Limited Liability Company For Rental Property

Description

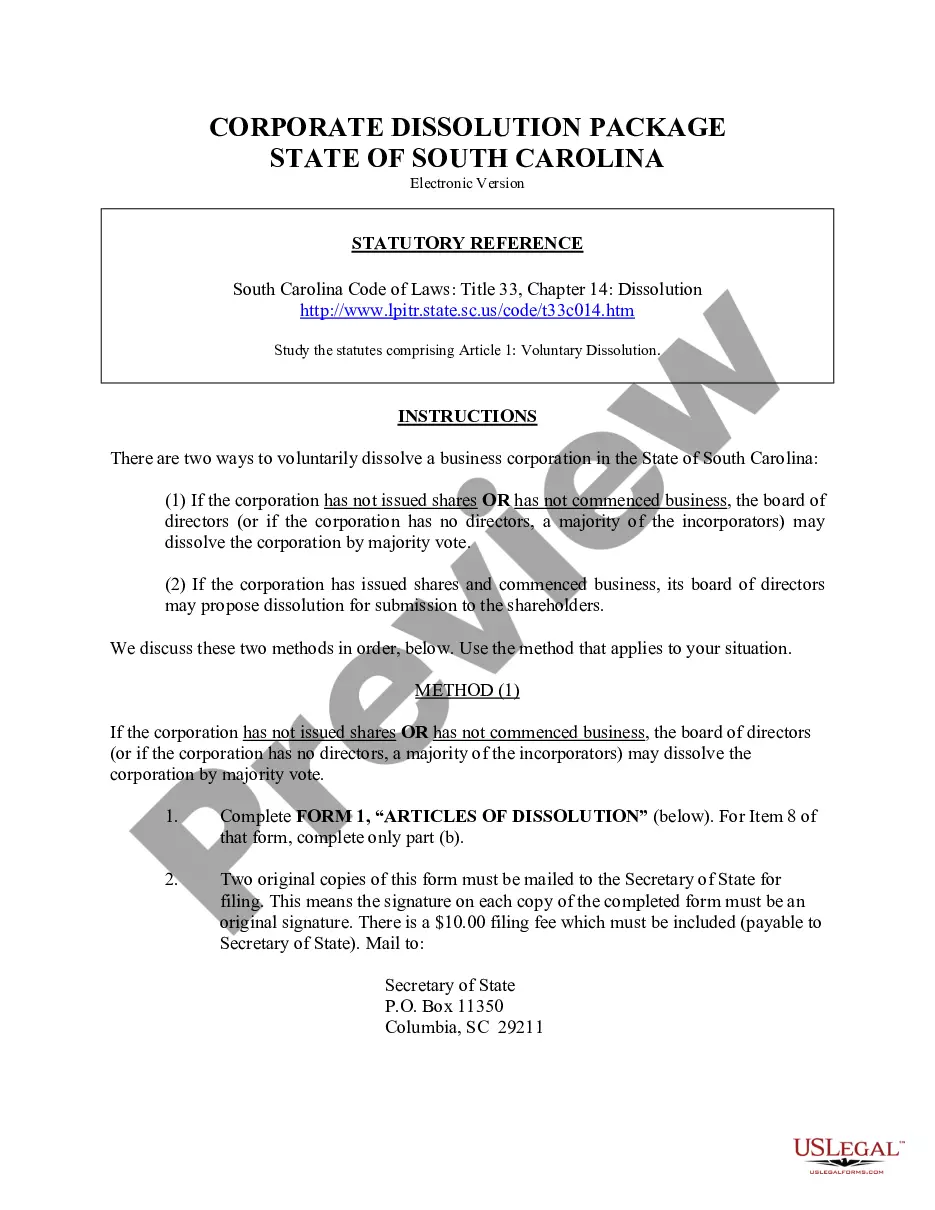

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- Log into your existing US Legal Forms account if you're a returning user, and confirm that your subscription is active to access the necessary forms.

- For first-time users, begin by reviewing the preview mode and form description to ensure you've selected the right template for your rental property LLC that complies with local regulations.

- Utilize the search feature if you need alternative forms, ensuring you find the right document that addresses your specific requirements.

- Purchase the form by clicking the 'Buy Now' button and opting for a suitable subscription plan, which requires account registration for full access.

- Complete your purchase by entering your payment details, whether via credit card or PayPal, to finalize your subscription.

- Download your selected form to your device. You can find it again anytime in the 'My Forms' section of your profile.

In conclusion, forming a limited liability company for rental property is seamless with US Legal Forms. Their extensive library and expert support ensure that you can confidently create legally sound documents tailored to your needs.

Ready to start? Visit US Legal Forms today and empower your LLC creation process!

Form popularity

FAQ

Transferring property to a limited liability company for rental property can have significant tax implications. Generally, this transfer may be considered a sale, triggering capital gains taxes. However, the LLC structure can also offer tax benefits, including deductions for operating expenses. Consulting with a tax professional is prudent to fully understand these implications and to optimize your tax situation.

Transferring a mortgage to a limited liability company for rental property is complicated. In most cases, lenders do not allow mortgages to be directly transferred to an LLC without their consent. You may need to refinance the mortgage in the LLC's name, so it’s crucial to communicate with your lender beforehand and seek legal advice to understand your options.

One potential disadvantage of putting your property in a limited liability company for rental property is the possible loss of certain tax benefits, such as homestead exemptions. Additionally, maintaining the LLC requires filing annual reports and paying fees. You also may face additional complexities in financing options and personal liability if the LLC does not adhere to legal formalities.

To put your rental property into a limited liability company for rental property, you first need to form the LLC through your state’s business filing office. Next, you will execute a deed to transfer ownership from you to the LLC. Be sure to follow local laws and regulations, as a professional service like uslegalforms can help guide you through the entire process with ease.

Yes, you can put your rental property in a limited liability company for rental property even if you have an existing mortgage. However, you should check your mortgage documents first. Some lenders might require permission or impose restrictions on transferring property to an LLC. It’s wise to consult with your lender and a legal professional to ensure compliance.

A limited liability company for rental property must file taxes if it generates any income, as the IRS requires reporting of all earnings, regardless of the amount. Even if your LLC earns below a specific threshold, tax obligations still exist. Filing is essential to maintain compliance, and you can utilize platforms like uslegalforms for guidance on required documentation and filing procedures.

The IRS taxes rental income from a limited liability company for rental property as ordinary income. You must report the total rental income received and can deduct any related operating expenses on your tax return. These expenses may include maintenance, repairs, and property management fees. Utilizing uslegalforms can help you navigate the complexities of reporting rental income effectively.

When setting up a limited liability company for rental property, you can opt for a single-member LLC or a multi-member LLC. A single-member LLC is often simpler for individual owners, while multi-member LLCs allow for shared ownership and responsibilities. Each type provides liability protection while benefiting from flexible taxation options. It is advisable to consult with professionals to determine which structure best fits your rental plans.

Filing taxes for a limited liability company for rental property involves reporting rental income and expenses on your personal tax return if the LLC is a single-member entity. You will typically use IRS Schedule E to detail your income and allowable deductions. If your LLC has multiple members, you may need to file Form 1065 and issue K-1 forms to the members. Remember, engaging the services of uslegalforms can simplify this process.

No, you generally do not file LLC and personal taxes together. A limited liability company for rental property can choose different tax classifications, often treating rental income as a pass-through to the owner's personal tax return. This means that you report the rental income and expenses on Schedule E of your personal taxes. However, the LLC itself may also need to file an informational return depending on its structure.