What is Power of Attorney?

Power of Attorney allows someone to act on another's behalf for financial or healthcare decisions. Explore state-specific templates to find what fits your needs.

Power of Attorney documents help individuals manage their affairs. Attorney-drafted templates are quick and simple to fill out.

Everything you need to manage your legal matters as you enter a later stage of life, all in one convenient package.

Designate someone to manage your financial matters, effective immediately, even if you become incapacitated.

Empower a trusted individual to manage your finances if you become unable to do so, ensuring your financial matters are handled according to your wishes.

Prepare for life's unexpected events with essential legal forms, all conveniently bundled for your peace of mind.

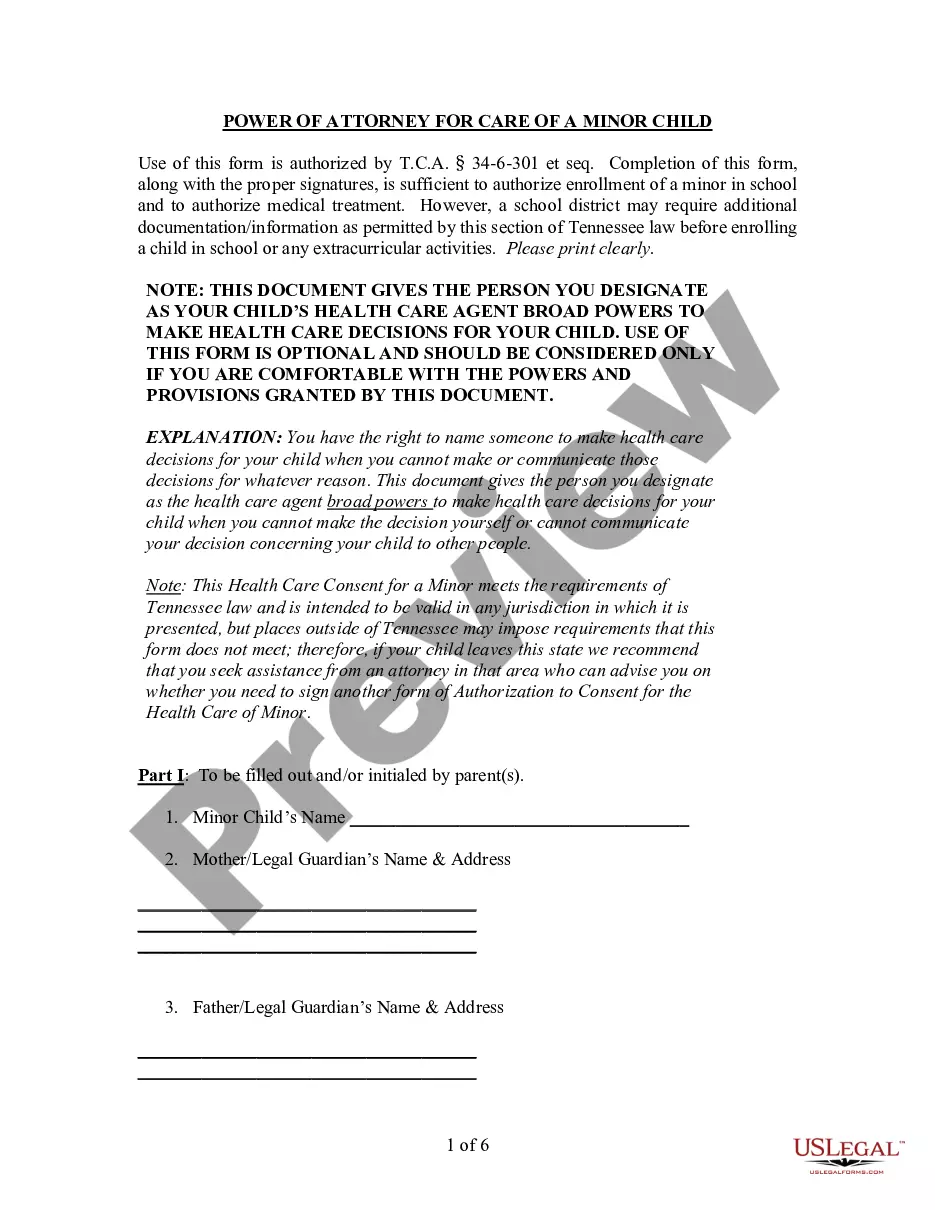

Empower someone to make healthcare and educational decisions for your child when you cannot, especially during emergencies or hardships.

