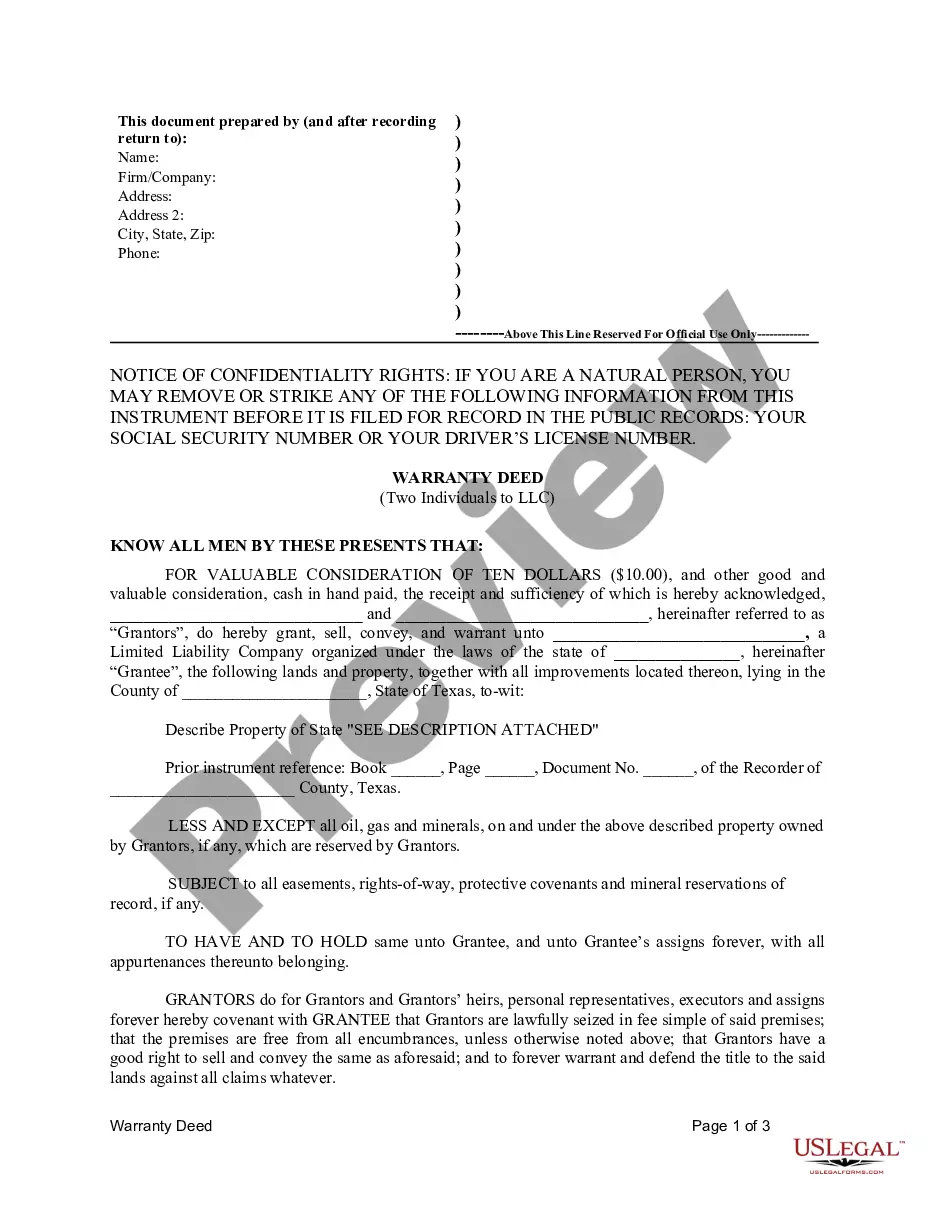

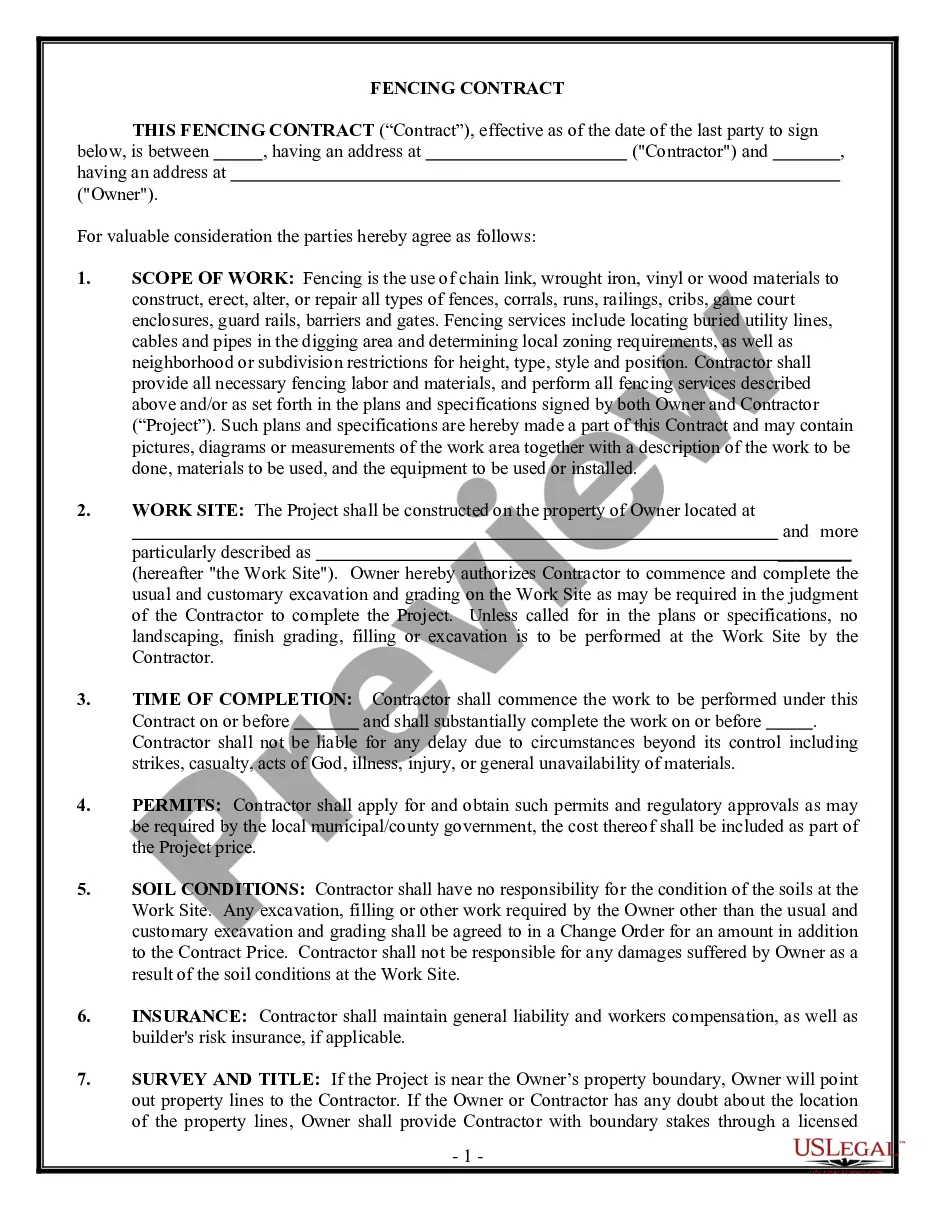

Texas Warranty Deed from two Individuals to LLC

Understanding this form

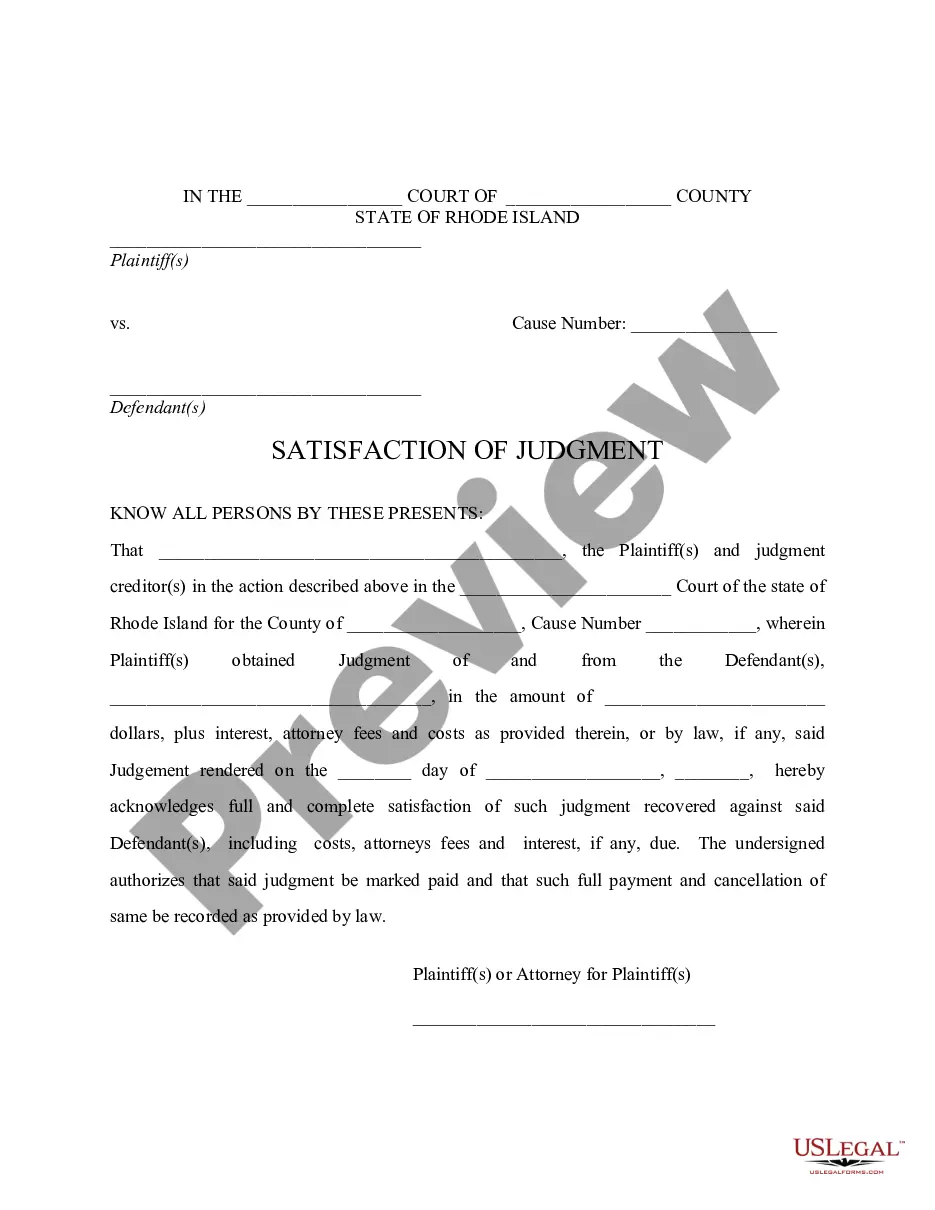

A Warranty Deed from two Individuals to LLC is a legal document used to transfer property ownership from two individuals (Grantors) to a limited liability company (Grantee). Unlike a standard warranty deed, this form specifically includes provisions regarding the reservation of oil, gas, and minerals under the property, ensuring that these resources remain with the Grantors. This form establishes a clear title transfer and guarantees the Grantee against any claims that might arise regarding the property.

Key parts of this document

- Identification of Grantors: Names and signatures of the individuals transferring the property.

- Identification of Grantee: Name of the LLC receiving the property.

- Property Description: Detailed information about the property being transferred, including legal descriptions.

- Reservation Clause: Specifies that oil, gas, and minerals under the property are reserved by the Grantors.

- Warranties and Covenants: Assurances from the Grantors regarding their legal ownership and the absence of encumbrances.

