Tx Gift Deed Texas Withdrawal

Description

How to fill out Texas Gift Deed For Individual To Individual?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Certain instances may require extensive research and substantial financial investment.

If you're looking for a more simple and economical method of drafting Tx Gift Deed Texas Withdrawal or any other documents without unnecessary hurdles, US Legal Forms is always at your service.

Not registered yet? No worries. It requires minimal time to sign up and explore the catalog.

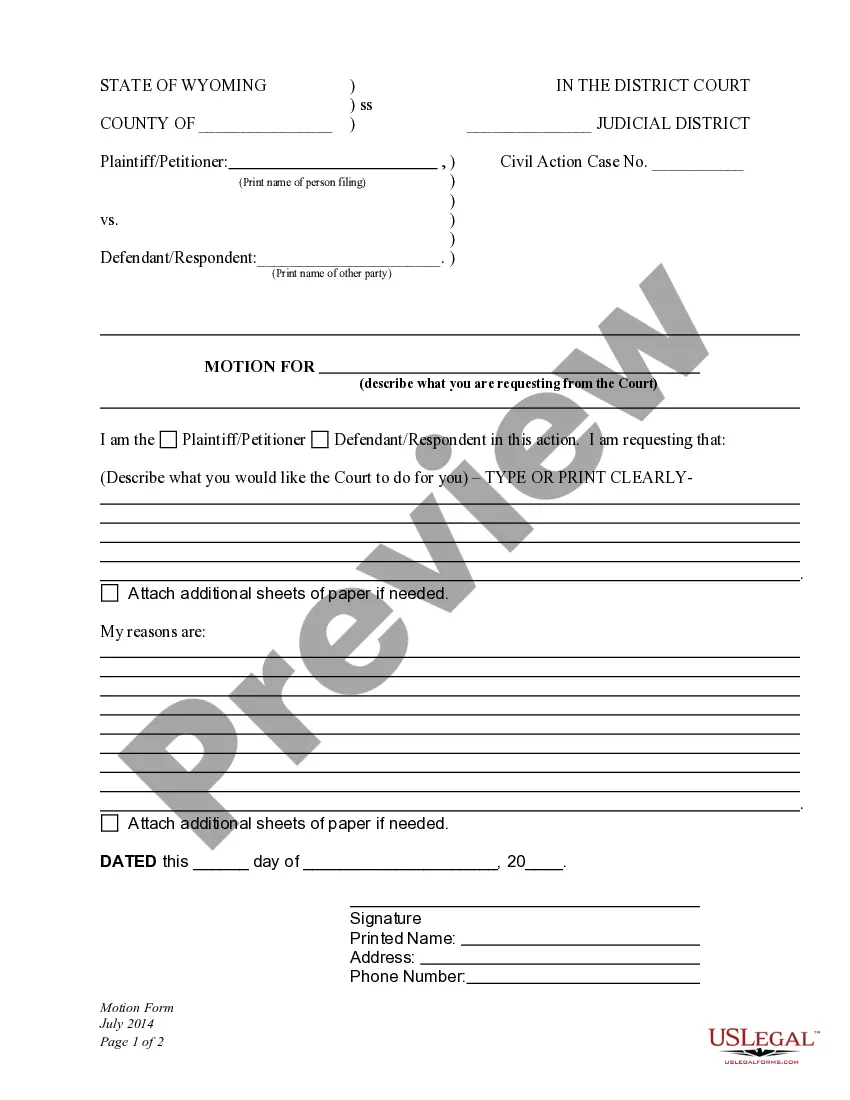

But before jumping directly to downloading Tx Gift Deed Texas Withdrawal, consider these suggestions: Review the document preview and descriptions to confirm that you are on the correct form. Verify that the template you select adheres to the regulations and laws of your specific state and county. Select the appropriate subscription plan to obtain the Tx Gift Deed Texas Withdrawal. Download the form, then complete, certify, and print it. US Legal Forms has an excellent reputation and over 25 years of experience. Join us today and make document execution a hassle-free process!

- Our digital library of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal matters.

- With just a few clicks, you can swiftly access state- and county-specific templates carefully prepared for you by our legal experts.

- Utilize our platform whenever you need a dependable and trustworthy service that allows you to easily find and obtain the Tx Gift Deed Texas Withdrawal.

- If you're already familiar with our services and have created an account, simply Log In to your account, select the form, and download it or re-download it at any time from the My documents section.

Form popularity

FAQ

A gift deed can be challenged on several grounds, including lack of capacity, undue influence, or misrepresentation. If the donor did not fully understand the implications of the gift or was coerced, these factors can invalidate the deed. Knowing the grounds for contesting a Tx gift deed texas withdrawal can empower you to address any disputes effectively.

In Texas, gift deeds must meet specific legal requirements to be valid. These include having a written document, proper execution, and clear intent from the donor. Familiarizing yourself with the rules governing Tx gift deed texas withdrawal can help ensure that your gift deeds are enforceable and legally sound.

A gift deed can indeed be canceled, but it requires valid reasons such as fraud or undue influence. If the gift was given under conditions that are no longer met, cancellation may also be possible. It's crucial to understand the procedures involved in Tx gift deed texas withdrawal to ensure that your rights are protected.

Yes, you can revoke a gift deed in Texas under certain conditions. The donor must provide clear and documented intent to cancel the gift, and this often involves a formal process. Understanding the legalities of Tx gift deed texas withdrawal is essential, and seeking professional help can simplify this process.

Cancellation of a gift deed can occur due to fraud, undue influence, or lack of capacity. If the donor was misled or coerced into giving the gift, this may serve as grounds for cancellation. Additionally, if there are significant changes in circumstances, such as the recipient's actions, it may prompt a Tx gift deed texas withdrawal.

To obtain a deed of release, you typically need to draft a legal document that expresses your intent to relinquish ownership rights. You may want to consult legal resources or professionals who specialize in real estate to ensure you meet all necessary requirements. Platforms like US Legal Forms can provide templates and guidance for creating a deed of release tailored to your needs.

A gift can be revoked if the donor provides clear evidence of intent to withdraw the gift. If the recipient fails to meet specific conditions set by the donor, this may also lead to revocation. In Texas, the process of Tx gift deed texas withdrawal often requires formal documentation to ensure legality and clarity.

To submit a quitclaim deed, you must take it to the county recorder's office in the county where the property is situated. It's important to ensure that the deed is properly filled out and signed before submission. Once filed, the quitclaim deed becomes part of public records. USLegalForms can assist you in preparing and filing the necessary documents for a seamless Tx gift deed Texas withdrawal.

Filing a gift deed in Texas involves several key steps. You must complete the deed form accurately, ensuring all necessary details are included. Once signed by both parties and notarized, you will file the deed with the county clerk where the property is located. Using USLegalForms can simplify this process, providing you with the right forms and guidance for a smooth Tx gift deed Texas withdrawal.

To transfer ownership of a house using a gift deed, you first need to prepare the deed, detailing the property information and the names of the giver and recipient. After that, both parties must sign the deed in front of a notary public. Finally, you should file the gift deed with the county clerk's office to record the transfer. This process is crucial for ensuring the legitimacy of the Tx gift deed Texas withdrawal.