This package provides the essential legal forms needed to communicate your medical treatment wishes in one convenient location.

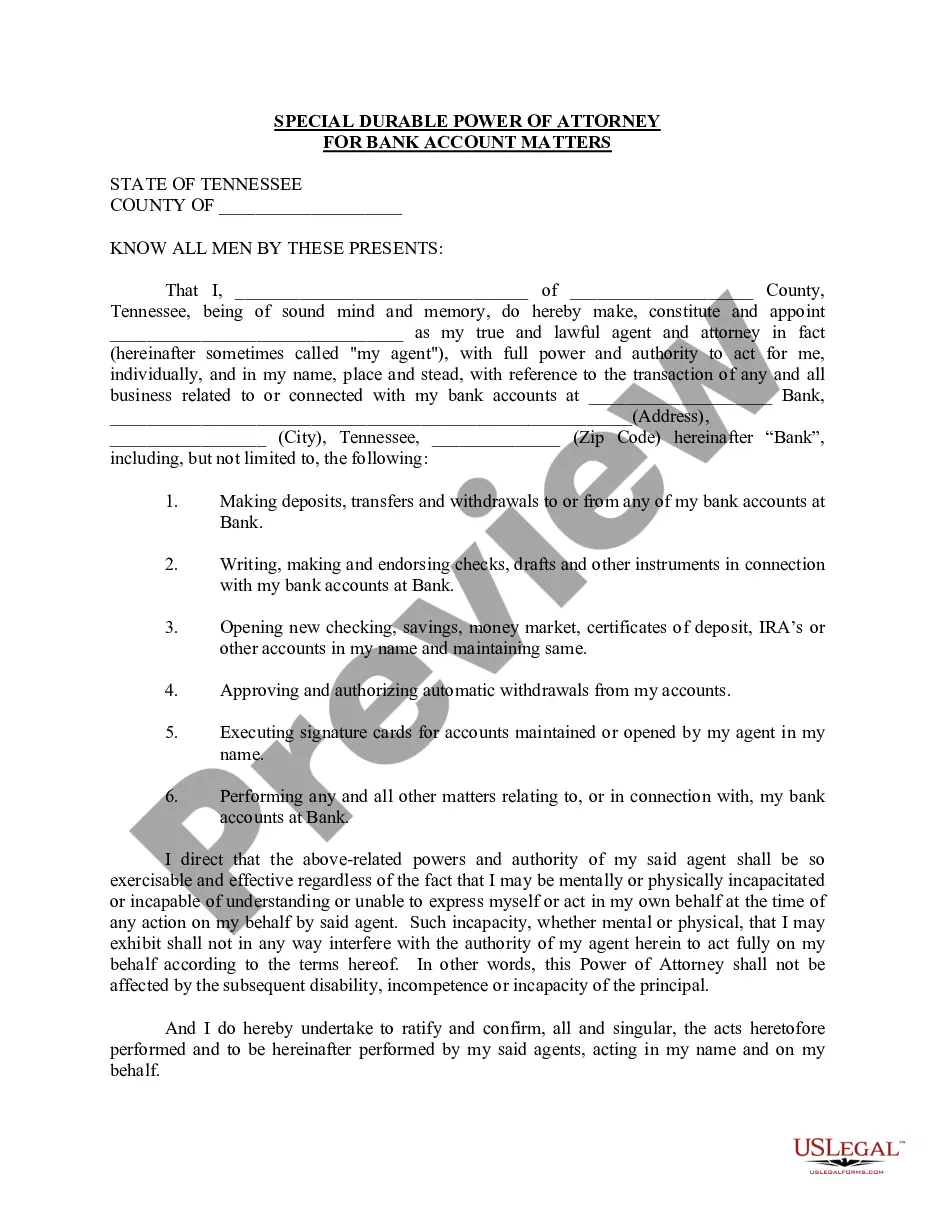

Authorize someone to manage your bank accounts, even if you become incapacitated, ensuring your financial matters are handled as you wish.

