Motion Order Form Tx Withholding

Description

How to fill out Texas Motion For Order Of Contempt For Failure To Pay Spousal Maintenance?

Creating legal documents from the ground up can frequently be overwhelming.

Certain situations may require extensive research and significant financial investment.

If you desire a more straightforward and cost-effective method to generate the Motion Order Form Tx Withholding or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal documents addresses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can promptly access state- and county-specific templates carefully assembled for you by our legal professionals.

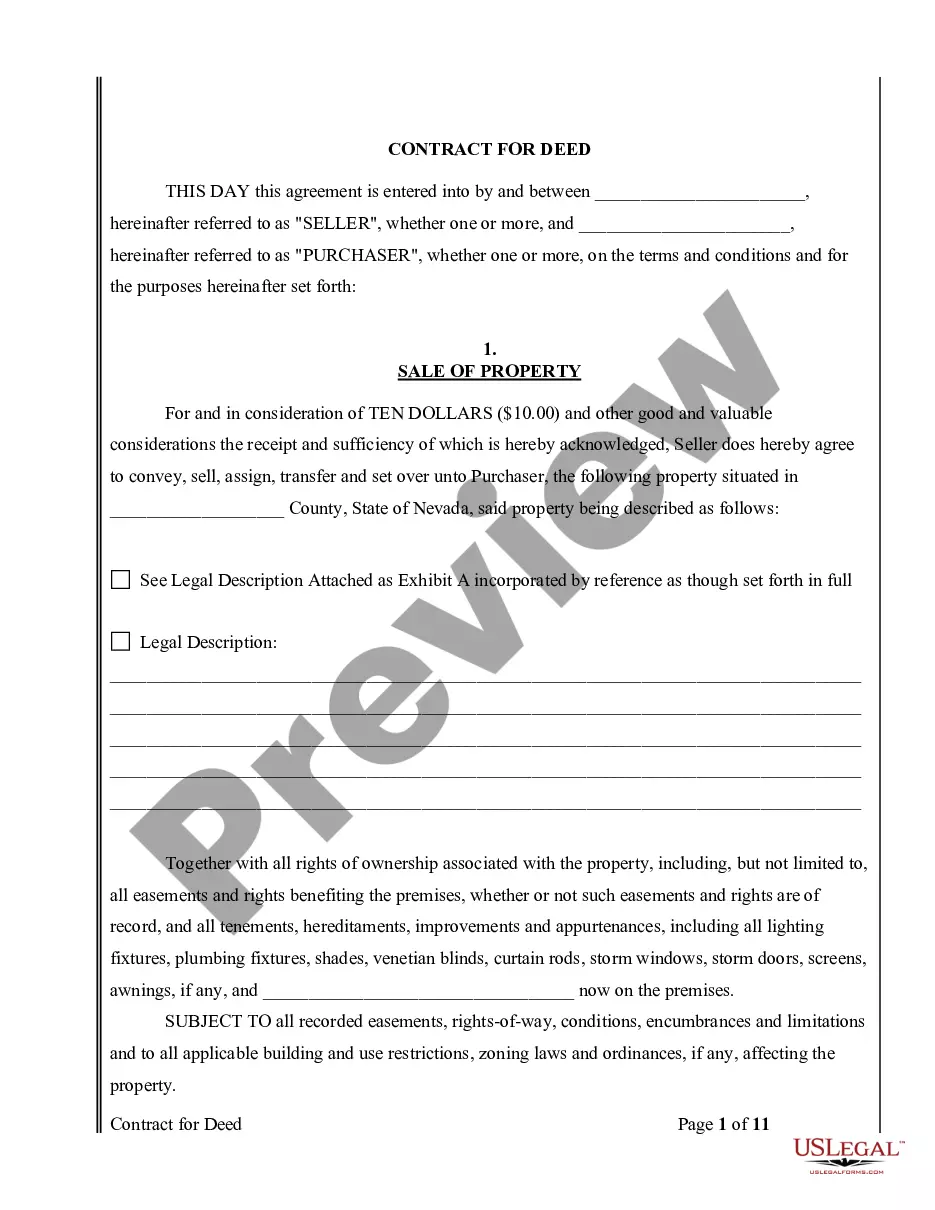

Review the document preview and descriptions to ensure you are accessing the correct file. Verify that the selected template adheres to the rules and legislation of your specific state and county. Select the appropriate subscription plan to obtain the Motion Order Form Tx Withholding. Download the document, then complete, sign, and print it out. US Legal Forms boasts a positive reputation and over 25 years of experience. Join us today and make the form completion process simple and efficient!

