Texas Gift Deed Sample For Movable Property

Description

How to fill out Texas Gift Deed For Individual To Individual?

It’s well known that you cannot become a legal expert at once, nor can you quickly learn how to draft a Texas Gift Deed Sample For Movable Property without having a specialized background.

Producing legal documents is a lengthy endeavor that demands specific education and expertise. So why not entrust the preparation of the Texas Gift Deed Sample For Movable Property to the professionals.

With US Legal Forms, one of the most extensive libraries of legal documents, you can discover anything from court filings to templates for in-office communications. We understand how vital compliance and adherence to federal and state regulations are.

Select Buy now. Once your payment is processed, you can access the Texas Gift Deed Sample For Movable Property, fill it out, print it, and send or mail it to the required parties or organizations.

You can return to your forms from the My documents tab at any time. If you’re already a customer, simply Log In to find and download the template from the same tab.

- Start by visiting our website and acquire the document you require in just a few minutes.

- Search for the document you seek using the search bar at the top of the page.

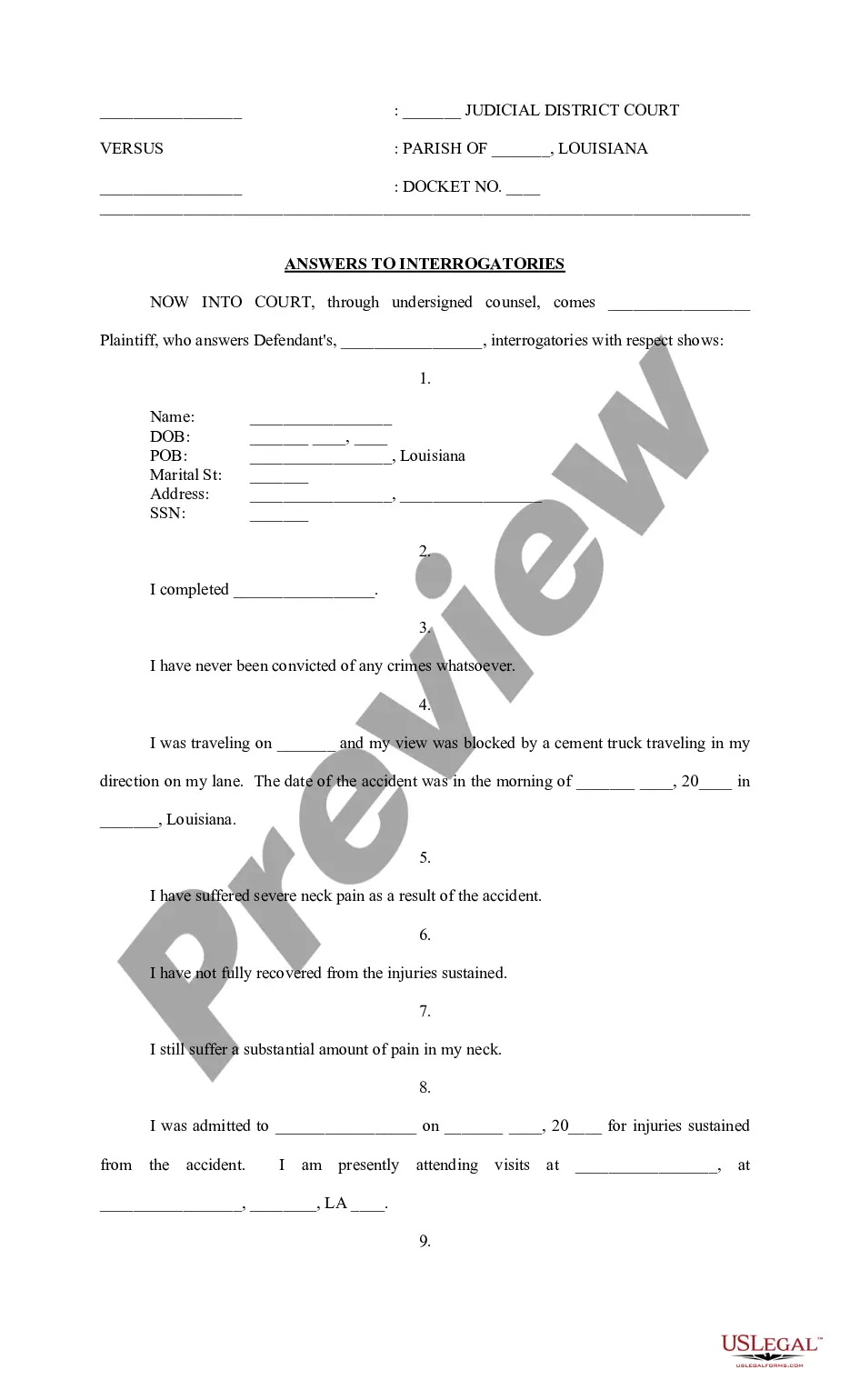

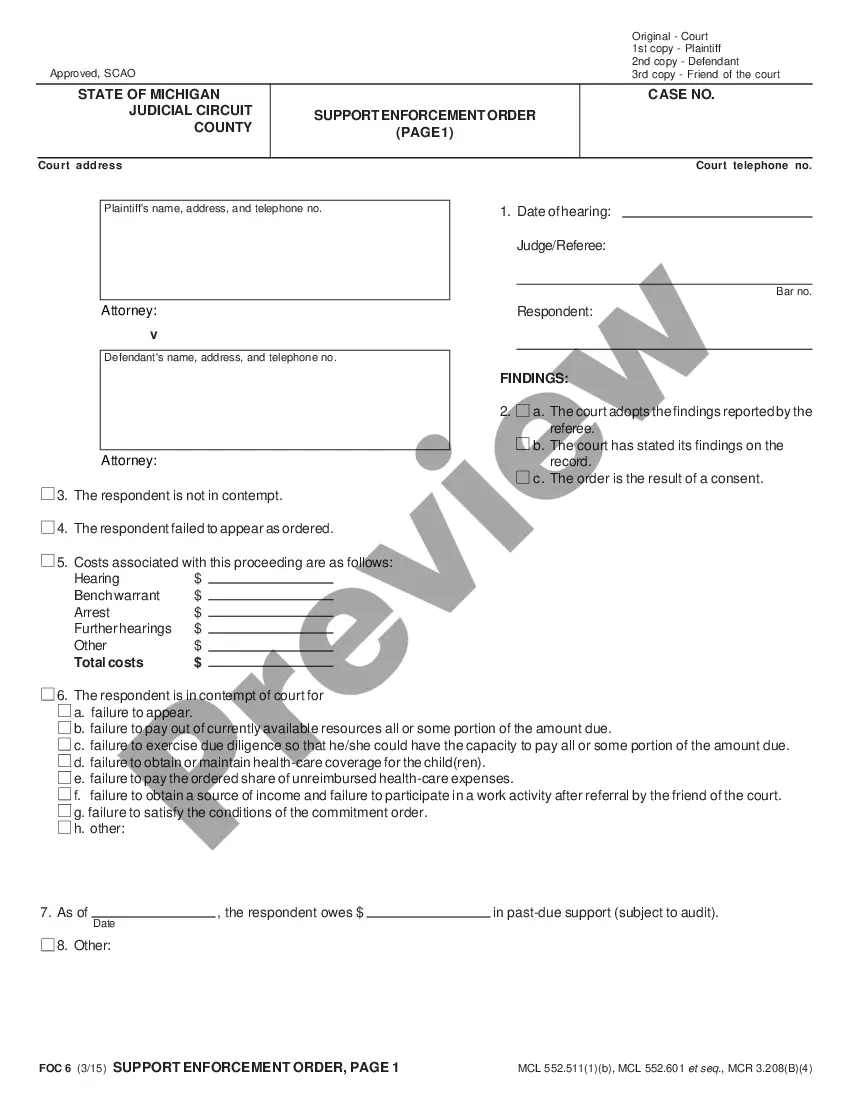

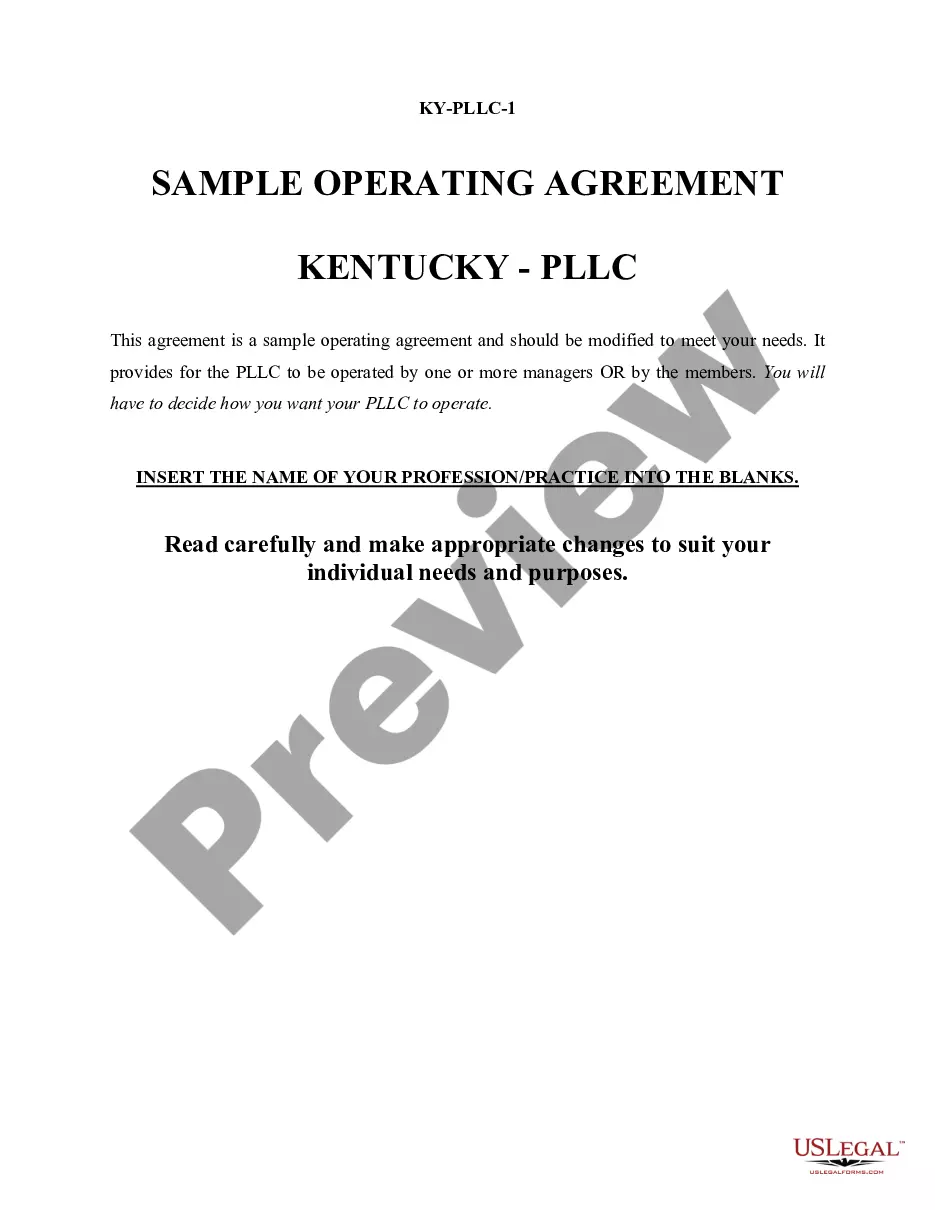

- Preview it (if this feature is available) and review the accompanying description to determine if the Texas Gift Deed Sample For Movable Property matches your needs.

- If you're looking for a different template, restart your search.

- Create a free account and choose a subscription plan to purchase the form.

Form popularity

FAQ