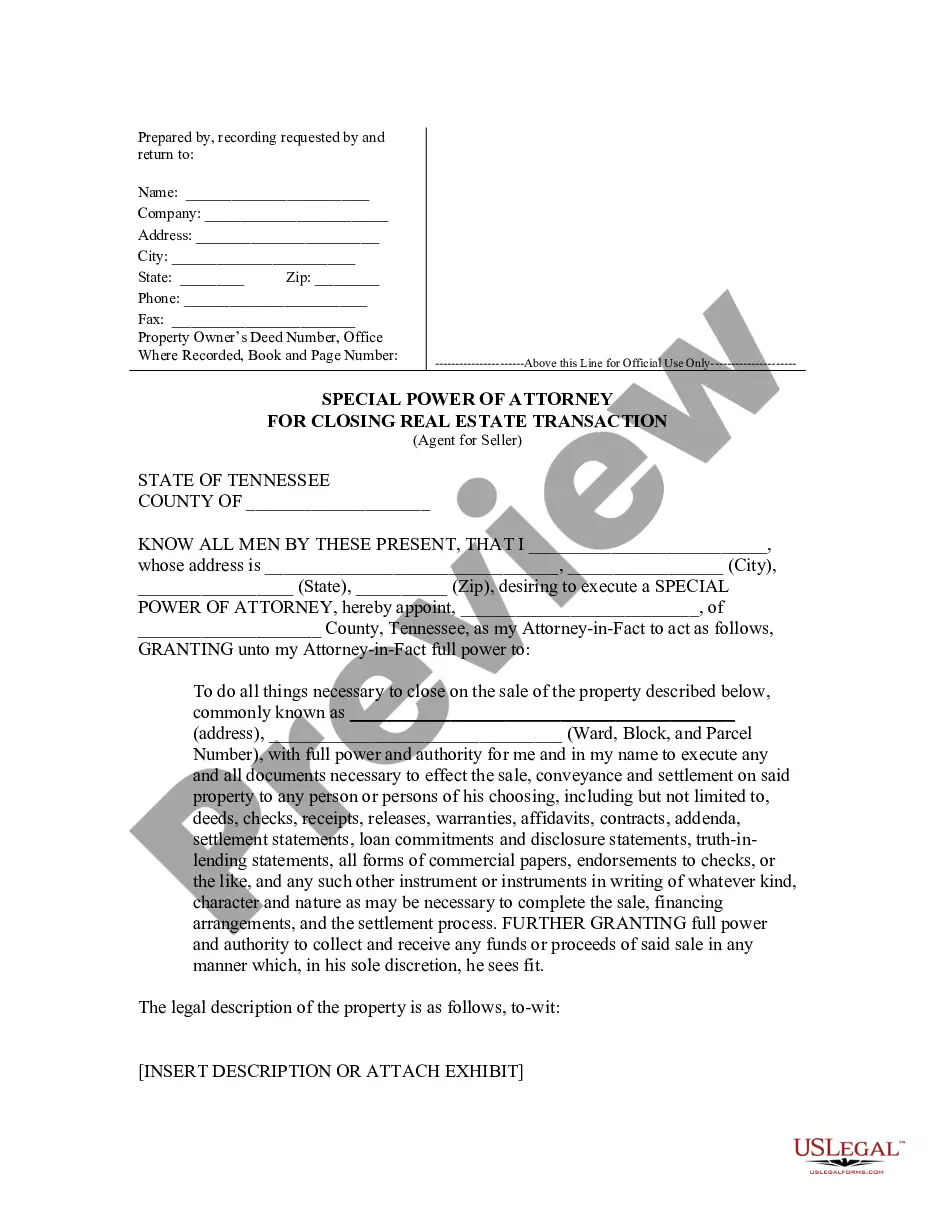

Authorize someone to handle your real estate sale transactions, ensuring smooth closings and document signings.

