Limited Liability Company With Example

Description

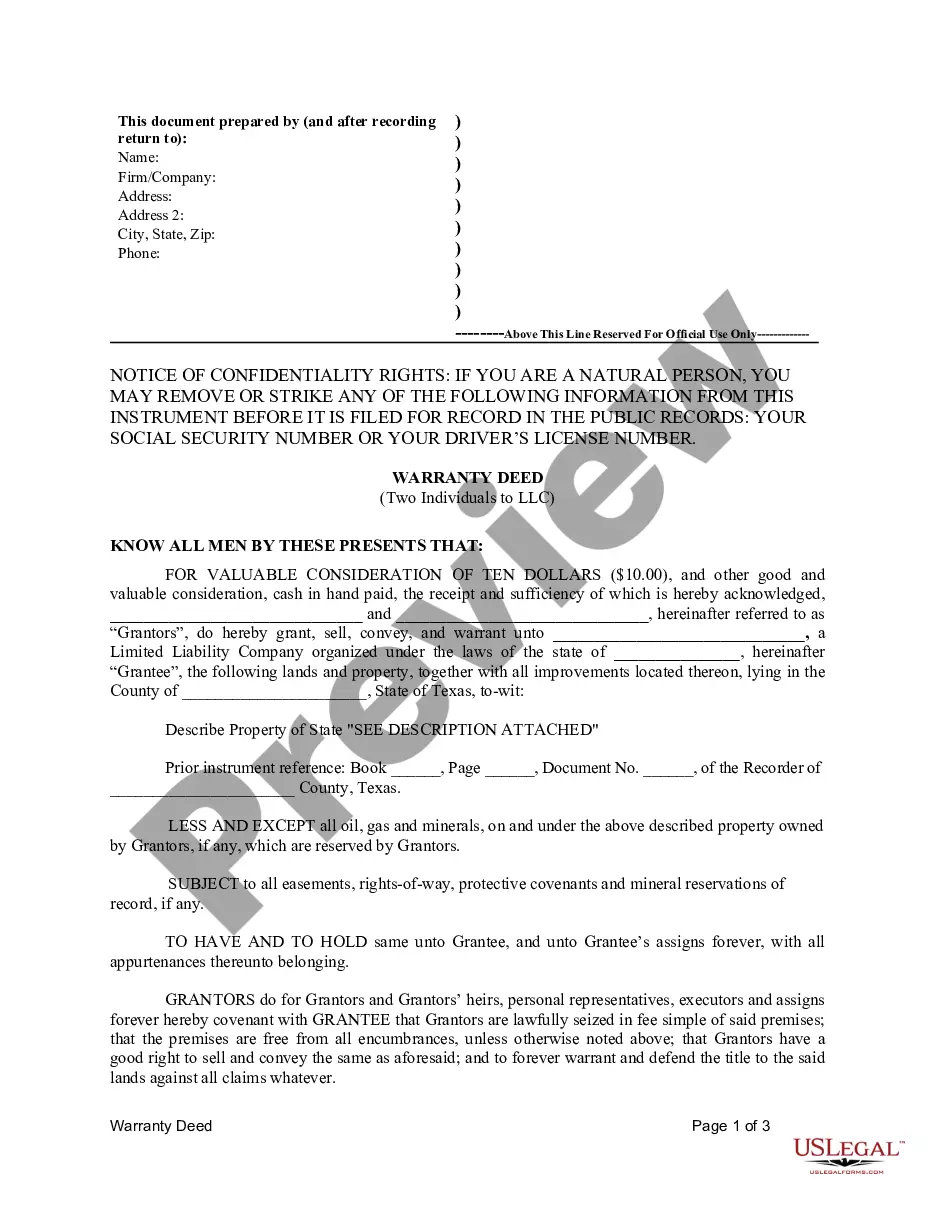

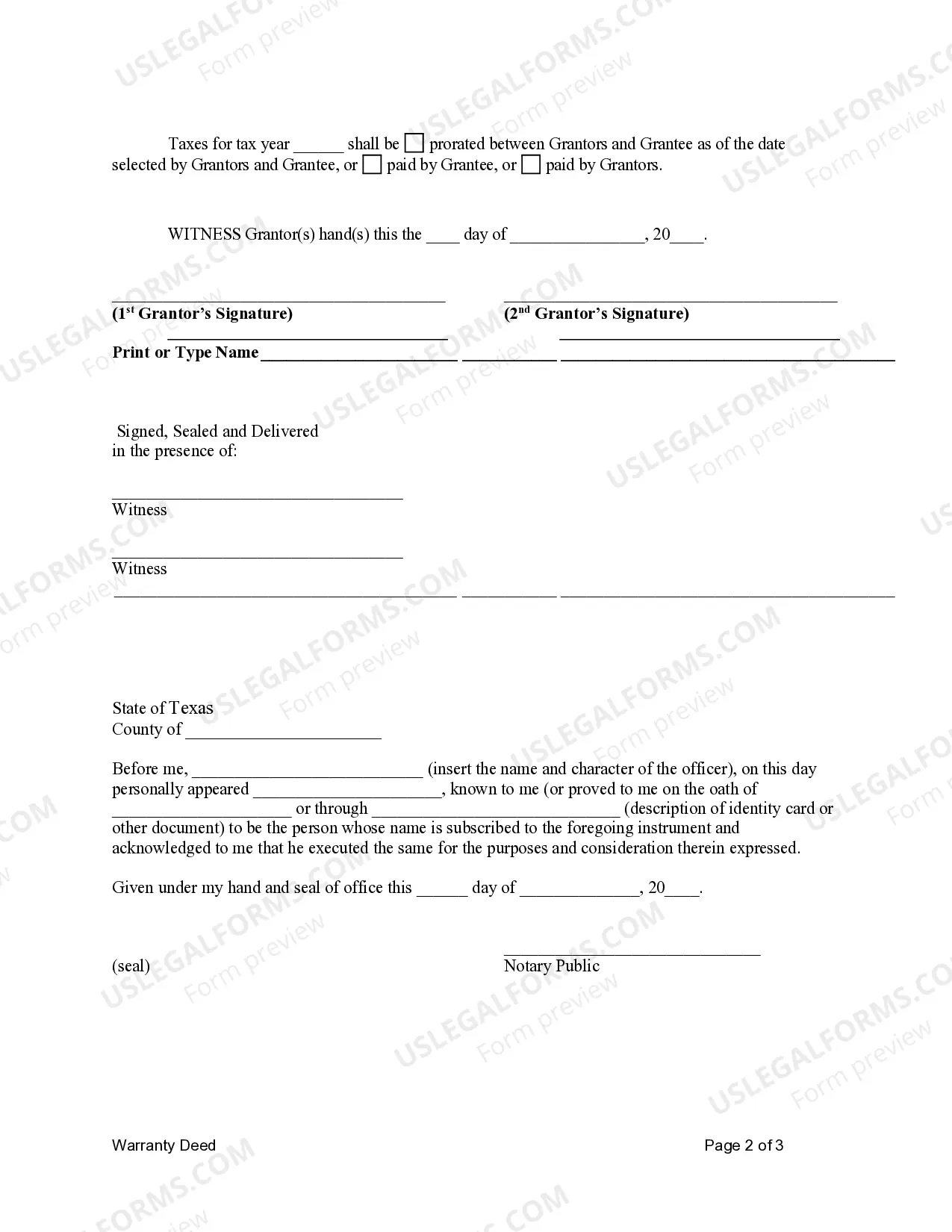

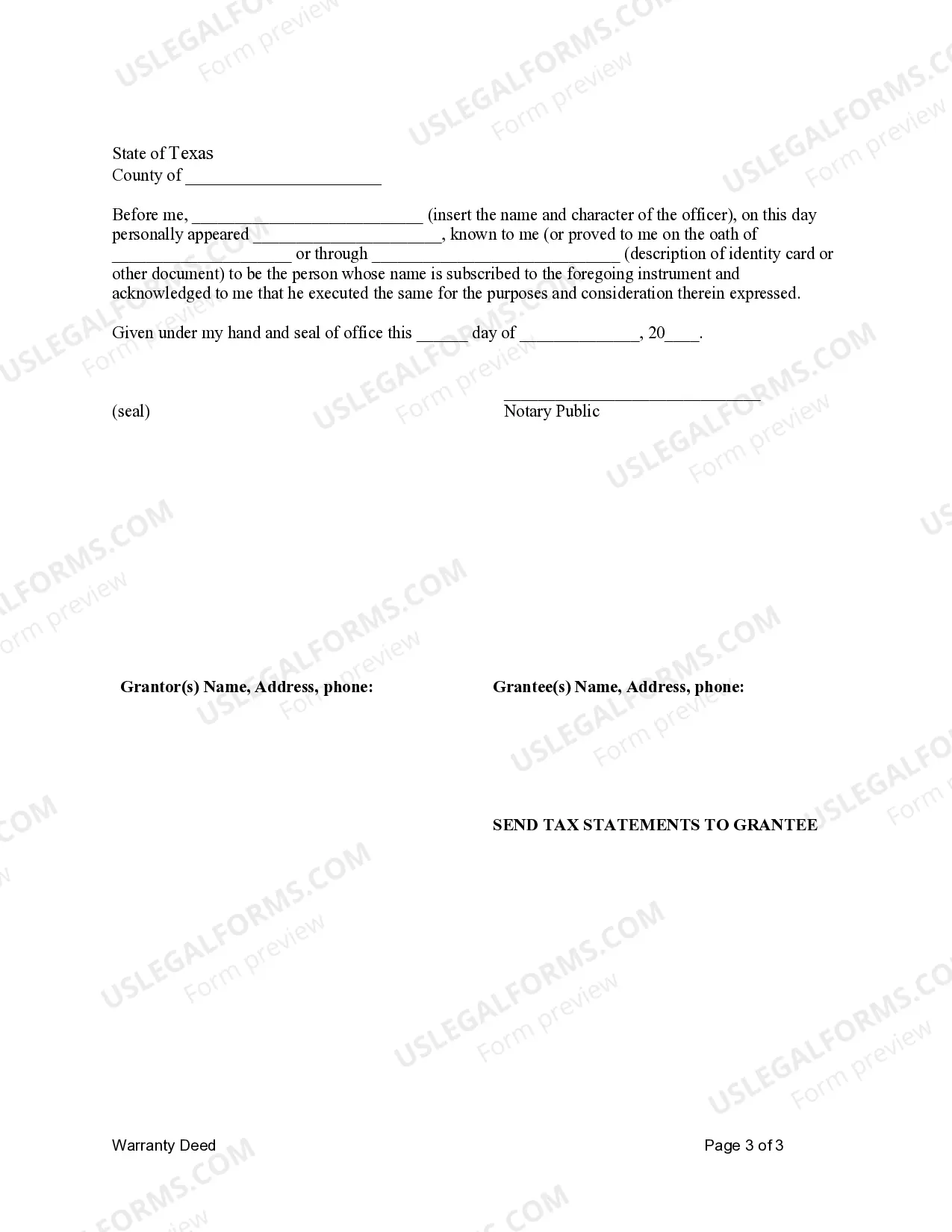

How to fill out Texas Warranty Deed From Two Individuals To LLC?

- If you're a returning user, begin by logging in to your account. Ensure your subscription is still valid for seamless access.

- If you're new to our service, start by exploring the Preview mode and read the form description to find the correct LLC template that complies with your jurisdiction.

- Should you need a different template, utilize the Search tab to locate the right document that fits your criteria.

- Click the Buy Now button to select your desired subscription plan. Make sure to register your account for access to all resources.

- Complete your payment by entering your credit card information or opting for PayPal.

- After purchasing, download your LLC template to your device and you can access it anytime through the My Forms section in your profile.

US Legal Forms provides unparalleled access to a huge library of over 85,000 editable legal templates, more than any competitor at a comparable cost. This extensive collection is designed to meet the needs of individuals and attorneys alike.

By using US Legal Forms, you can easily generate legally sound documents with expert assistance available for complex inquiries. Start your LLC journey today!

