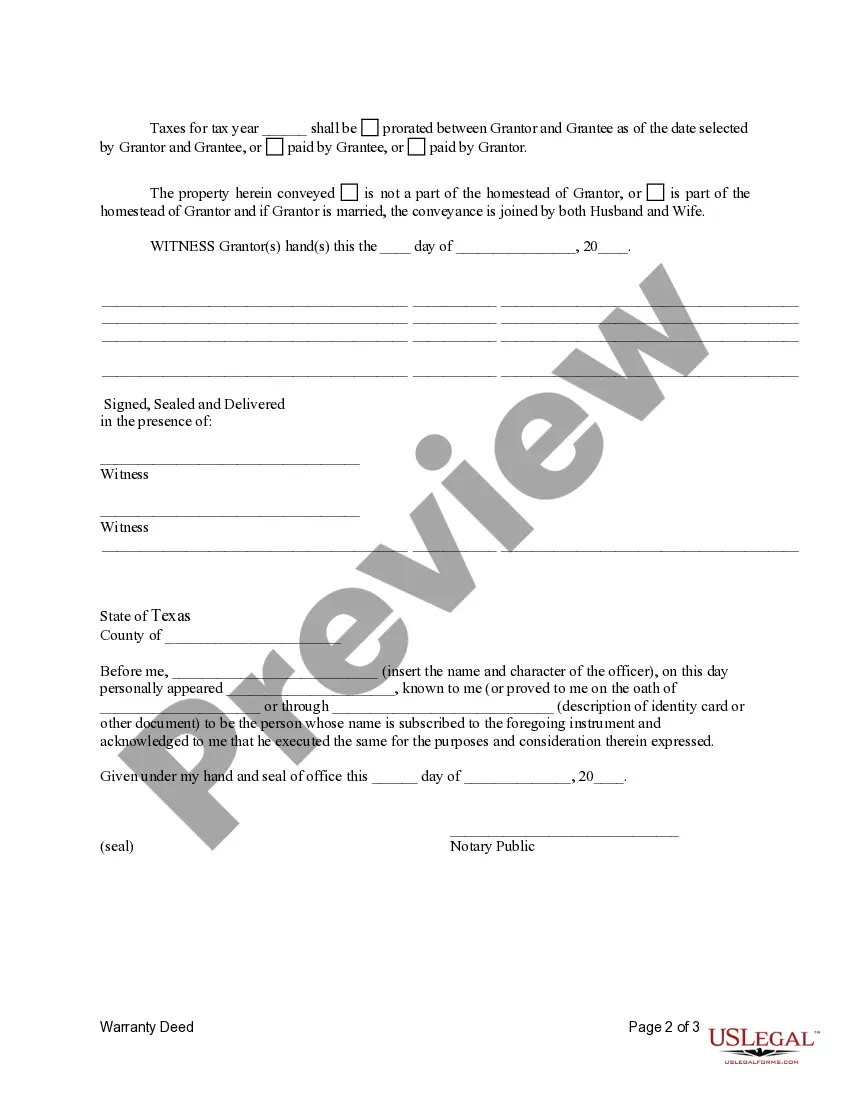

- Tax proration instructions for the year of transfer.

When this form is needed

This form is typically used when an individual wishes to transfer ownership of property they own to an LLC they have formed. It is useful in real estate transactions where liability protection is a consideration, or when an individual wants to manage their property through a business entity. Common scenarios include estate planning, investment purposes, or restructuring property ownership for tax benefits.

Intended users of this form

- Individuals transferring real estate to their own LLC.

- Property owners looking to limit personal liability by shifting property ownership to a business structure.

- Real estate investors seeking to organize their properties within an LLC framework.

- Those involved in estate planning where LLCs are utilized for asset management.

Instructions for completing this form

- Identify the parties involved: Provide the names of the grantor (individual) and grantee (LLC).

- Specify the property: Include a complete legal description of the property being transferred.

- Enter the consideration amount: State the payment made, typically a token amount like ten dollars.

- Include reservations: Note any reservations for oil, gas, and minerals as stated in the form.

- Obtain signatures: Ensure the grantor and any necessary witnesses or notaries sign the document.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide a complete legal description of the property.

- Not including required reservations for minerals or other rights.

- Neglecting to sign the document or have it properly notarized.

- Omitting the consideration amount, which can affect the validity of the deed.

Advantages of online completion

- Convenient access to legally drafted forms that are easy to download and complete.

- Editability allows for tailored entries specific to your transaction.

- Reliable legal terminology ensures compliance with state laws.

- Instant availability means you can complete your transaction without delays.

Main things to remember

- The Warranty Deed from Individual to LLC facilitates property transfer from an individual to a limited liability company.

- Understanding the key components and terms is essential for successful completion.

- Proper notarization is necessary for the document's legal validity.

- Utilizing this form can help protect an individual's personal assets through an LLC structure.

Looking for another form?

Form popularity

FAQ

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

The deed must be presented to and accepted by the grantee, and it should be filed of record in the county clerk's office to put the public on notice of the transfer. Failure to file the deed can subject the property to future claims by other parties. Most commonly, a grantor provides a general warranty deed.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Does LLC ownership count as time used as a primary residence? For a single-member LLC, the answer is typically yes. For example, if the house is owned by an LLC. The Treasury Regulations allow for the capital gains exclusion when title is held by a single-member disregarded entity.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.