Florida Quitclaim Deed for Trustee to Beneficiary

Description

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

Gain entry to the largest collection of legal documents.

US Legal Forms serves as a resource for locating any state-specific document in just a few clicks, including examples of Florida Quitclaim Deed for Trustee to Beneficiary.

No need to spend hours of your time searching for an admissible court sample. Our certified professionals ensure that you receive the most current documents consistently.

After selecting a pricing plan, create your account. Make payment via credit card or PayPal. Download the sample to your device by clicking on the Download button. That’s it! You should fill out the Florida Quitclaim Deed for Trustee to Beneficiary template and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and effortlessly browse over 85,000 valuable samples.

- To take advantage of the document library, select a subscription and establish your account.

- If you have completed that, simply Log In and click Download.

- The Florida Quitclaim Deed for Trustee to Beneficiary file will immediately be saved in the My documents section (a section for all forms you store on US Legal Forms).

- To set up a new profile, review the quick tips below.

- If you intend to use a state-specific template, make sure to select the correct state.

- If feasible, review the description to understand all the details of the form.

- Make use of the Preview option if it’s available to examine the document's details.

- If everything looks correct, click Buy Now.

Form popularity

FAQ

A trustee's deed transfers property held in a trust, often following a sale or distribution of assets, while a quitclaim deed transfers whatever interest the current owner has in the property, without assurances of title. In a situation involving a Florida Quitclaim Deed for Trustee to Beneficiary, the quitclaim deed may be used to transfer property interest directly to beneficiaries as designated by the trustee. This vital distinction helps clarify the purpose and implications of each deed type within the realm of property law.

