Texas Supporting Form Purchase With Credit Card

Description

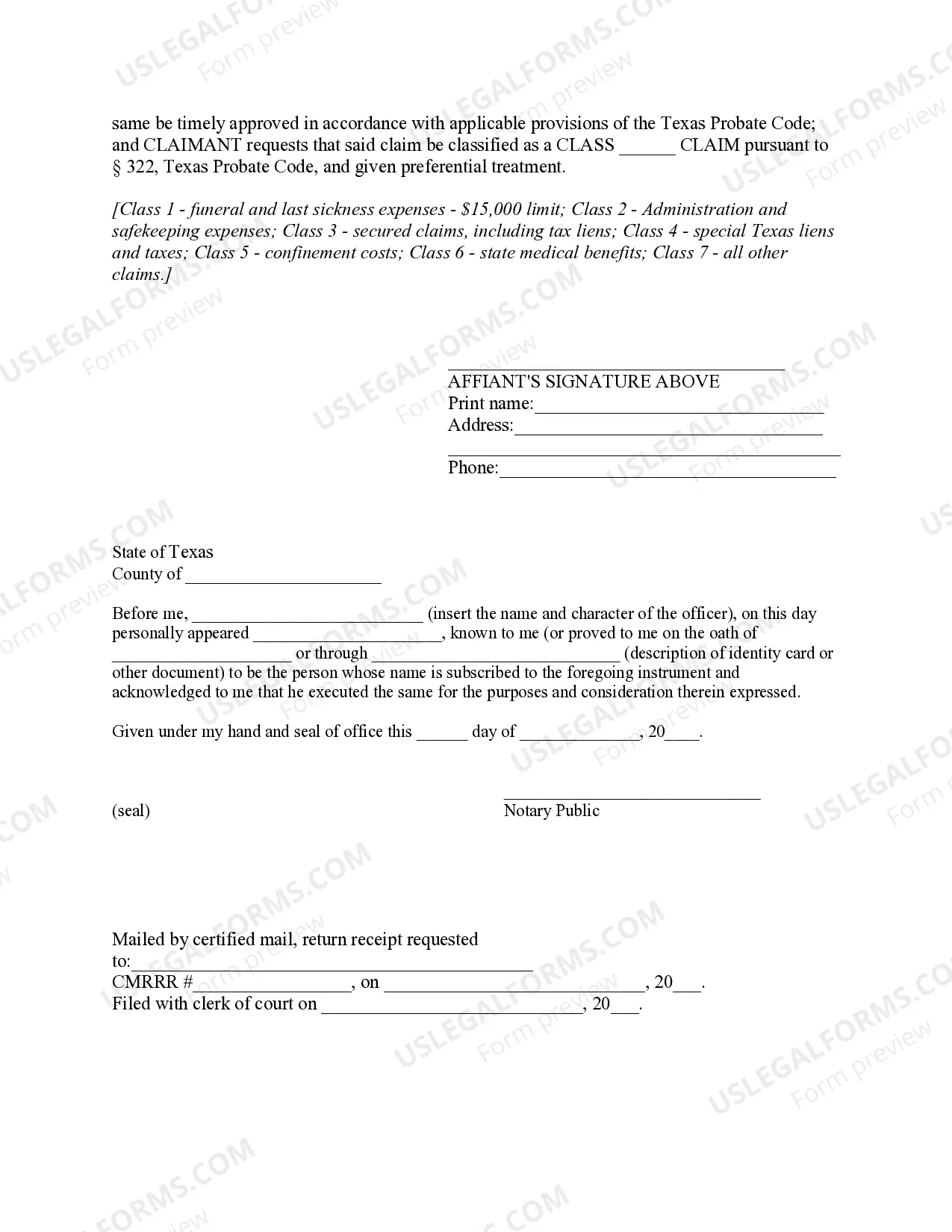

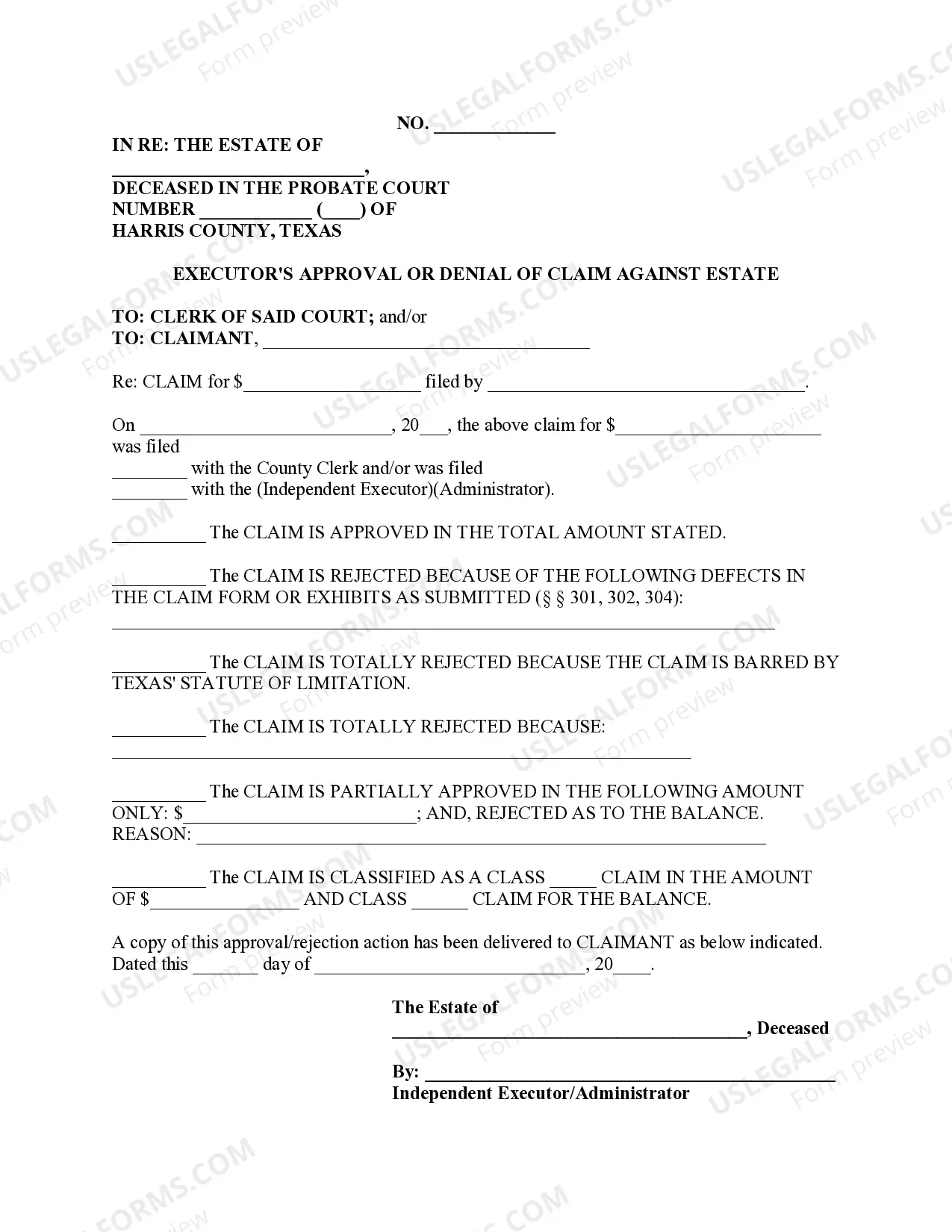

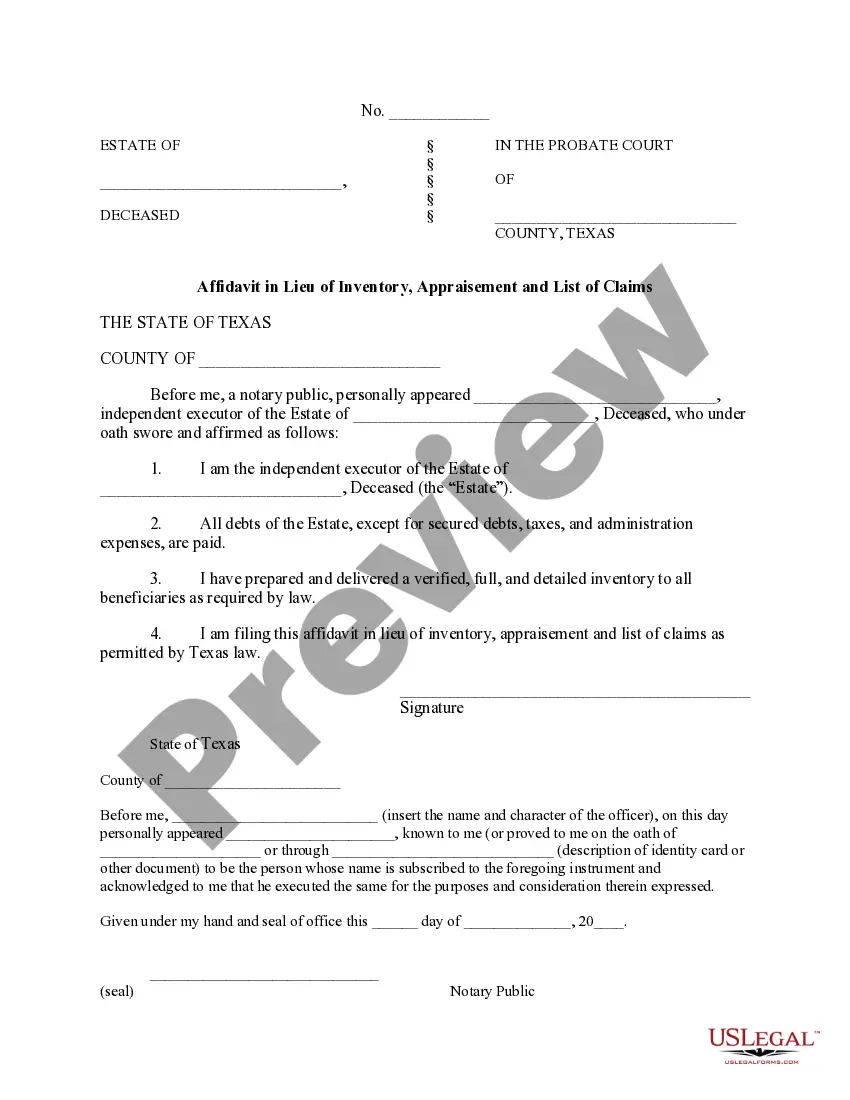

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more affordable way of creating Texas Supporting Form Purchase With Credit Card or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of more than 85,000 up-to-date legal forms addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-specific forms carefully put together for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Texas Supporting Form Purchase With Credit Card. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and explore the library. But before jumping straight to downloading Texas Supporting Form Purchase With Credit Card, follow these recommendations:

