South Carolina Remix

Description

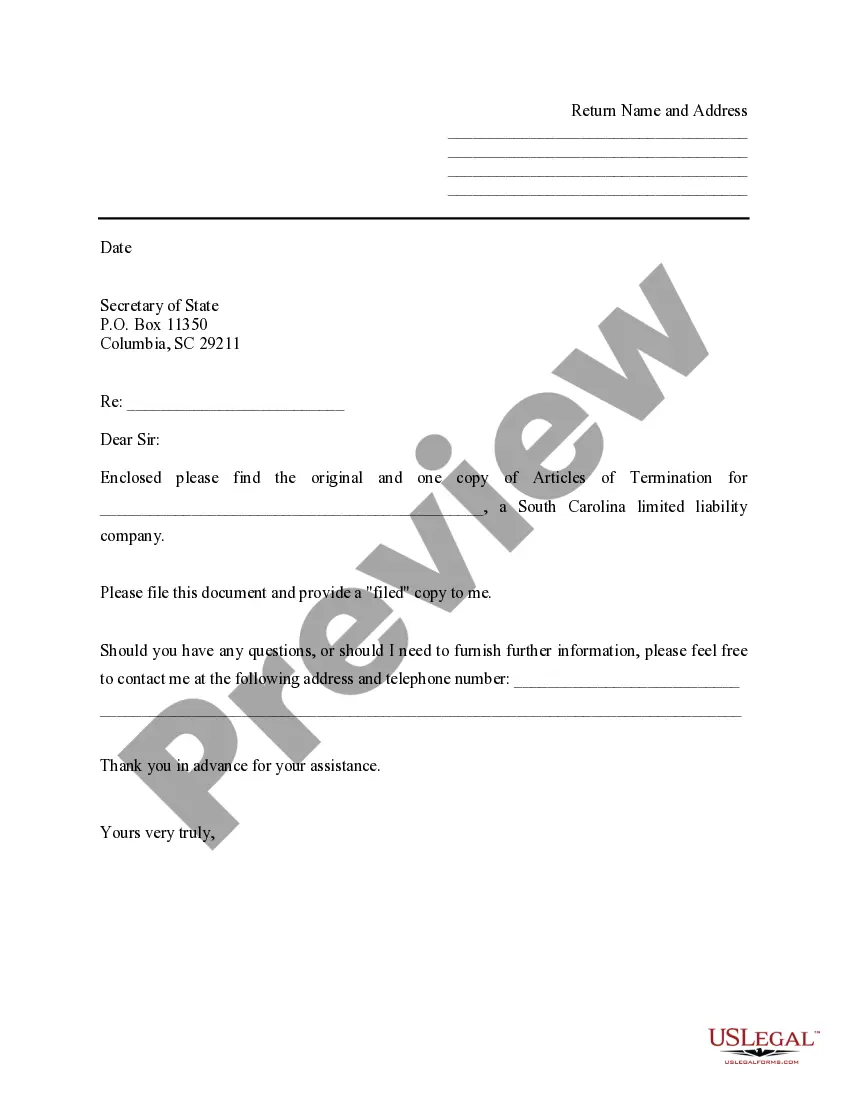

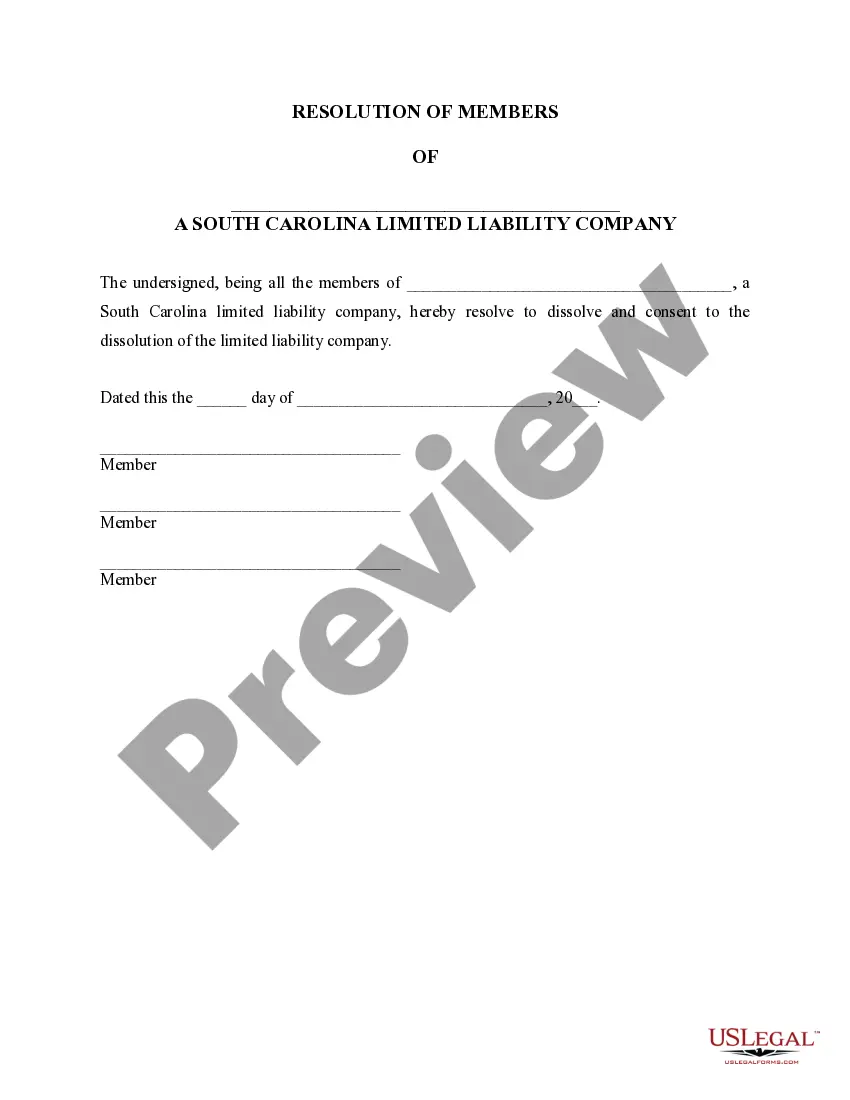

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; if not, renew it to continue accessing forms.

- Explore the Preview mode to assess the selected form's description. Confirm it aligns with your legal requirements.

- If necessary, utilize the Search function to locate additional templates that suit your needs.

- Proceed to purchase your chosen form by clicking the Buy Now button and selecting the appropriate subscription plan.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Download your completed document to your device. Access it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms provides a robust collection of legal forms that surpasses competitors, ensuring an efficient and user-friendly experience. Its extensive library and premium expert access make it an invaluable resource.

Transform your legal document needs today with US Legal Forms—start your journey now!

Form popularity

FAQ

Filing only federal taxes and omitting state taxes is generally not advisable if you have South Carolina income. Each state has its own tax regulations, and South Carolina requires its residents to file state taxes when they meet certain criteria. Ignoring state obligations can result in penalties or legal issues. A platform like USLegalForms can assist you in staying compliant with both federal and state tax filings.

Filing a South Carolina state return depends on your income situation and residency status. If you earned income in South Carolina or are a resident of the state, you typically have to file a return. However, it’s wise to consider potential benefits to filing even if you might not be required. For help navigating these requirements, check out USLegalForms.

To elect the South Carolina Pass-Through Entity Tax (PTET), eligible partnerships and S-corporations must file an election. This process involves submitting the necessary forms to the South Carolina Department of Revenue. By making this election, entities can avoid double taxation at the individual level. Explore support from USLegalForms to streamline your election process.