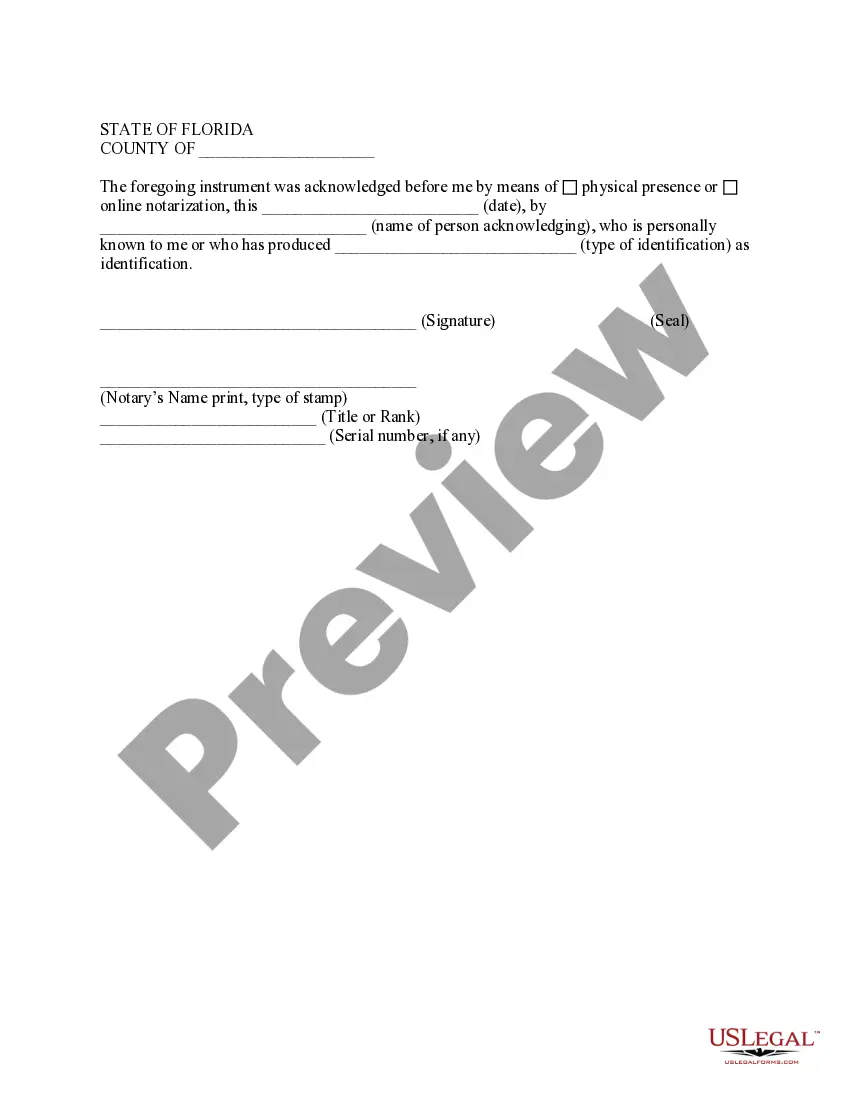

In Florida, a quit claim deed allows a property owner to transfer their interest to another party without guaranteeing that the title is clear. It's important to have the quit claim deed signed in front of a notary and recorded with the county clerk for the transfer to take effect legally. Additionally, ensure that the document includes the names of the grantor and grantee, as well as a legal description of the property. Understanding these rules is crucial when considering a Florida Quitclaim Deed for Trustee to Beneficiary.

In Florida, you do not necessarily need a lawyer to file a quitclaim deed, such as the Florida Quitclaim Deed for Trustee to Beneficiary. However, having legal guidance can help ensure that all paperwork is completed correctly and meets local requirements. It is especially beneficial if the deed transfer involves complex properties or disputes regarding ownership. Using platforms like US Legal Forms can also assist you in preparing the necessary documents.

Transferring a trust to a beneficiary typically involves a formal process outlined in the trust agreement. Beneficiaries may need to fill out specific forms, like the Florida Quitclaim Deed for Trustee to Beneficiary, to officially transfer property titles. It’s advisable to review the trust document for any specific instructions and consult with an expert if needed. Ensuring everything is properly documented protects the rights of all parties involved.

Selling property inherited from a trust involves a few key steps. First, you should verify your status as a beneficiary and confirm your rights to the property. After that, executing a Florida Quitclaim Deed for Trustee to Beneficiary can help transfer the title to you, allowing you to sell the property. Consulting a real estate professional can help you navigate the selling process effectively.

To change ownership of a property after death in Florida, you need to follow the procedures set forth in the will or trust. If the property is held in a trust, you can utilize a Florida Quitclaim Deed for Trustee to Beneficiary to transfer the title directly to the beneficiaries. If the property is not in a trust, you may need to go through probate to establish legal ownership before making any changes.

When a trust creator passes away, the trust assets are transferred to the beneficiaries as outlined in the trust document. This process typically bypasses probate, allowing for quicker access to the assets. A Florida Quitclaim Deed for Trustee to Beneficiary can be used to formally transfer property titles from the trust to the beneficiaries. Ensuring accurate documentation can streamline the overall transfer process.

The primary purpose of a trustee deed is to facilitate the transfer of property held in a trust to beneficiaries. This deed ensures that the property is conveyed according to the terms of the trust agreement. Using the Florida Quitclaim Deed for Trustee to Beneficiary helps in this transfer by streamlining the legal process while ensuring that your beneficiaries receive the property as intended.

A trustee deed and a quitclaim deed serve different purposes. A trustee deed is used when a trustee transfers property from a trust, while a quitclaim deed transfers ownership rights without any warranties. The Florida Quitclaim Deed for Trustee to Beneficiary may be used to convey property interests, but its function does not provide the same legal assurances as a trustee deed.

Writing a beneficiary deed requires you to specify the property address, the names of the beneficiaries, and clear instructions on how the property should be transferred upon your death. The beneficiary deed must be signed and notarized to be valid in Florida. This process often aligns with the principles behind the Florida Quitclaim Deed for Trustee to Beneficiary, making it beneficial for estate planning.