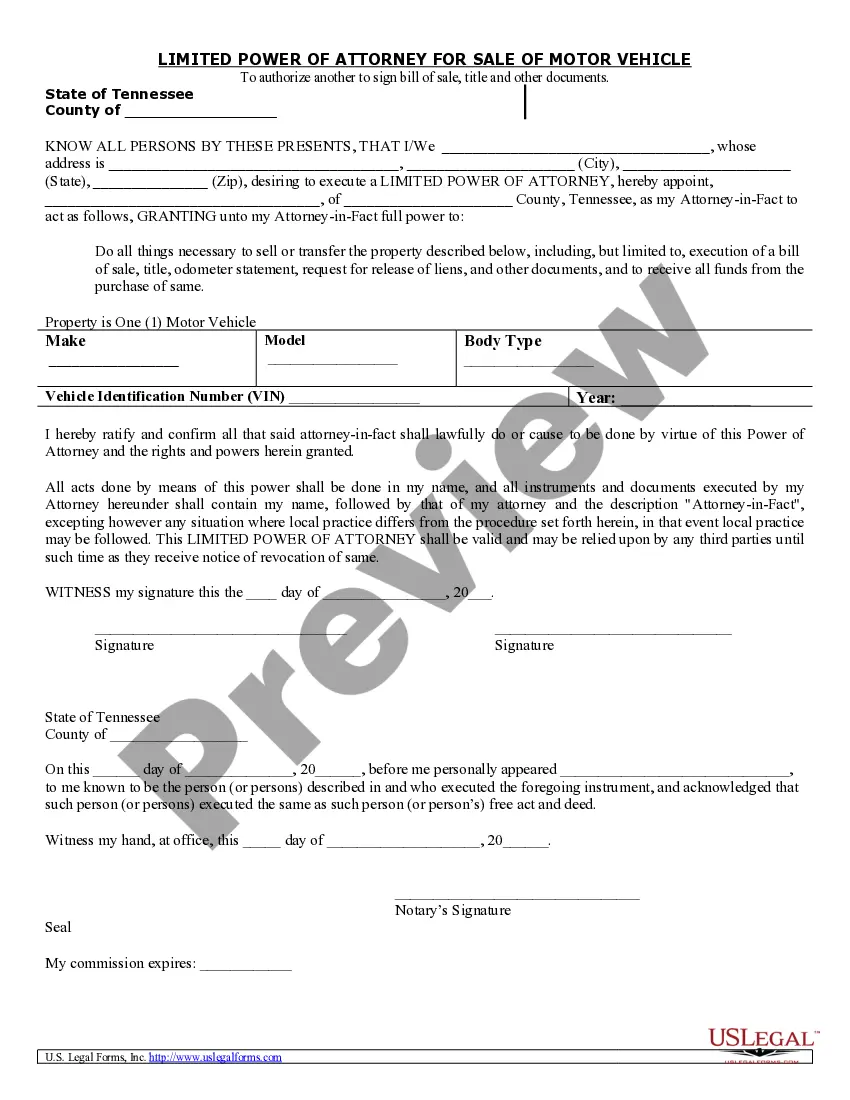

Authorize someone to sell your vehicle by signing necessary documents on your behalf, ensuring a smooth transfer of ownership.

