Survivorship For Child

Description

How to fill out Texas General Warranty Deed - Individual To Three Individuals?

Precisely crafted official paperwork is one of the essential safeguards for preventing issues and legal disputes, but acquiring it without a lawyer's support may require time.

Whether you need to swiftly locate a current Survivorship For Child form or any other templates for employment, family, or business situations, US Legal Forms is always ready to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button beside the selected document. Furthermore, you can access the Survivorship For Child at any time since all the documentation ever acquired on the platform stays accessible within the My documents tab of your profile. Save time and money on preparing formal paperwork. Experience US Legal Forms today!

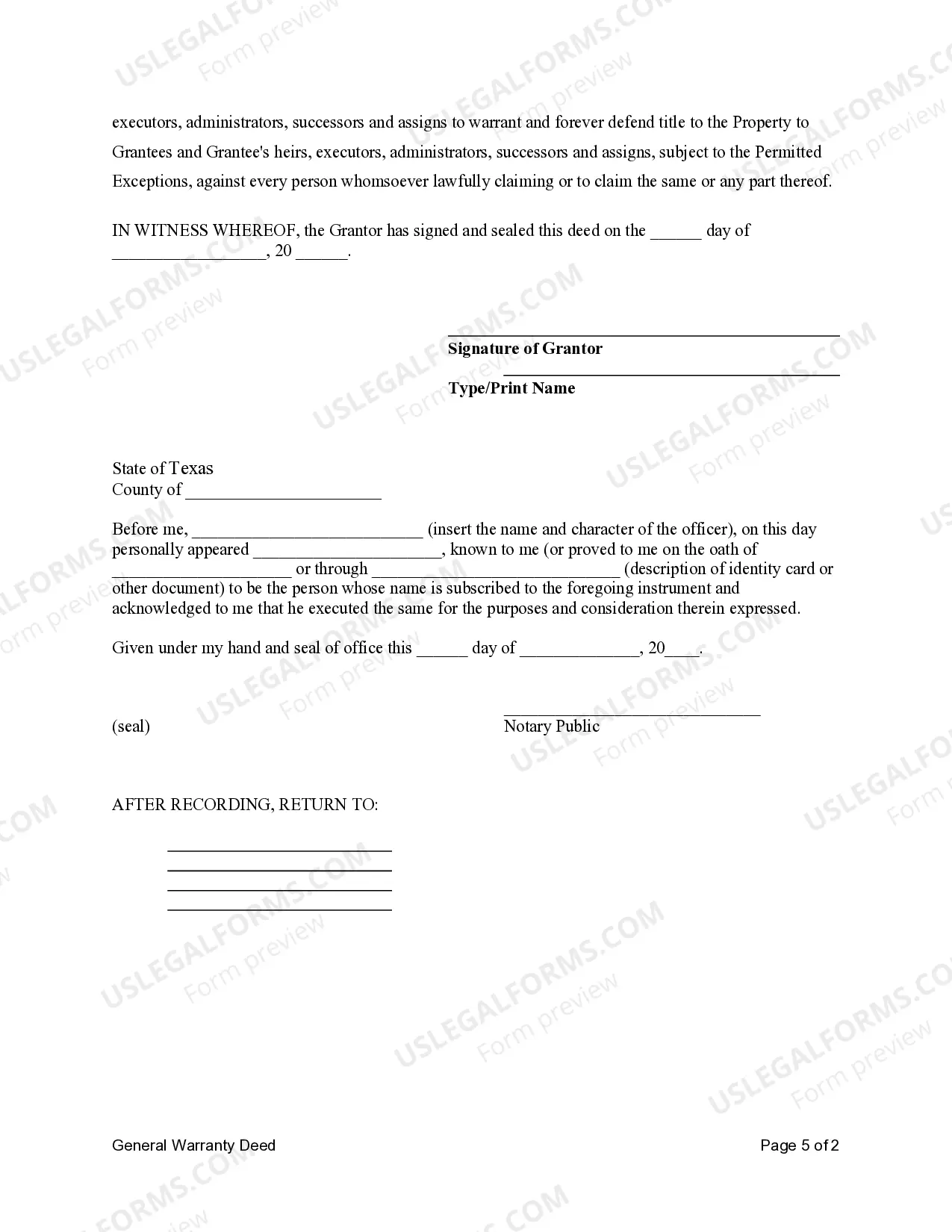

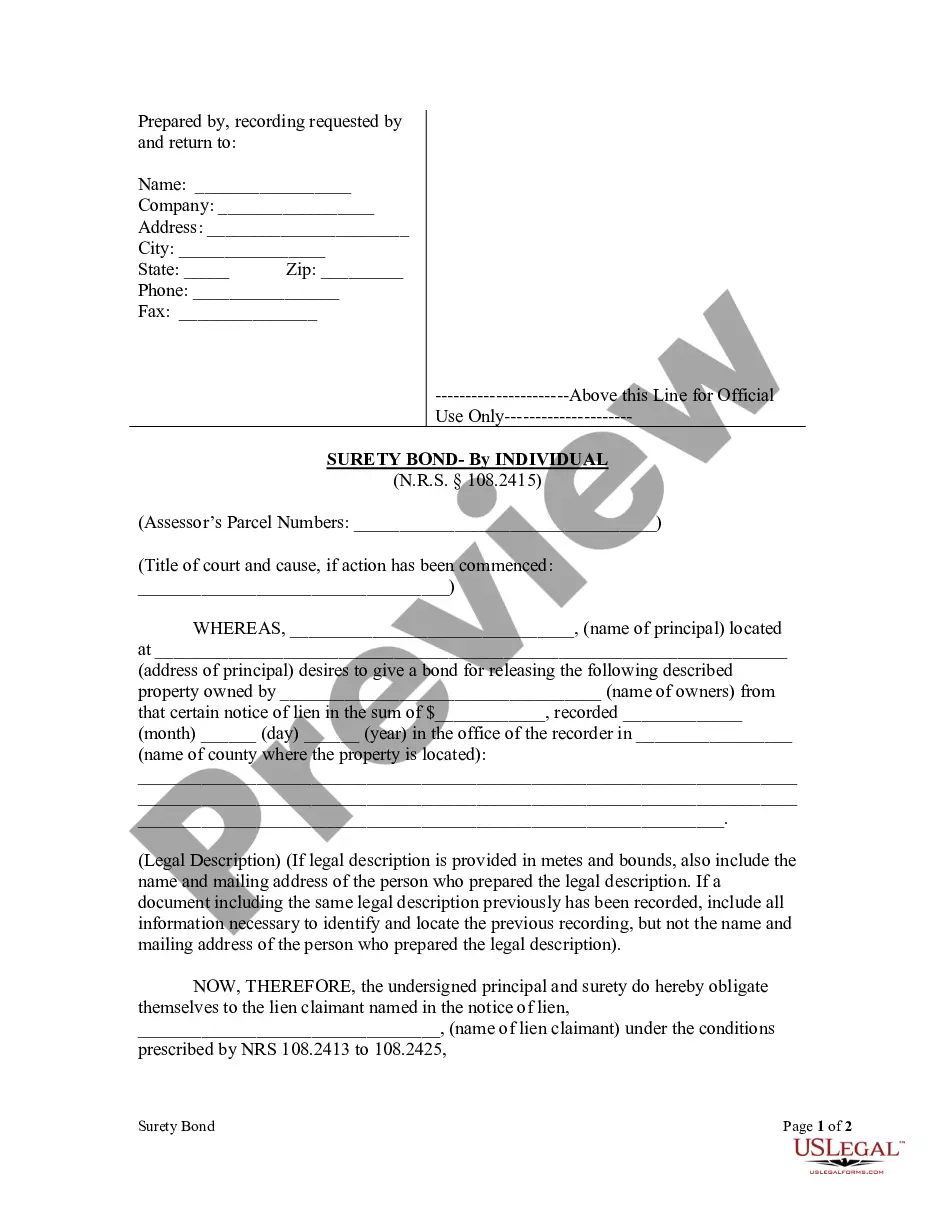

- Ensure that the document aligns with your circumstances and location by reviewing the description and preview.

- Search for an alternative sample (if required) using the Search bar located in the page header.

- Select Buy Now when you find the suitable template.

- Choose a pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to acquire the subscription plan (through a credit card or PayPal).

- Pick PDF or DOCX file format for your Survivorship For Child.

- Hit Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Yes, there are survivor benefits specifically aimed at children under the survivorship for child framework. Typically, these benefits include monetary support from Social Security, which can help cover living expenses after a parent's death. It's essential for guardians to explore these options to ensure that children receive the financial assistance they need. Utilizing resources, like the uslegalforms platform, can simplify the process of applying for these benefits.

When a parent dies, a child may be entitled to various benefits under the concept of survivorship for child. These benefits often include financial support through life insurance payouts, Social Security survivor benefits, and access to the deceased parent's estate. Additionally, children may receive support such as counseling services to help them cope with their loss. Understanding these benefits is crucial for providing the necessary support during a challenging time.

