Texas Foreclosure Notice Requirements

Description

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

Regardless of whether for corporate objectives or personal matters, everyone must handle legal situations at some stage in their life.

Filling out legal documents necessitates meticulous attention, starting with selecting the appropriate form example.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- For instance, if you select an incorrect version of a Texas Foreclosure Notice Requirements, it will be rejected upon submission.

- Thus, it is vital to acquire a reliable source of legal documents like US Legal Forms.

- If you need to obtain a Texas Foreclosure Notice Requirements template, follow these straightforward steps.

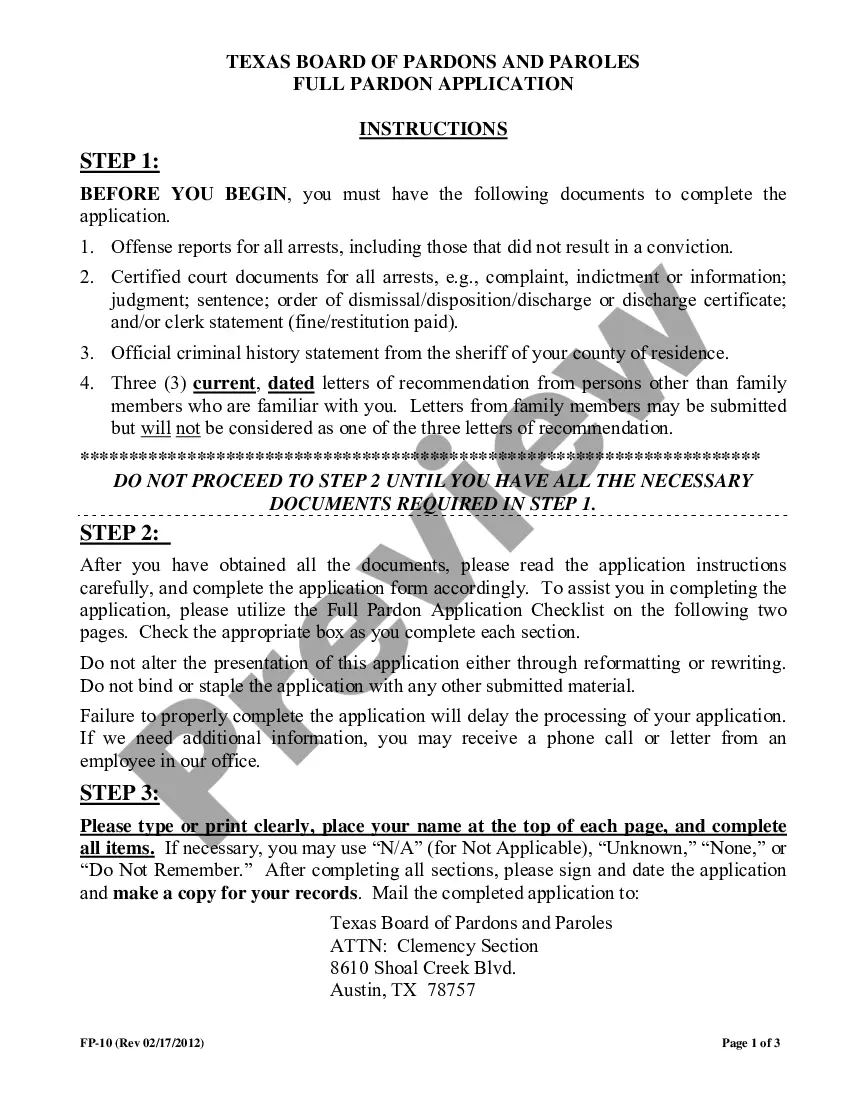

- Access the template you require using the search bar or catalog navigation.

- Review the form’s description to confirm it aligns with your circumstances, state, and area.

- Click on the form’s preview to examine it.

- If it is the wrong document, revert to the search feature to find the Texas Foreclosure Notice Requirements example you need.

- Download the file if it satisfies your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- In case you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: you may utilize a credit card or PayPal account.

- Select the document format you wish and download the Texas Foreclosure Notice Requirements.

- Once it is downloaded, you can fill out the form using editing software or print it and fill it out manually.

- With an extensive US Legal Forms library available, you never need to waste time searching for the appropriate template online.

- Utilize the library’s easy navigation to discover the correct template for any circumstance.

Form popularity

FAQ

Texas law requires that the lender/servicer must send the borrower a notice of default and intent to accelerate by certified mail that provides at least 20 days to cure the default before notice of sale can be given.

Texas is bound by federal law that stipulates a borrower must be 120 days delinquent on a mortgage loan before the foreclosure process can begin. The manner in which most mortgages are structured means that four mortgage payments will likely be missed before a lender will begin the foreclosure process.

In most cases involving a home loan, federal regulations state the foreclosure action cannot begin until the loan is over 120 days delinquent. Texas Civil Practice and Remedies Code Section 16.035 places a 4-year statute of limitations on foreclosure actions though there are some exceptions to this law.

This is basically a document telling you that the lender will foreclose on your property if you do not take action to stop it. Ignoring it will only lead to further legal trouble, and it could prevent you from being able to negotiate with the lender to find a solution that allows you to keep your home.

In a non-judicial foreclosure, after the 20-day "right to reinstate" period has expired and at least 21 days before the sale, the servicer must provider the borrower with a Notice of Sale, letting them know the date and earliest time of the sale.