Partial Mortgage Release Form South Dakota Withdrawal

Description

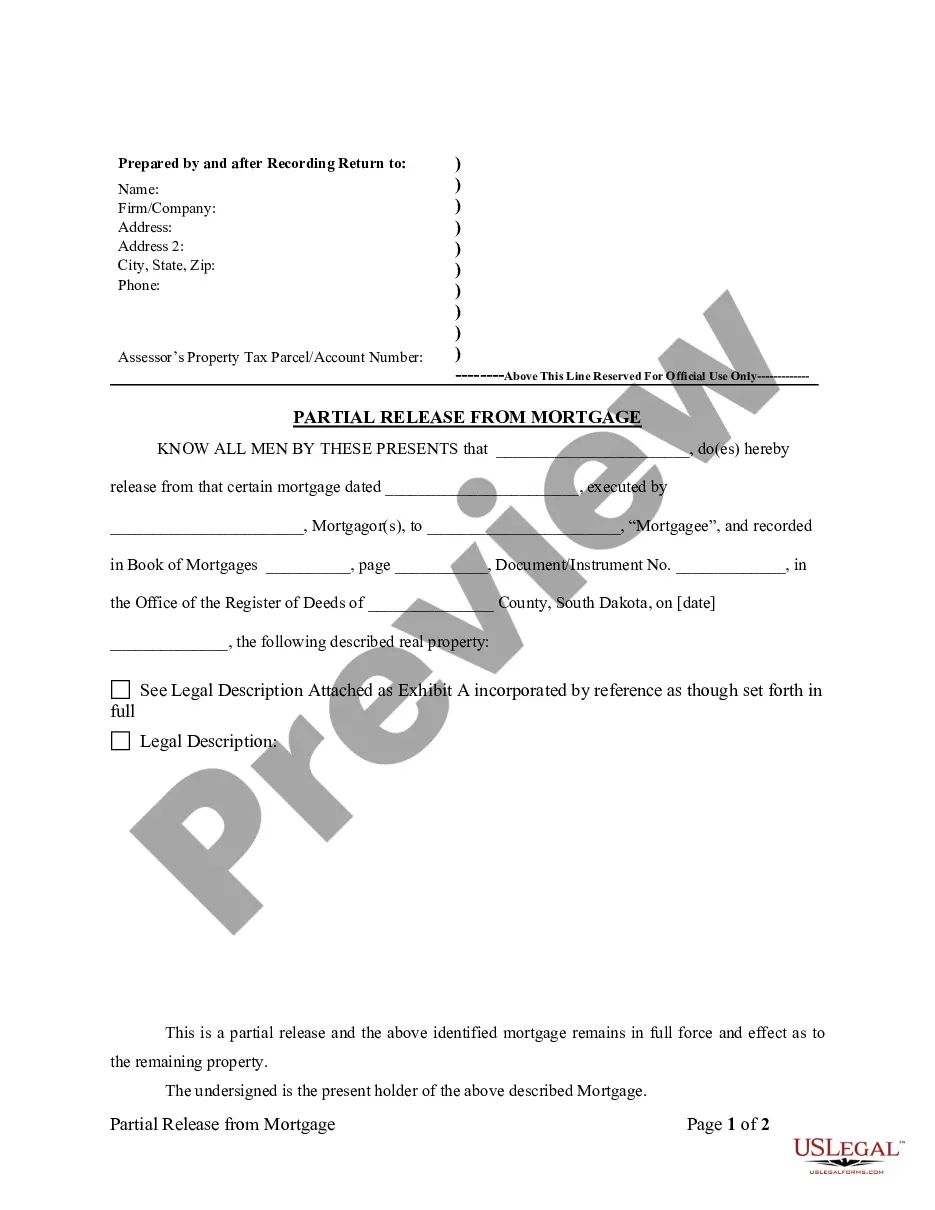

How to fill out South Dakota Partial Release Of Property From Mortgage By Individual Holder?

What is the most trustworthy service to acquire the Partial Mortgage Release Form South Dakota Withdrawal and other current iterations of legal documents.

US Legal Forms is the solution! It boasts the largest compilation of legal forms for any situation.