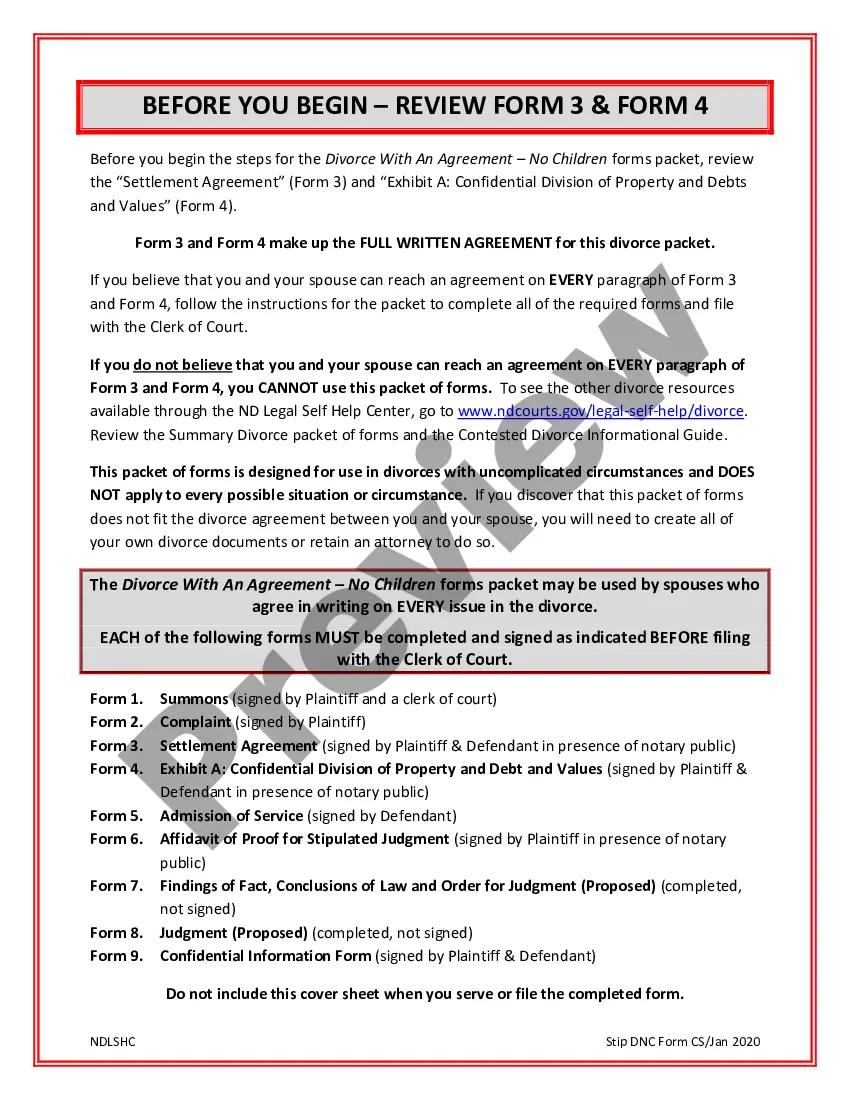

- Review the document preview and descriptions to ensure that you are on the the form you are searching for.

- Check if template you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to buy the Texas Supporting Form Purchase With Credit Card.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us now and transform document execution into something simple and streamlined!

Form popularity

FAQ

Your credit card authorization form ought to include the following details: The credit card information like card type, the cardholder's name, the card number, and the card expiry date. The merchant's business information ? like name, address and contact number/mail ID.

The Credit Card Fee charged to restaurants is a charge for an expense that Taxpayer incurs to provide its taxable service. It is part of the sales price of the Service Fee and is taxable as a data processing service. Section 151.007(a)(2); Rule 3.330(d)(3).

The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file.

The payment must be in money order, personal check, cash, or credit/debit card. The owner or the authorized person may write a check. Personal ID is required. The owner will need to complete and sign a form VTR-60.

Tax Code Section 31.06 requires a collector to accept payment by credit card, but allows the collector to collect a fee for processing the payment not to exceed five percent of the amount of taxes and any penalty and interest being paid. The fee is in addition to the amount of taxes, penalties or interest.