Rules For Llc In Texas

Description

How to fill out Texas Limited Liability Company LLC Formation Package?

Whether for corporate reasons or for personal matters, everyone must handle legal situations at some point in their lives.

Completing legal paperwork requires meticulous focus, starting from selecting the correct form template.

Once saved, you can fill out the form using editing programs or print it out and complete it manually. With a vast US Legal Forms catalog available, you will never have to waste time searching for the right sample online. Take advantage of the library’s user-friendly navigation to find the suitable template for any occasion.

- For instance, if you choose an incorrect version of the Rules For Llc In Texas, it will be rejected upon submission.

- Thus, it's crucial to have a trustworthy resource for legal documents like US Legal Forms.

- If you need a Rules For Llc In Texas template, follow these straightforward steps.

- Obtain the sample you require using the search bar or catalog browsing.

- Review the form’s description to confirm it corresponds with your situation, state, and locality.

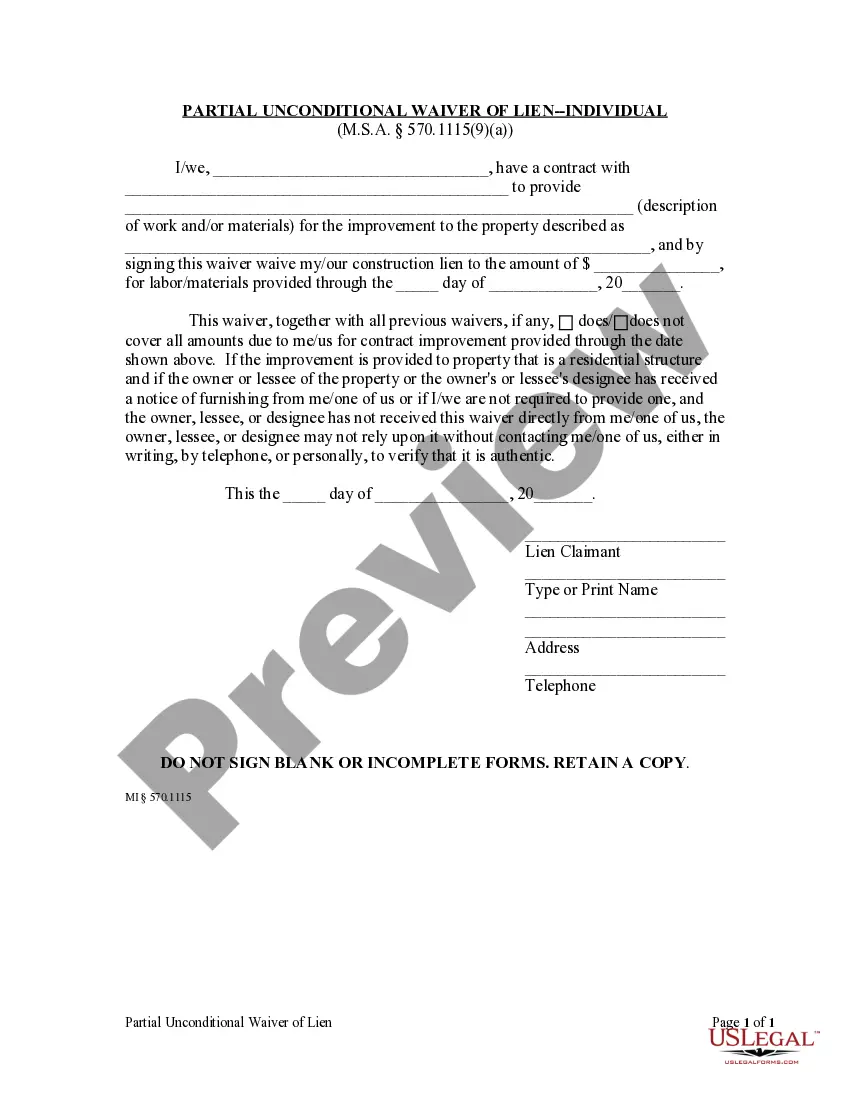

- Click on the form’s preview to view it.

- If it is the incorrect document, return to the search tool to find the Rules For Llc In Texas template you need.

- Acquire the file if it suits your needs.

- If you already possess a US Legal Forms account, just click Log in to access prior saved documents in My documents.

- In case you don’t have an account yet, you may download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the file format you desire and download the Rules For Llc In Texas.

Form popularity

FAQ

Texas LLCs are taxed as pass-through entities by default, which means that the LLC itself doesn't pay income tax. Instead, the profits and losses of the LLC are passed on to the LLC owners (called members) and reported as income on their individual tax returns.

Starting an LLC in Texas will include the following steps: #1: Choose a name for your LLC. #2: Appoint a registered agent. #3: File the certificate of formation. #4: Create your operating agreement. #5: Obtain an employer identification number (EIN)

Texas LLC Filing Fee: Certificate of Formation ($300) The fee for a mail filing is $300 and the fee for an online filing is $308. The filing fee is a one-time fee. You don't have to pay any monthly (or annual) fees to maintain your Texas LLC.

Overview of LLC Naming Rules Organizational Designations. ... You can't use a name that a competing business is already using. ... You can't use a deceptively similar name. ... If the names are similar, you will need a letter of consent for approval.

There are no annual registration fees imposed on LLCs in Texas. However, your LLC may need to file an annual franchise tax statement with the Texas Comptroller. For more information on the Texas franchise tax, see the Comptroller's website.