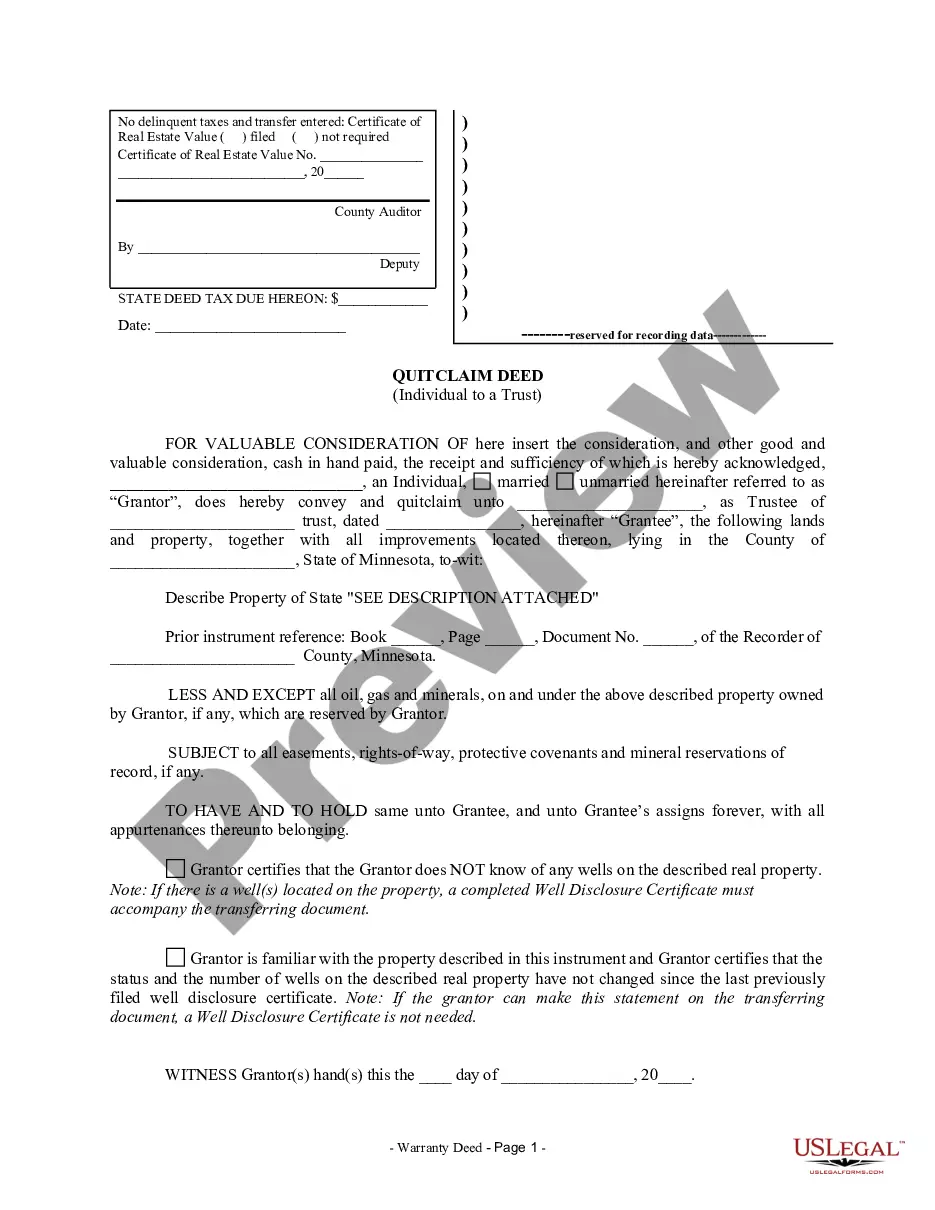

This detailed sample Texas Gift Deed (Individual to Individual)complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Gift Deed Template With Consideration

Description

How to fill out Texas Gift Deed For Individual To Individual?

Using legal templates that comply with federal and state laws is crucial, and the internet offers many options to pick from. But what’s the point in wasting time searching for the correctly drafted Gift Deed Template With Consideration sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and life case. They are simple to browse with all documents organized by state and purpose of use. Our experts keep up with legislative changes, so you can always be sure your paperwork is up to date and compliant when obtaining a Gift Deed Template With Consideration from our website.

Getting a Gift Deed Template With Consideration is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the instructions below:

- Examine the template utilizing the Preview feature or through the text outline to ensure it meets your needs.

- Look for another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Gift Deed Template With Consideration and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Gift deeds in Texas are valid; however, there are strict requirements for gift deeds in Texas. Therefore, if you have a document that might be a gift deed or if someone is claiming they have a gift deed to a property that should be yours, you should contact an attorney as soon as possible.

Gift Deed ? A gift deed is a special type of grant deed that ?gifts? ownership of real property interest to another person or entity. This deed is different from a standard grant deed because it specifically designates that the transfer was not subject to a sale, and the grantor received no monetary compensation.

The Gift Deed needs to be in writing. It must include the full name of the current owner and the full name, mailing address and vesting of the new owner. The property needs to be properly described.

A gift is a voluntary irrevocable transfer of property from one person to another without consideration. The giver of the gift is the donor, while the receiver is the donee.

However, Texas does not impose a gift tax on transfers of real estate between family members nor is there a capital gains tax in Texas, so you may only be liable for federal taxes. When transferring a house after death through a will or trust, estate taxes may come into play.