Texas Gift Form Printable For Car

Description

How to fill out Texas Gift Deed For Individual To Individual?

It's clear that you cannot become a legal authority instantly, nor can you learn how to swiftly prepare the Texas Gift Form Printable For Car without possessing a specialized skill set.

Assembling legal documents is a lengthy process that demands specific training and expertise. So why not entrust the preparation of the Texas Gift Form Printable For Car to the professionals.

With US Legal Forms, one of the most comprehensive legal document repositories, you can find everything from court documents to templates for internal business communication.

If you need a different template, restart your search.

Create a free account and select a subscription plan to purchase the template. Click Buy now. After the transaction is completed, you can download the Texas Gift Form Printable For Car, fill it out, print it, and send or mail it to the designated recipients or organizations.

- We understand how vital compliance and adherence to federal and local laws and regulations are.

- That's why, on our site, all templates are location-specific and current.

- Here’s how to start with our platform and obtain the form you require in just a few minutes.

- Find the form you need using the search bar at the top of the page.

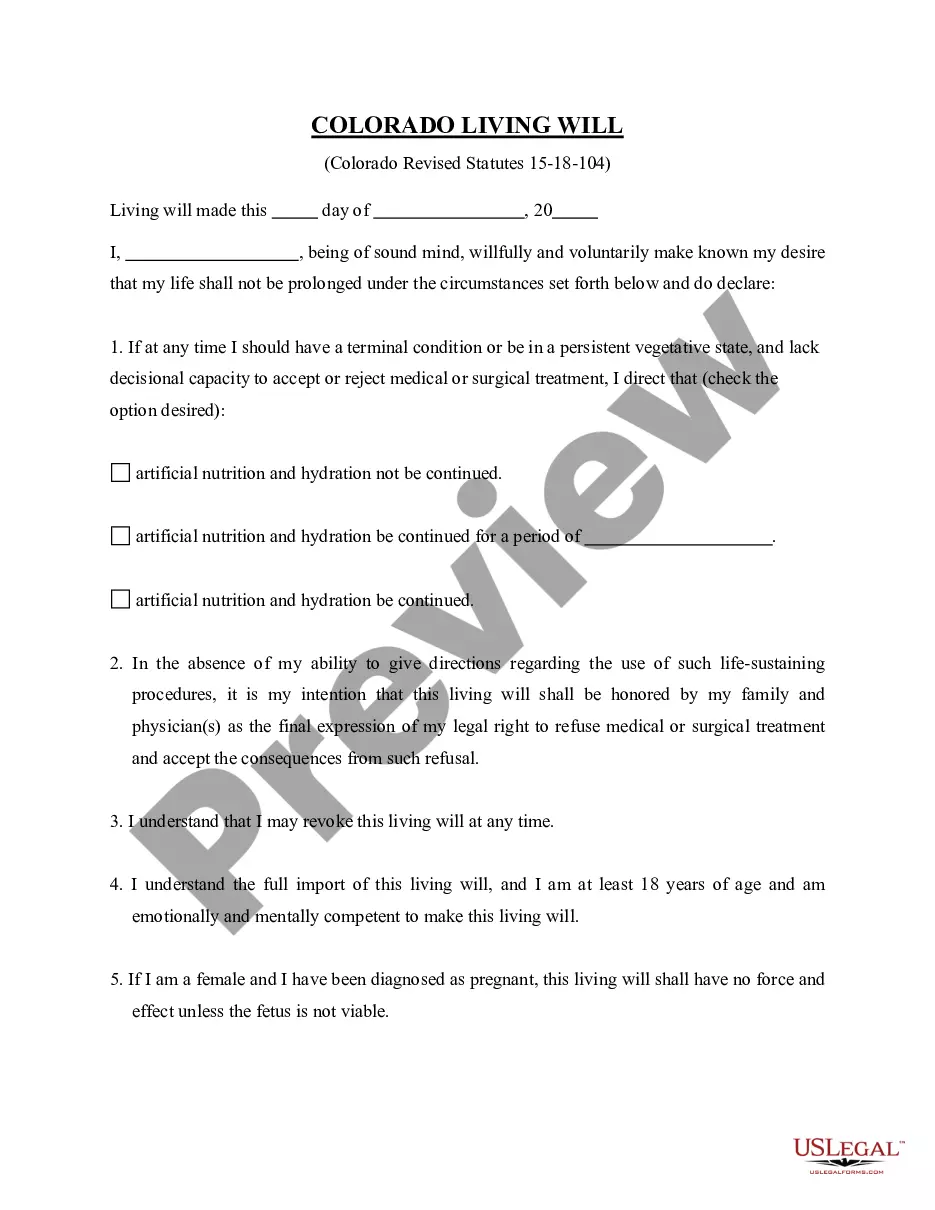

- Preview it (if this option is available) and review the supporting description to see if the Texas Gift Form Printable For Car is what you're looking for.

Form popularity

FAQ

Create a bill of sale Sure, you're not selling your car, but your local department of motor vehicles will still need you to draft a document showing the details of the gift and other conditions attached. As the giver, you need to create a bill of sale that identifies you as the previous owner and the to-be owner.

Taxable Transfers The transaction is subject to motor vehicle tax and standard presumptive value (SPV) procedures may apply. The $10 gift tax is due when a motor vehicle is transferred between eligible family members for no consideration.

In addition to completing Form 130-U, Application for Texas Title and/or Registration (PDF), both the donor and person receiving the motor vehicle must complete a required joint notarized Form 14-317, Affidavit of Motor Vehicle Gift Transfer, describing the transaction and the relationship between the donor and ...

The donor and recipient must complete a joint notarized Affidavit of Motor Vehicle Gift Transfer (form 14-317) and must be filed in person by either the donor or recipient.