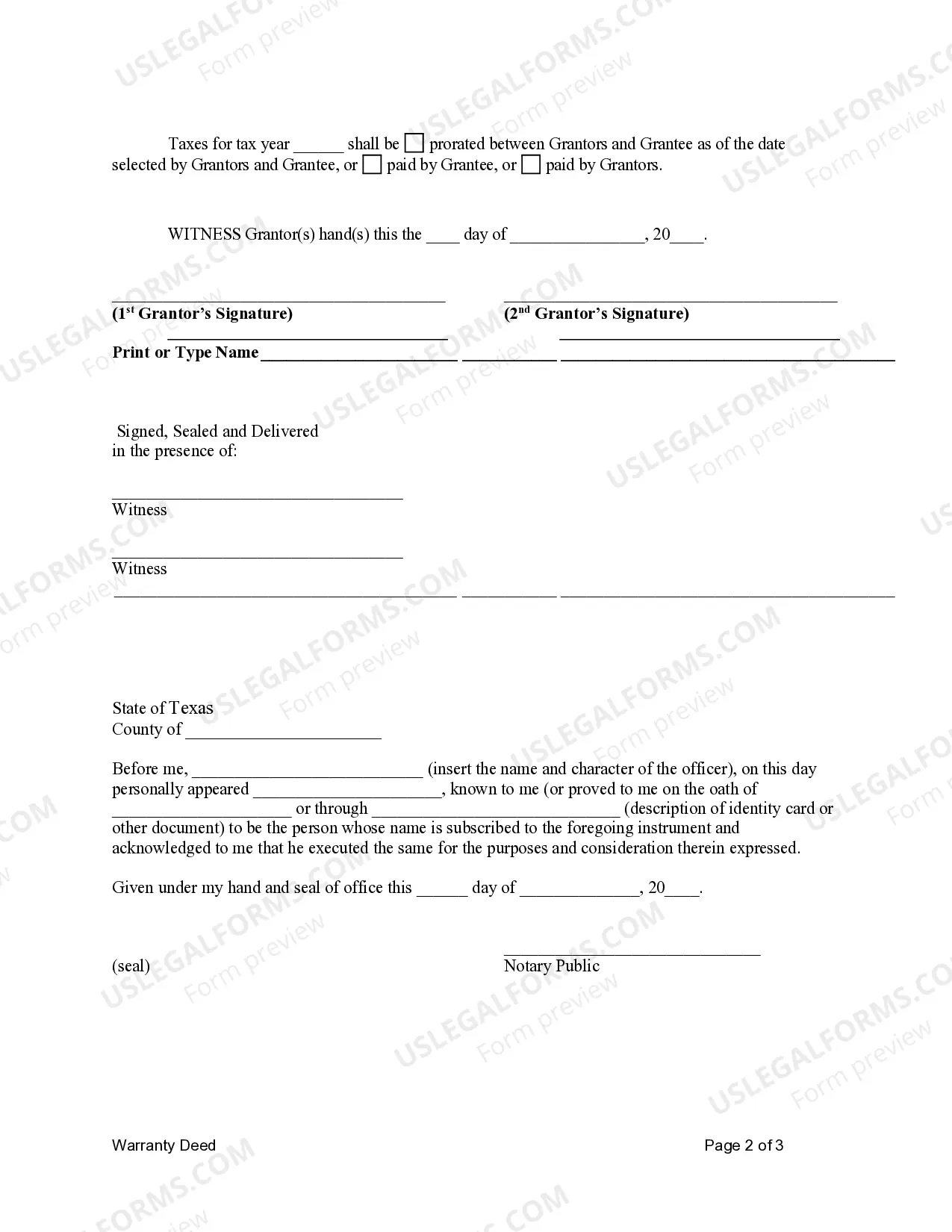

- Taxes: Information on how property taxes will be handled between the parties.

Common use cases

This Warranty Deed is used when two individuals wish to transfer real estate ownership to a limited liability company, often for business or investment purposes. It is typically required in scenarios such as selling property to a business, transferring property for asset protection, or changing the title of property owned jointly by individuals to an LLC structure.

Who should use this form

- Real estate owners looking to transfer property to an LLC.

- Individuals involved in joint ownership of property who want to formalize the transfer to a business entity.

- Business owners needing to acquire property for business operations.