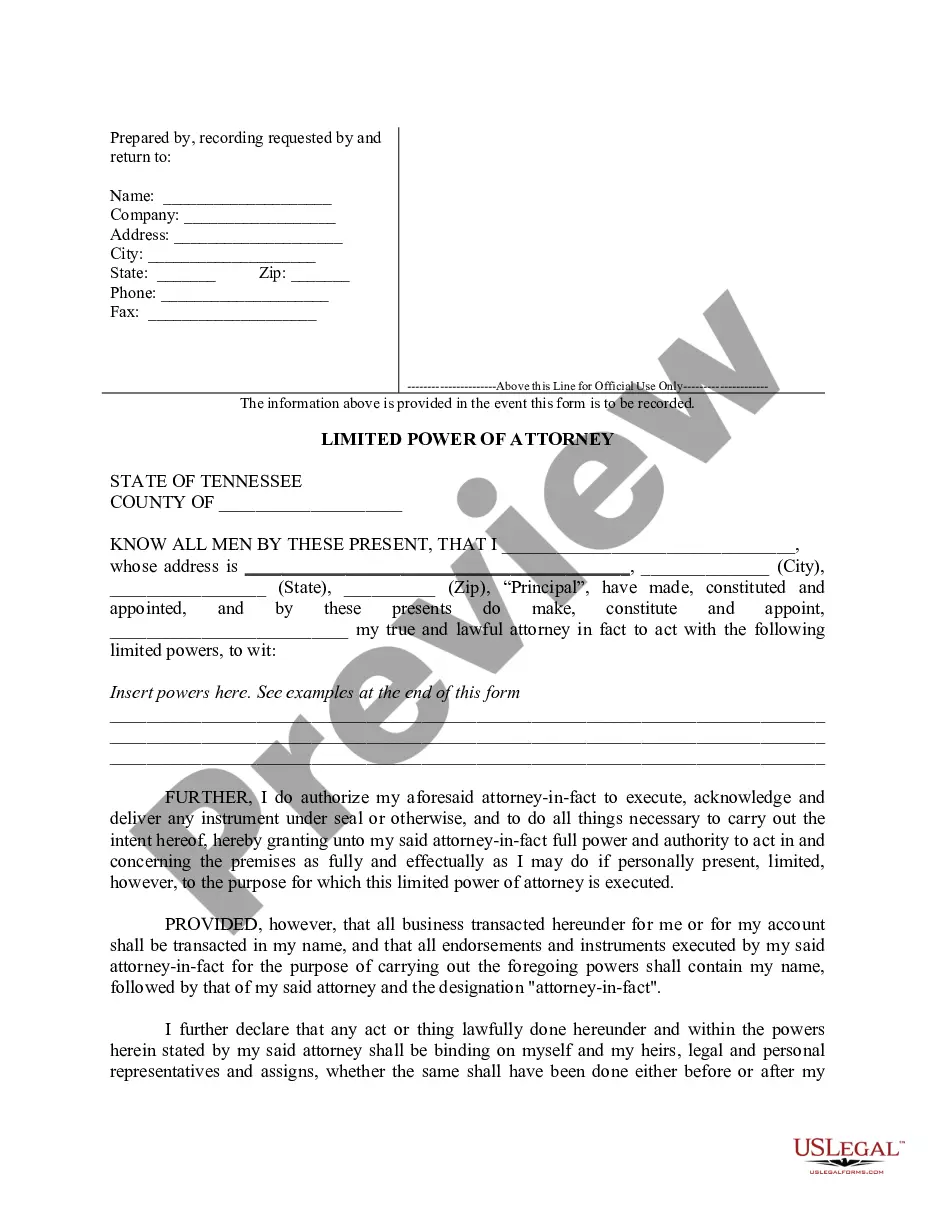

Easily grant specific powers to someone you trust for a limited time or purpose, protecting your interests without full control transfer.

Power of Attorney can be revoked by the principal at any time.

An agent must act in the best interest of the principal.

Documents may be subject to state-specific requirements.

Notarization or witnessing may be necessary for validity.

Different types of Power of Attorney serve different needs.

An agent's authority can be broad or limited.

Advance Directives complement Power of Attorney in healthcare decisions.

Initiate your Power of Attorney process with these steps.

A trust is not necessary if you have a will, but it can provide benefits.

If you do nothing, state laws will dictate asset distribution.

It's wise to review your plan every few years or after major life changes.

Beneficiary designations typically override wills and trusts, so review them regularly.

Yes, you can appoint separate agents for financial and healthcare decisions.