You generally need to file a South Carolina state tax return if you meet certain income thresholds or have South Carolina-source income. Even if your income is below the filing requirement, it may be beneficial to file to claim any potential refund. The South Carolina remix of tax rules can be confusing; thus, consulting with a professional or using USLegalForms can provide clarity.

Failing to file a South Carolina state return can lead to penalties and interest on unpaid taxes. The state may initiate enforcement actions to collect any owed amounts. Additionally, it might affect your eligibility for certain benefits and tax credits. To avoid these issues, consider using resources like USLegalForms for assistance with your filing.

Individuals who earn income in South Carolina must file the SC1040. If you are a resident, part-year resident, or non-resident with South Carolina-source income, you need to complete this form. Filing the SC1040 helps you fulfill your state tax obligations and can lead to potential refunds. Utilizing services like USLegalForms can simplify the process of filing your SC1040 efficiently.

To file an amended SC tax return, you need to complete the designated amendment form for South Carolina and provide the necessary documentation. Ensure that you clearly indicate the changes you are making. Timely filing is essential to avoid additional fees. Accessing USLegalForms can make this process more straightforward and efficient.

When filling out the SC1040 form, begin with your personal information, including your Social Security number. Follow the guidelines to report your income, deductions, and credits accurately. Double-check your calculations to avoid mistakes that could lead to delays or penalties. For assistance with this form, consider the helpful tools offered by USLegalForms.

The PT 100 form in South Carolina is used for reporting your personal property taxes. This form helps the South Carolina Department of Revenue track various personal assets for taxation purposes. It is important to complete the form accurately to avoid penalties. If you need help understanding this form, resources on USLegalForms can provide clarity.

To amend a tax return you have already filed, you need to use the appropriate forms designated by the IRS and the South Carolina Department of Revenue. Start by clearly stating the changes and updating any necessary information. Submitting your amended return promptly is vital to minimize any penalties. USLegalForms can assist you in navigating these forms effectively.