Form popularity

FAQ

Apple is a corporation, officially known as Apple Inc. Unlike a limited liability company with example, which is often used by smaller businesses, corporations operate under different legal requirements. This structure helps Apple secure investments and maintain its extensive operations across the globe. Understanding these distinctions can help you choose the best structure for your own business.

The term 'LLC in Amazon' generally refers to sellers who operate their business as an LLC while selling on the Amazon platform. These sellers take advantage of the limited liability company with an example structure to shield their personal assets from business risks. Operating as an LLC provides many sellers on Amazon with benefits like tax flexibility and easier management. Therefore, it can be a strategic choice for online entrepreneurs.

Google is not a limited liability company; it operates as a corporation called Alphabet Inc. While limited liability companies with examples are appealing for smaller businesses, larger companies like Google benefit from being a corporation. This setup allows them to issue stock and reach a wider market. If you have a growing business, considering an LLC might be a smart move.

Many types of businesses use the limited liability company structure due to its benefits. For instance, restaurants, consulting firms, and e-commerce businesses often choose LLCs to limit personal liability while enjoying tax advantages. This structure is also favorable for small to medium-sized businesses. It’s always wise to evaluate your options and choose what suits your business plan best.

No, Amazon is not an LLC company; it is a corporation. LLCs offer more flexibility and fewer reporting requirements than corporations. However, corporations like Amazon can more easily attract investors. Thus, each business structure has its advantages depending on your goals and needs.

Amazon is classified as a corporation, specifically a publicly traded corporation. Unlike a limited liability company with an example, a corporation has a different set of regulations and can issue shares to the public. This allows Amazon to raise significant capital, which fuels its growth and expansion. Understanding the structure of your business helps in making informed decisions.

A limited liability company, or LLC, is a business structure that protects its owners from personal liability for debts. For example, if Sarah starts a bakery as an LLC, her personal assets, like her home or car, are safe from claims against her business. This structure combines the benefits of a corporation with the flexibility of a partnership. Hence, it's a popular choice for many entrepreneurs.