Transferring property title to a family member in Texas is straightforward with a Texas gift deed sample for movable property. This sample helps you draft a deed that clearly indicates the intent to gift the property, streamlining the transfer process. You can also avoid potential disputes by documenting the transfer properly. For additional support, USLegalForms offers comprehensive resources to guide you through the process.

To effectively pass property to your children, consider using a Texas gift deed sample for movable property. This document provides a clear and legally binding way to transfer ownership without the complications of formal sales or wills. Moreover, it can simplify the process, ensuring that your wishes are carried out smoothly. Utilizing legal resources from USLegalForms can help you create an appropriate gift deed tailored to your needs.

While gift deeds can provide benefits, they also come with disadvantages. Once you transfer property via a gift deed, you relinquish ownership, which is irreversible. Moreover, the recipient may face tax implications later, especially if property values increase. To navigate these potential pitfalls, consider utilizing a Texas gift deed sample for movable property, ensuring a well-informed decision.

You do not necessarily need a lawyer to transfer a deed in Texas; however, seeking legal assistance can help avoid mistakes. Using a Texas gift deed sample for movable property can simplify the process, but ensuring all legal requirements are met is vital for a successful transfer. Additionally, legal expertise can provide peace of mind, particularly if the property transfer involves complexities.

Both a transfer under a will and a gift of property involve transferring ownership from one party to another. However, a will operates after death, while a gift occurs during the donor's life. In essence, both methods can use a Texas gift deed sample for movable property, but their timing and legal processes differ significantly. Understanding these distinctions can guide your planning effectively.