If you have not yet created an account with our library, follow these steps to get one: Examination of form compliance. Before obtaining any template, ensure it meets your specific use case and complies with your state or county's regulations. Review the form description and utilize the Preview if available.

- Each template is expertly drafted and validated for conformity with federal and state laws and regulations.

- They are categorized by sector and state of application, making it simple to locate the one you require.

- Veteran users of the platform simply need to Log In to the system, verify their subscription status, and click the Download button next to the Partial Mortgage Release Form South Dakota Withdrawal to retrieve it.

- Once saved, the template remains accessible for future use within the My documents tab in your profile.

Form popularity

FAQ

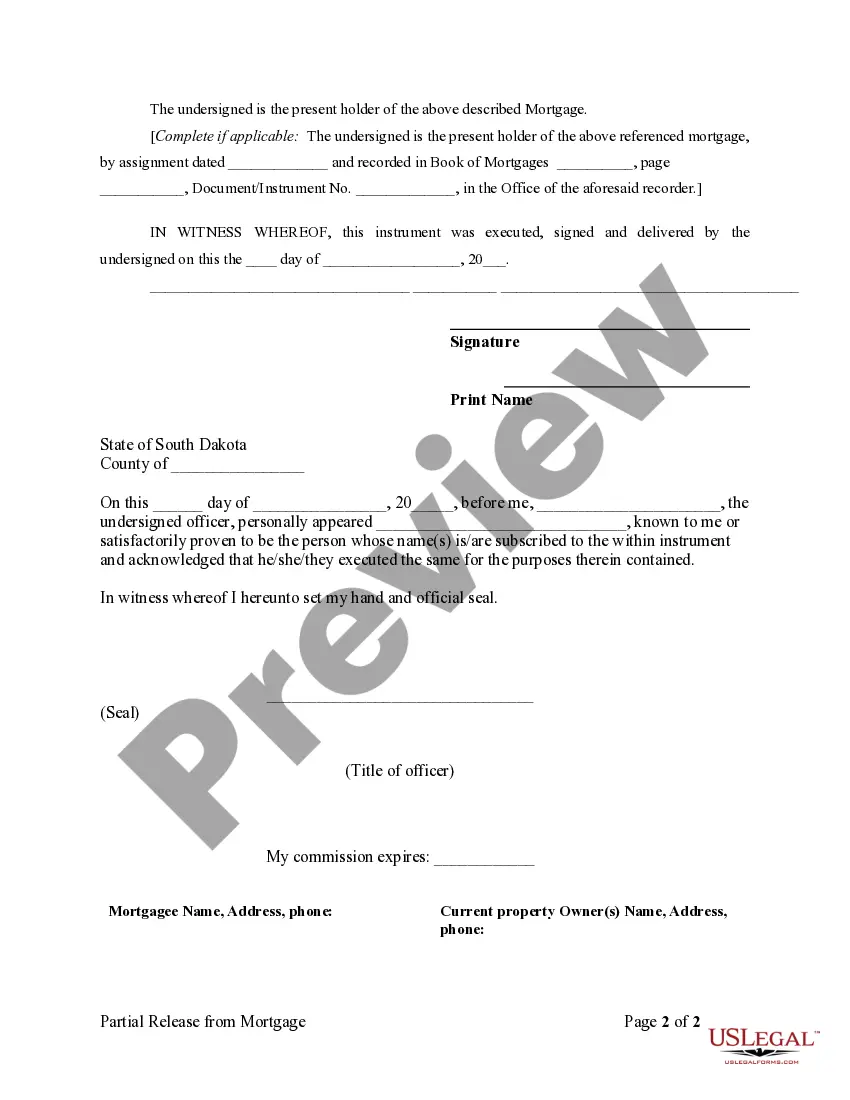

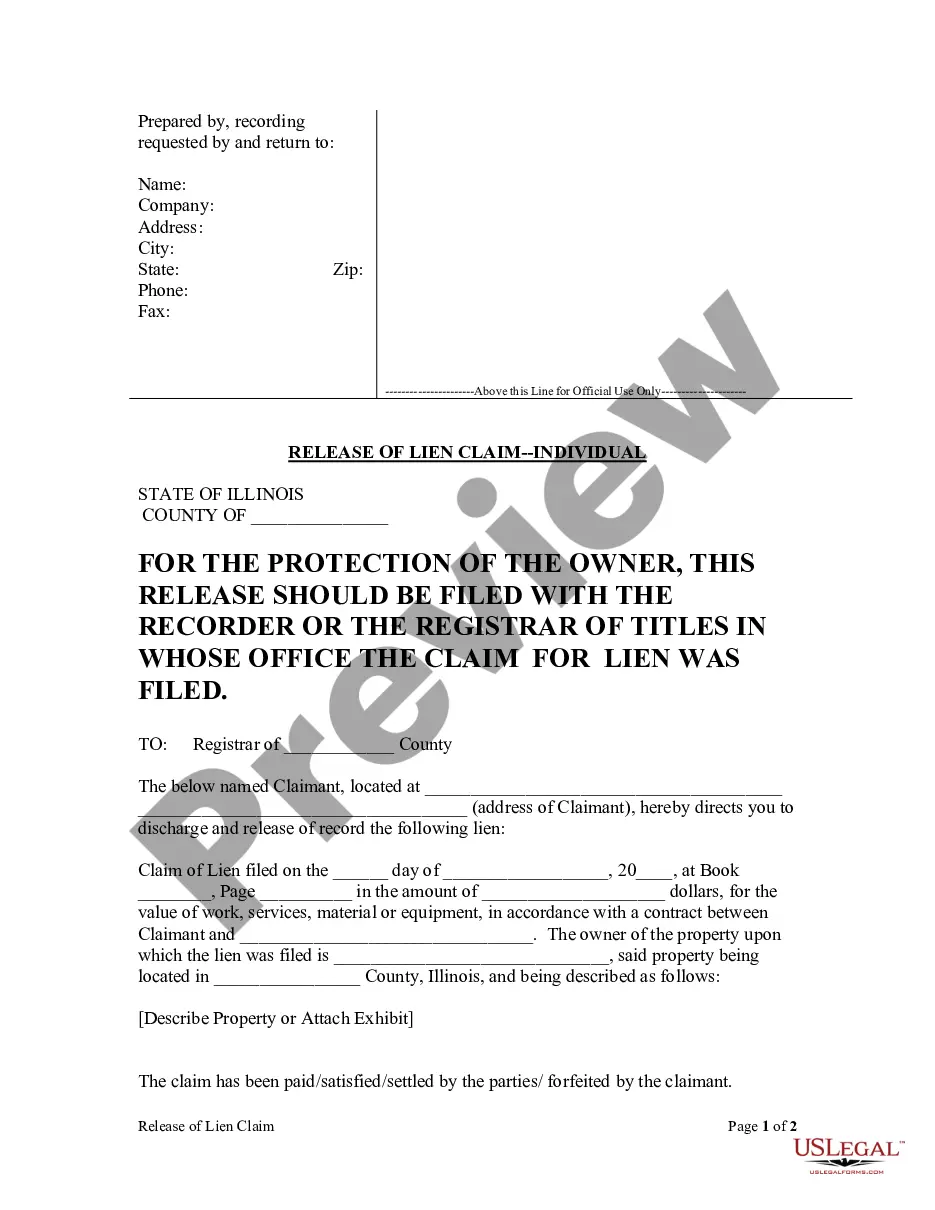

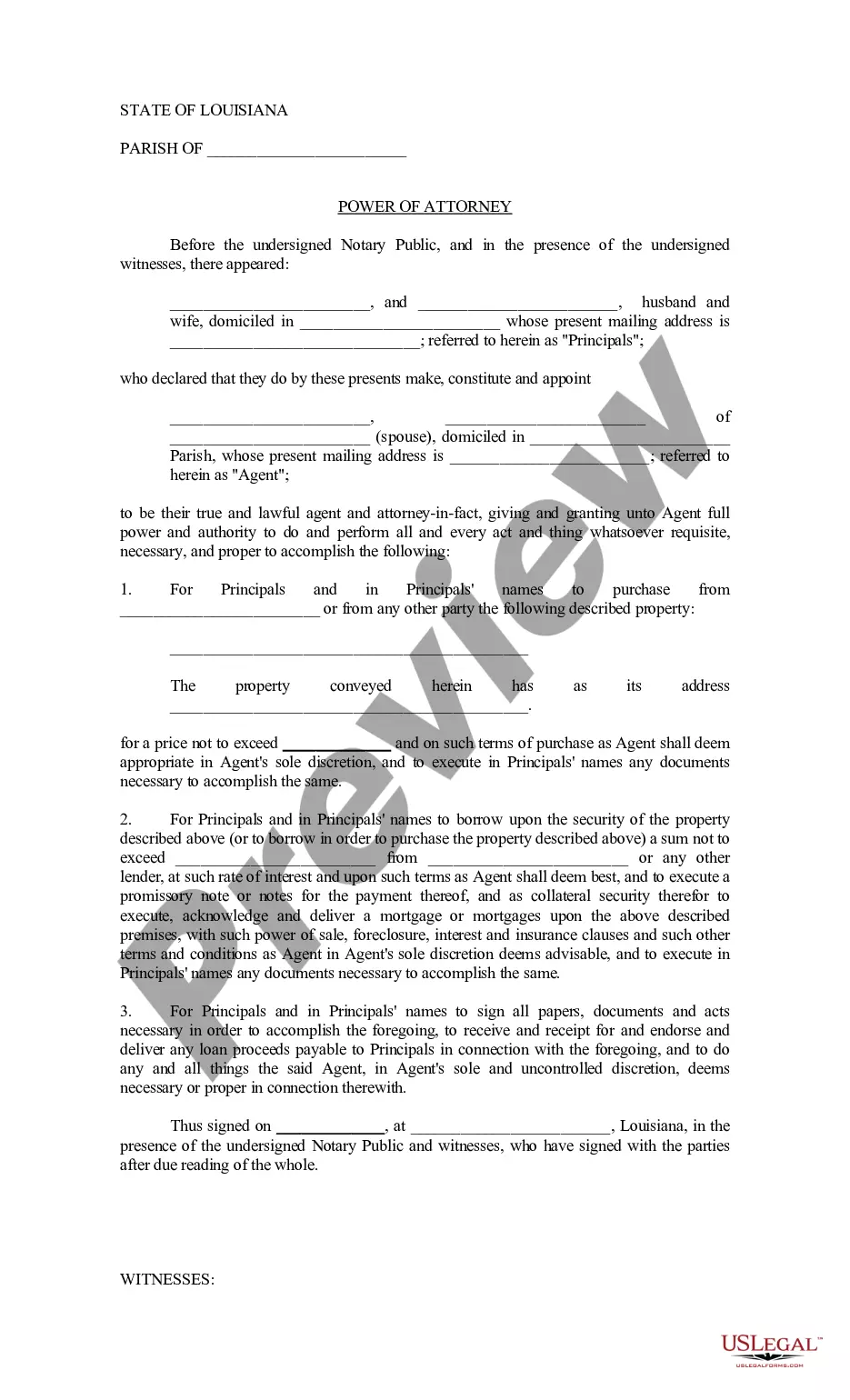

Releasing a mortgage lien often involves two or three signatures. Depending on your state, the person who's given the mortgage, the borrower, and the lender may be required to sign the release. In many states, a notary public signature and, possibly, a seal, is also needed to have a legal release of lien.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

Here are the things that you need to do:Ask the bank to prepare a standard full payment confirmation letter or Certificate of Mortgage Economic Cancellation.Make sure that you get to sign a Deed of Mortgage Cancellation before a Notary Public.More items...

Requirements for a Partial Release of a MortgageYou've had the mortgage for at least 12 months, in most cases. Your mortgage is current, meaning your account has not been more than 30 days past due within the last 12 months. No borrower can be released from their liability of the loan as part of the transaction.

In addition the following information should be included:The Payee Name.The Owner(s) of the mortgage holder.Total amount of mortgage.Mortgage date of execution.Full and legal description of the property to include tax parcel number.Acknowledgement that all payments have been made in full.More items...?21-Apr-2022