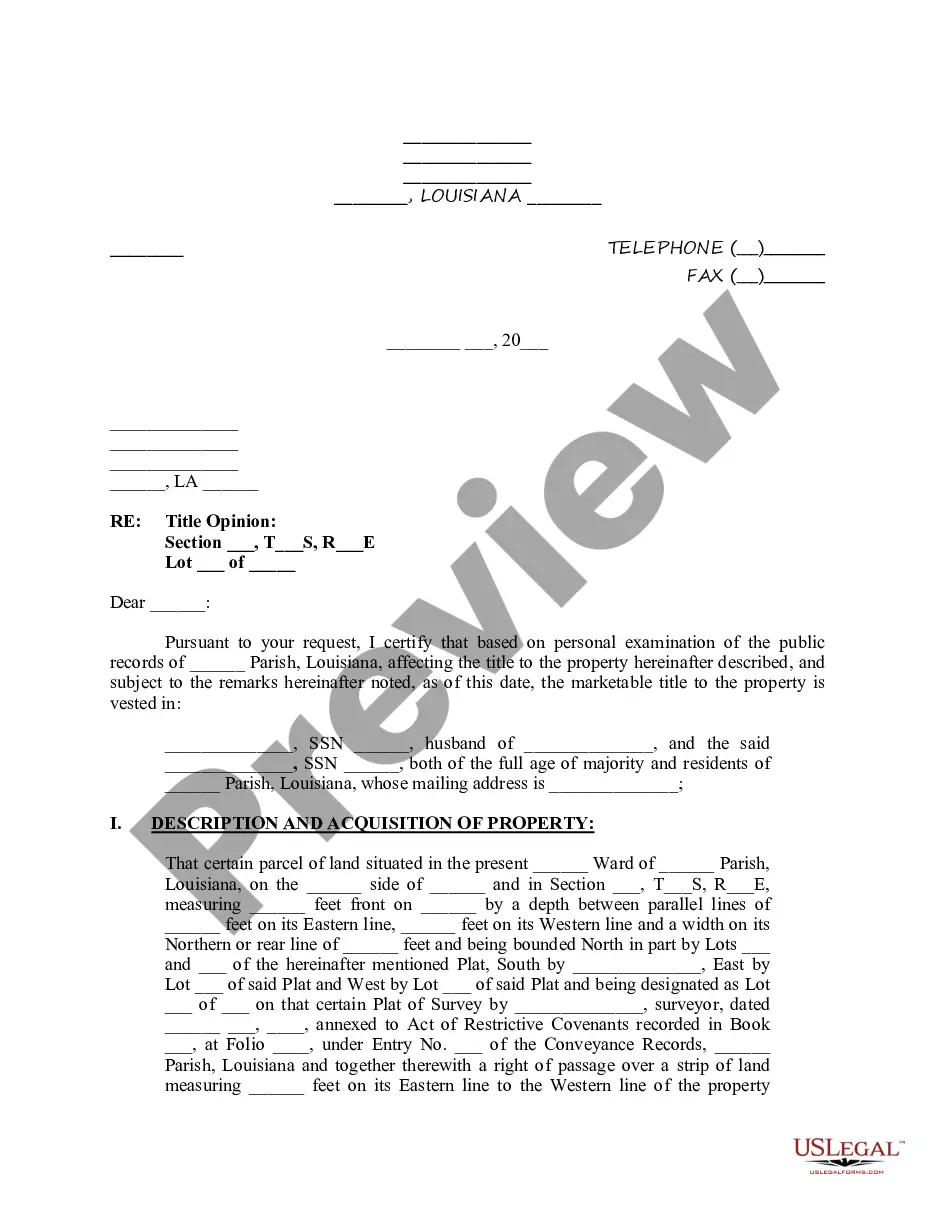

To get a limited liability company with example, first determine the name and structure of your LLC, ensuring it meets state regulations. Next, file the required paperwork, like articles of organization, with your state's business office. Finally, consider creating an operating agreement to outline the roles and responsibilities of members. Resources like USLegalForms can help streamline the entire registration process.

While it may seem unusual, you can start a limited liability company with example even if you do not have an established business. This can be a strategic move for individuals planning to launch a business in the future, as it offers protection from personal liability. However, you will need to actively maintain the LLC by filing annual reports and paying necessary fees. Consulting platforms like USLegalForms can guide you through the initial setup.

To establish a limited liability company with example, you typically begin by choosing a unique name that complies with state regulations. Next, you should file articles of organization with your state, providing necessary information about your business. After that, creating an operating agreement can help define ownership and management structure. Various platforms, like USLegalForms, can simplify this process for you.