Incorporate In Texas Without Power

Description

How to fill out Texas Business Incorporation Package To Incorporate Corporation?

Precisely composed official documents serve as one of the essential assurances for preventing issues and legal disputes, yet acquiring them without the help of an attorney can be time-consuming.

Whether you seek to swiftly locate an up-to-date Incorporate In Texas Without Power or any other forms for employment, family, or business situations, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button adjacent to the chosen file. Moreover, you can access the Incorporate In Texas Without Power anytime later since all documents ever obtained on the platform remain retrievable within the My documents section of your account. Save time and expenses on generating official documents. Experience US Legal Forms today!

- Verify that the document aligns with your situation and locale by reviewing the description and sample.

- Search for alternative examples (if necessary) using the Search bar in the header of the page.

- Press Buy Now once you find the appropriate template.

- Choose the pricing option, Log In to your account, or create a new one.

- Select your preferred payment method for purchasing the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX format for your Incorporate In Texas Without Power.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

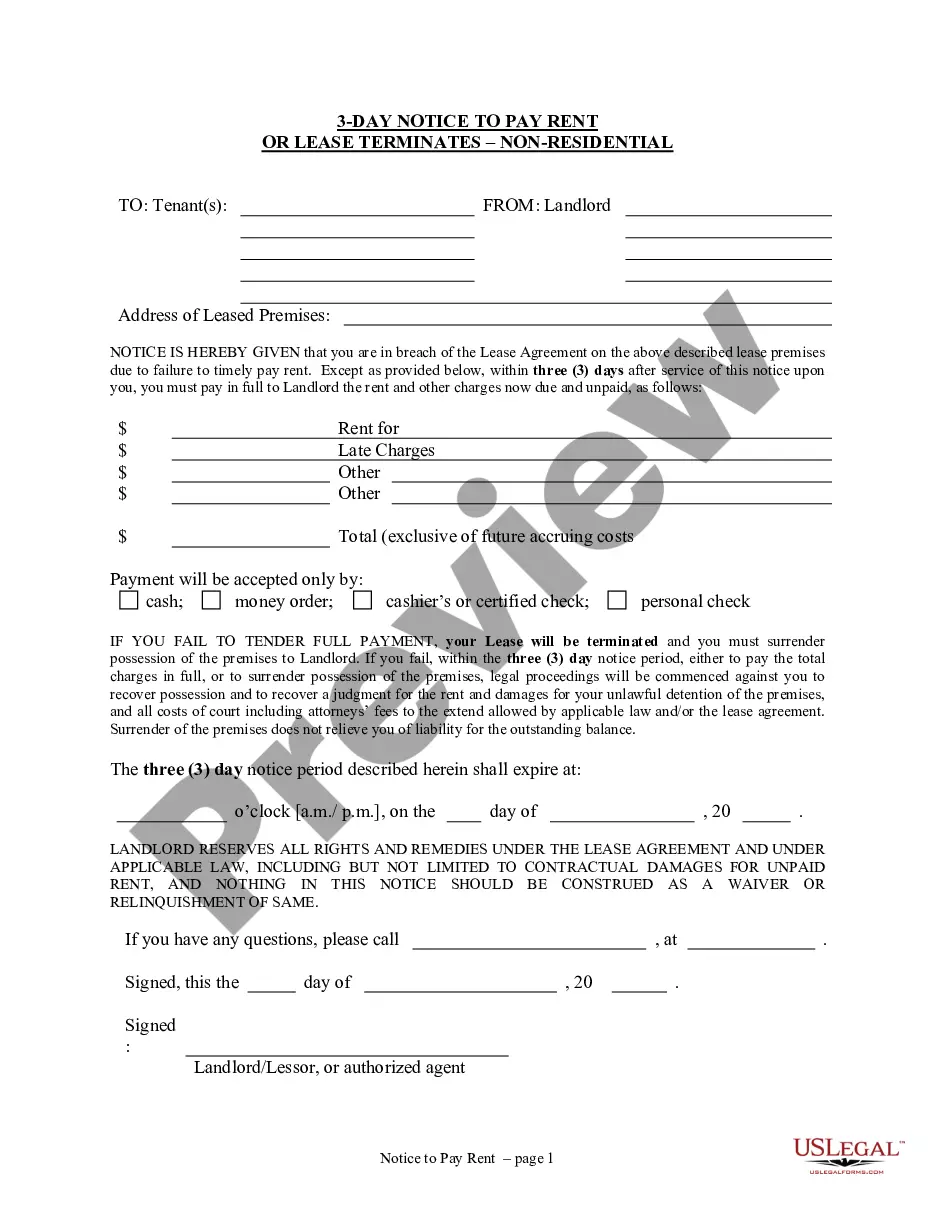

In the state of Texas, articles of incorporation are required when forming a corporation. Both S corporations and C corporations must file the articles of organization with the Secretary of State's office.

The certificate may be filed online through the Texas Secretary of State SOSDirect website or it can be filed by mail. The filing fee is $300.

In the state of Texas, articles of incorporation are required when forming a corporation. Both S corporations and C corporations must file the articles of organization with the Secretary of State's office.

Cost to Incorporate in Texas A certificate of formation for a Texas for-profit corporation, for instance, has a $300 filing fee. Texas nonprofit corporations, however, only have to pay a $25 fee.

How To Set Up A Texas C-Corporation Filing In Texas. You need to file a Certificate of Formation to incorporate your business in Texas. You file the Certificate of Formation with the Texas Secretary of State. There is a $300 filing fee required by the State.