- Utilize our platform whenever you need dependable and trustworthy services to easily find and download the Motion Order Form Tx Withholding.

- If you’re familiar with our site and have previously registered an account with us, simply Log In, search for the template, and download it or access it again later in the My documents section.

- Don’t possess an account? No worries. It requires minimal time to sign up and explore the library.

- However, before you proceed to download the Motion Order Form Tx Withholding, consider these recommendations.

Form popularity

FAQ

An M1W is a Minnesota Withholding Exemption Certificate used to inform an employer about your withholding tax status. This form determines how much state income tax will be withheld from your paycheck. Being informed about the M1W and related topics like the Motion order form tx withholding is essential for effective tax planning. For further help, consider checking out uslegalforms for relevant resources.

Yes, South Carolina does have a state withholding form, known as the SC W-4. This form allows employees to indicate their withholding preferences, similar to the federal W-4 form. Coordinating this with your other forms can provide a clearer picture of your tax withholding situation, including elements like the Motion order form tx withholding. You can find the South Carolina form online for ease of access.

In Minnesota, the marriage credit is available to couples who have filed their taxes jointly and meet specific income qualifications. This credit can reduce your tax liability and is designed to support families. It's beneficial to explore all available credits when filing, including considering how the Motion order form tx withholding may impact your overall tax strategy. For comprehensive insights, refer to uslegalforms.

To obtain the 1099-G MN form, you should first check with the Minnesota Department of Revenue. They typically issue this form for unemployment benefits and state tax refunds. You can often download it online or request a paper copy if preferred. Don’t forget that aspects like the Motion order form tx withholding can also affect how you file your returns related to the 1099-G.

You can request a tax form by visiting the IRS website or by contacting the tax authorities in your state. Many states also allow online requests, which is often the quickest option. Additionally, ensure that you mention the Motion order form tx withholding to find specific forms related to withholding taxes. If you need assistance, uslegalforms can provide the necessary templates for forms.

The FL 195 form is a court form used in family law matters, primarily for child support issues. This form allows individuals to request an income withholding order or modify an existing one effectively. When you fill out the FL 195 form in conjunction with a Motion order form tx withholding, you can streamline your case and ensure proper execution of child support payments. Accessing the correct forms, like the FL 195, through platforms like uslegalforms can make the process easier.

An income withholding order in Arizona is a legal directive that your employer must follow to withhold a portion of your wages to meet child support obligations. When established, it ensures that payments are made directly to the custodial parent or the state. To initiate this process, you often need to fill out a Motion order form tx withholding, which simplifies the submission of necessary documents to the court. By using accurate forms, you can reduce delays and ensure compliance with state regulations.

To file tax withholding, ensure you have completed the appropriate forms and submitted them to your employer or payment source. Keep a copy of your completed forms for your records. Additionally, using resources like the Motion order form tx withholding can provide clarity and support as you manage your tax responsibilities effectively.

Common withholding mistakes often include miscalculating allowances, failing to update the form after major life changes, and not considering additional income sources. These errors can lead to under-withholding or over-withholding of taxes. By using the Motion order form tx withholding, you can review your situation thoroughly and minimize the chances of making these common mistakes.

You should submit your W-4V form to your payroll department or the human resources office at your workplace. If you’re self-employed or receiving certain government payments, send it directly to the agency responsible for your payments. Utilizing a Motion order form tx withholding can streamline the process and help guarantee your form is submitted correctly to the right entity.