Eligibility for the survivor benefit plan includes children, spouses, and sometimes parents of the deceased worker. The survivors must meet specific conditions related to their relationship and dependency on the workforce. Each case may vary, so it's important to assess individual circumstances. The US Legal Forms platform serves as a valuable tool to guide users through the survivor benefit plan application process.

A child qualifies for survivorship for child benefits if they are under 18, or under 19 while in high school, and can demonstrate dependency on the deceased worker. Additionally, the child must not have remarried before the age of 18. Understanding these specifics is crucial for securing the benefits. Resources from US Legal Forms can assist families in understanding and applying for these benefits efficiently.

To be eligible for survivorship benefits, the deceased worker must have had sufficient work credits and contributions to Social Security. Children must have a valid claim based on their relationship to the worker. Generally, eligibility hinges on factors like age and dependency status, making it important to understand the guidelines. The US Legal Forms platform can help clarify these eligibility criteria.

Survivorship for child benefits typically apply to dependents of deceased workers. This includes biological children, adopted children, and in some situations, stepchildren. To qualify, these children must be under the age of 18, or under 19 if they are still in high school. Families can rely on the US Legal Forms platform to navigate the eligibility requirements effectively.

The surviving spouse must execute a simple Affidavit of Survivorship to memorialize the transfer. The affidavit, along with the deceased spouse's death certificate, will then be recorded with the County Recorder's Office to officially document that the transfer took place.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office. There are a few types of deeds that accomplish this in California, including a quitclaim deed, grant deed and transfer on death deed.

If all the joint owners of an asset intended that when one of them died their share would pass to the other joint owner(s), then this is a survivorship asset. This type of asset is always owned equally and the deceased's share of the asset passes to the other joint owner(s) by survivorship.

Under the right of survivorship, each tenant possesses an undivided interest in the whole estate. When one tenant dies, the tenant's interest disappears and the others tenants' shares increase proportionally and obtain the rights to the entire estate.