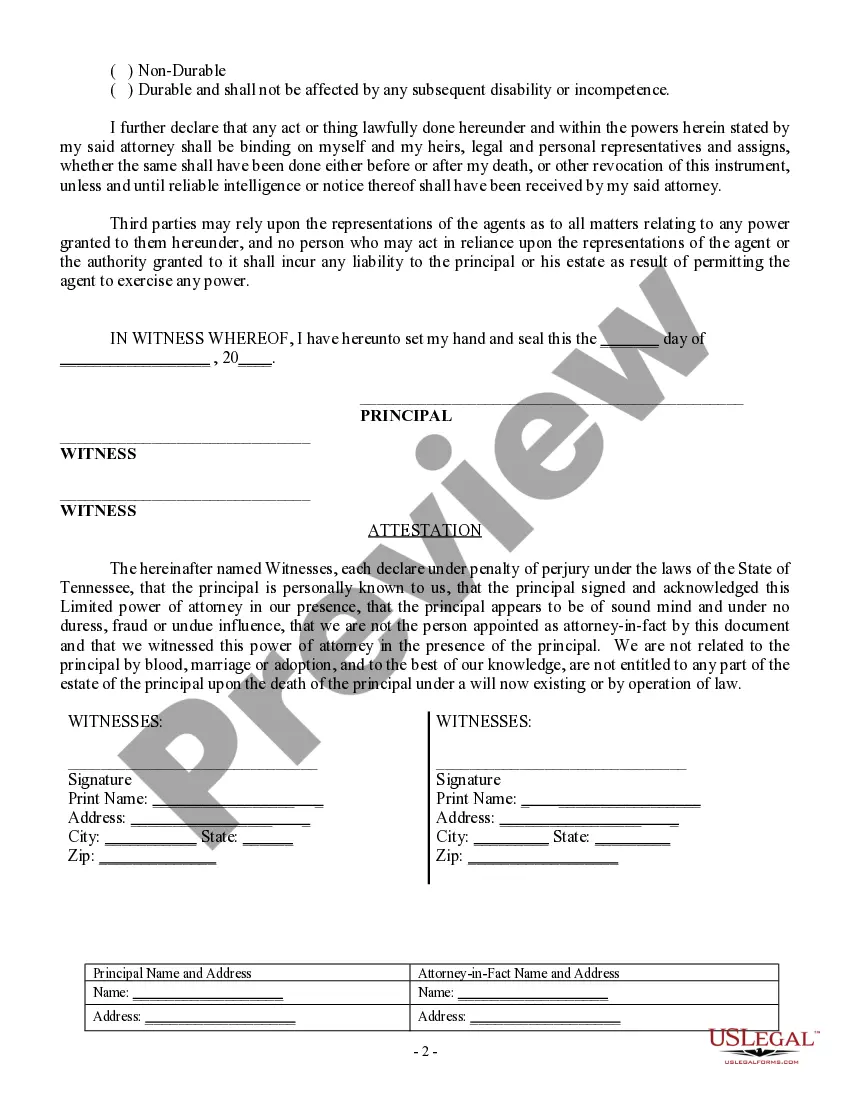

This Limited Power of Attorney form provides for a limited power of attorney for stock transactions only. It used by a shareholder to authorize another person to vote stock and to conduct other corporate powers. The document must be signed before two witnesses.

Power of attorney powers vary from state to state, dictating the specific rights and responsibilities afforded to an individual who is granted power of attorney. Understanding the various types and limitations of power attorney powers is crucial to ensure compliance with local laws. Below, we will provide an overview of power attorney powers for the states, detailing the different types and highlighting relevant keywords. Different types of power of attorney powers for the states: 1. General Power of Attorney: A general power of attorney grants the appointed individual, known as the attorney-in-fact or agent, broad decision-making powers over the principal's personal, financial, and legal affairs. It typically covers a wide range of activities such as managing banking transactions, signing contracts, handling real estate, and making healthcare decisions on behalf of the principal. 2. Limited Power of Attorney: A limited power of attorney, also known as special power of attorney, authorizes the agent to act on the principal's behalf for specific matters or within a certain timeframe. This type of power of attorney is often used for particular transactions, such as selling a property, signing documents when the principal is unavailable, or managing specific financial accounts. 3. Durable Power of Attorney: A durable power of attorney remains in effect even if the principal becomes mentally or physically incapacitated. This type of power of attorney ensures that the agent can continue to act on the principal's behalf when they are unable to handle their affairs independently. It grants comprehensive powers, including financial decision-making, healthcare choices, and legal matters. 4. Springing Power of Attorney: A springing power of attorney only becomes effective upon the occurrence of a specific event, usually the mental or physical incapacity of the principal. Such powers allow the agent to act on behalf of the principal only in the designated circumstances, ensuring that the principal's interests are protected when necessary. 5. Medical Power of Attorney: A medical power of attorney, also known as a healthcare power of attorney or healthcare proxy, designates an agent to make medical decisions on behalf of the principal. This power of attorney focuses solely on healthcare-related matters, including medical treatments, procedures, and end-of-life decisions. 6. Financial Power of Attorney: A financial power of attorney grants the agent authority over the principal's financial affairs, such as managing bank accounts, paying bills, filing tax returns, and making investments. This type of power of attorney is particularly useful when the principal requires assistance in managing their finances due to age, illness, or other circumstances. 7. Real Estate Power of Attorney: A real estate power of attorney confers the agent the power to act on the principal's behalf in real estate matters, including buying, selling, or leasing property. It enables the agent to sign contracts, negotiate deals, and handle all legal documentation pertaining to real estate transactions. Understanding the specifics and nuances of power attorney powers for the states is essential to ensure compliance with state laws and protect the interests of both the principal and the appointed agent. Consult with legal professionals or refer to state-specific statutes for complete guidance on power attorney powers in your respective jurisdiction.