In Texas, gifting property can have several tax implications. The donor may need to consider federal gift tax limits, which apply if the gift exceeds a certain value. Additionally, gifted property typically bypasses probate, but it can still influence future taxation for the recipient. To understand the nuances and find a Texas gift deed sample for movable property, consult with a tax professional.

A quitclaim deed transfers whatever interest the grantor has in the property without any warranties about the property’s title, while a gift deed is specifically used to indicate that property is being given as a gift, usually with no payment involved. A gift deed, especially for movable property, also clearly states the intent to gift and often includes more detailed terms about the transfer. Understanding these differences can help you choose the appropriate deed for your needs.

To give someone a piece of property, you’ll need to prepare a gift deed that clearly lists all relevant information, including the names of the donor and recipient, as well as a detailed description of the property. The deed must be signed by both parties, and it’s advisable to have it notarized. This ensures that the transfer is legally binding and recognized by the state.

Yes, you can gift a portion of property, but it requires a properly executed deed detailing the specific share being transferred. Using a Texas gift deed sample for movable property can help you accurately reflect the division of ownership. However, ensure that all parties involved understand the implications of shared ownership to avoid future disputes.

The most tax-efficient way to gift a property generally involves staying within the annual gift tax exclusion limits, which allows you to gift a certain amount without incurring taxes. Additionally, consider using a Texas gift deed sample for movable property to document the transfer clearly. It’s also wise to consult with a tax advisor to understand any implications related to capital gains taxes for the recipient.