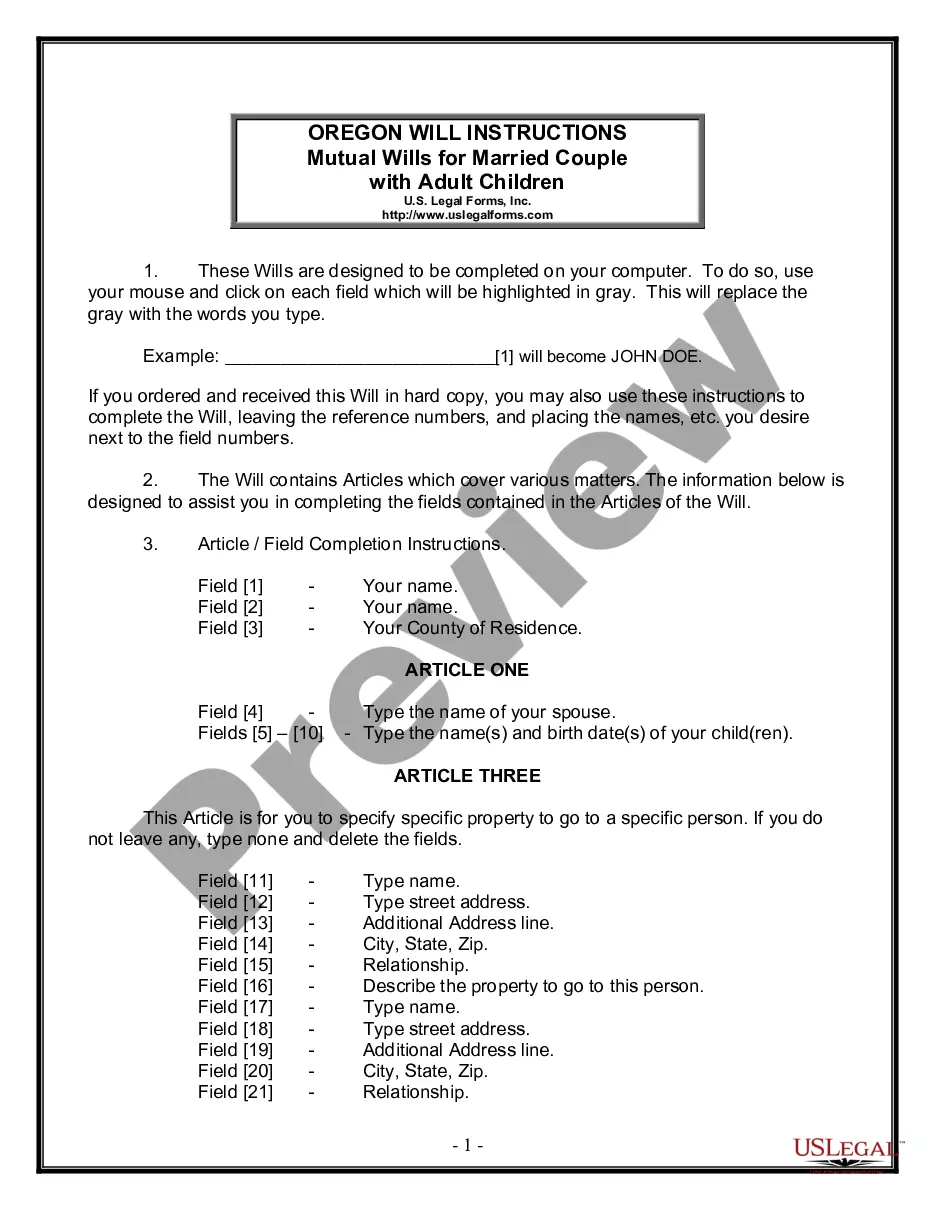

Instructions for completing this form

- Identify the parties: Fill in the names of the Grantors and the Grantee.

- Specify the property: Provide a complete legal description of the property being transferred.

- Enter consideration: Document the amount of monetary consideration for the transfer, usually ten dollars.

- Check for reservations: Indicate the reserved rights for oil, gas, and minerals if applicable.

- Include signatures: Ensure all Grantors sign the document in front of a notary public.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include a complete legal description of the property.

- Not properly reserving mineral rights if the Grantors wish to retain them.

- Omitting signatures or failing to have the document notarized.

- Incorrectly stating the nature of ownership, leading to potential disputes.

Key takeaways

- The Warranty Deed allows for a legal transfer of property from individuals to an LLC.

- It protects both parties by outlining warranties and ensuring clarity of ownership rights.

- Always ensure notarization for legal validity and compliance with state laws.

- Review the deed for accuracy to avoid common mistakes during the transfer process.

Looking for another form?

Form popularity

FAQ

The answer is yes. Parties to a transaction are always free to prepare their own deeds. If you do so, be sure your deed measures up to your state's legal regulations, to help avert any legal challenge to the deed later.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

In order to make the Warranty Deed legally binding, the Seller needs to sign it front of a notary public. Then signed and notarized deed must be filed at the city or county office for recording property documents. Before filing with this office all previously billed property taxes must be paid in full.

The Texas warranty deed is a form of deed that provides an unlimited warranty of title.In Texas, warranty deeds are often used: When a buyer is purchasing residential property from a seller for full value; When the buyer does not intend to purchase title insurance; or.

In Texas, you can't add your spouse's name to an existing deed, but you can create a new deed by transferring the property from yourself to you and your spouse jointly. You can do this by using either a deed without warranty or a quit claim deed.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Write the county where the property is located on line provided next to the words "County of" beneath the words "The State of Texas." Write the name and address of the grantor on the lines provided after the words "Know all men by these presents, That I."

But back to basics. In order to validly convey title to real estate in Texas, a grantor must execute a deed to the property in front of a notary public. The deed must be presented to and accepted by the grantee, and it should be filed of record in the county clerk's office to put the public on notice of the transfer.