South Carolina Llc Dissolution

Description

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- Log into your US Legal Forms account if you're a returning user. Verify your subscription is active and download the required dissolution form.

- If you're new to US Legal Forms, start by previewing available templates. Choose one that aligns with your LLC dissolution requirements in South Carolina.

- Search for alternative forms if necessary. Utilize the search function to explore more options that may better suit your needs.

- Purchase the selected document. Click 'Buy Now' and select your preferred subscription plan. You'll need to create an account to access the documents.

- Complete your transaction by entering payment details or using your PayPal account to secure your subscription.

- Download your South carolina llc dissolution form. It will be saved in your account under 'My Forms,' where you can access it anytime.

In conclusion, utilizing US Legal Forms empowers you to efficiently navigate the South Carolina LLC dissolution process by providing access to a diverse library of legal forms. The steps outlined above will guide you in securing the necessary documents for a smooth dissolution.

Get started today with US Legal Forms and ensure your dissolution is handled correctly!

Form popularity

FAQ

Shutting down an LLC in South Carolina involves formally dissolving the business. You must file the necessary dissolution forms and clear any financial obligations, including taxes and creditors. Utilizing services from US Legal Forms can streamline this process, ensuring that your South Carolina LLC dissolution complies with all legal requirements.

Dissolving an LLC means officially closing the business in accordance with state laws, while terminating an LLC often refers to ceasing operations without following legal procedures. In South Carolina LLC dissolution, you must file appropriate forms with the Secretary of State and settle any debts. It's important to complete both processes to avoid future liabilities and ensure that your LLC is properly closed.

When you dissolve your LLC, it ceases to exist legally, which means it can no longer conduct business. However, you must still resolve any pending obligations, settle debts, and handle distributions to members. Ensuring all steps are followed correctly during the South Carolina LLC dissolution process helps prevent future liabilities and legal complications.

While many people may view dissolving a company and closing it as synonymous, there are distinct differences. Dissolution is a legal process that formally ends your LLC's existence, while closing often refers to halting business operations without formal legal paperwork. For a successful South Carolina LLC dissolution, following the proper procedures ensures everything is legally sound.

A dissolved LLC has officially ended its legal existence but may still need to fulfill certain obligations, while a terminated LLC is no longer recognized legally and cannot engage in any business activities. Understanding this difference is crucial during the South Carolina LLC dissolution process. It's important to properly manage your LLC status to avoid complications.

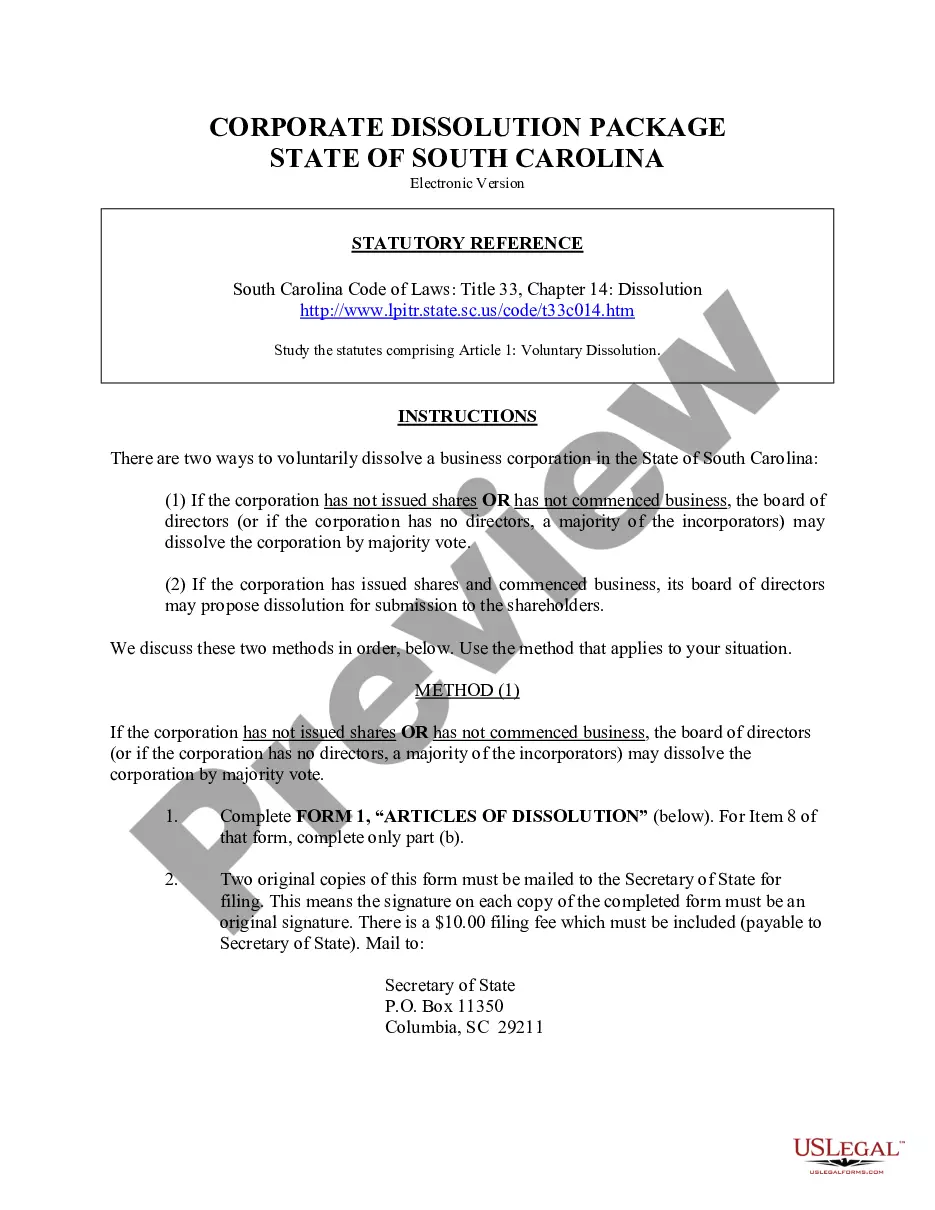

To dissolve your LLC in South Carolina, start by holding a vote among the members to approve the dissolution. Then, file Articles of Dissolution with the South Carolina Secretary of State. Finally, ensure you address all outstanding debts and obligations, which is a key part of the South Carolina LLC dissolution process.

The process of dissolving an LLC in South Carolina can be straightforward if you follow the correct steps. It involves filing the appropriate forms, settling any debts, and notifying relevant parties. While it may seem complex, using resources like USLegalForms can make South Carolina LLC dissolution efficient and manageable.

In South Carolina, the terms dissolution and cancellation are often used interchangeably, but they refer to different processes. Dissolution is the formal closing of an LLC that ends its legal existence, while cancellation involves removing the LLC's authority to operate in the state. Understanding South Carolina LLC dissolution is essential for ensuring proper compliance and avoiding any legal issues.

To shut down a business in South Carolina, start by informing your employees and settling all debts. You’ll then need to fill out and file the Articles of Dissolution with the Secretary of State. This procedure is crucial for a proper South Carolina LLC dissolution, ensuring that you have cleared all obligations and can officially close your business without any lingering responsibilities.

Filing for dissolution of your LLC in South Carolina requires you to complete the Articles of Dissolution form. You can submit this form online or by mail to the Secretary of State, along with any applicable fees. Make sure to check for any additional requirements specific to your LLC type, as properly following these steps ensures a complete and effective South Carolina LLC dissolution.