Whenever work is done or material is furnished for the improvement of real estate upon the employment of a contractor or some other person than the owner and such laborer, mechanic, contractor or materialman shall in writing notify the owner of the furnishing of such labor or material and the amount or value thereof, the lien given by SECTION 29-5-20 shall attach upon the real estate improved as against the true owner for the amount of the work done or material furnished. But in no event shall the aggregate amount of liens set up hereby exceed the amount due by the owner on the contract price of the improvement made.

Llc Were Follows For Tax Purposes

Description

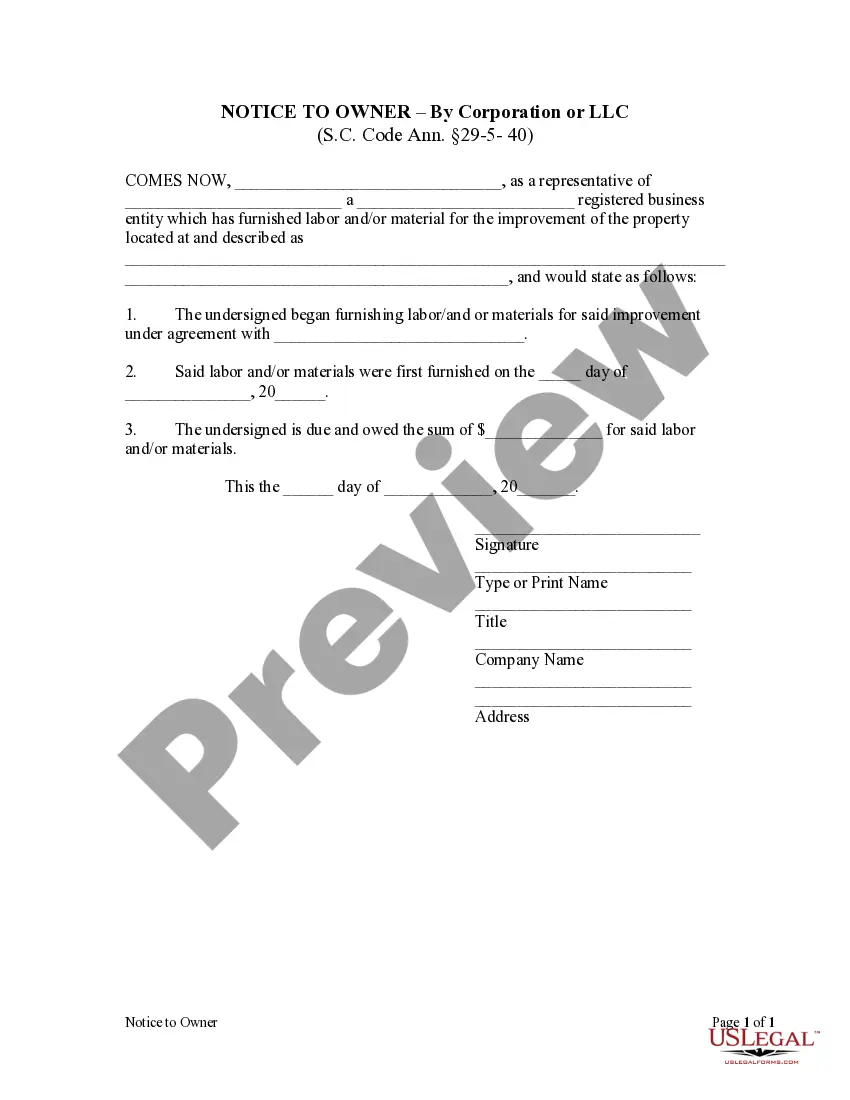

How to fill out South Carolina Notice To Owner By Corporation?

- If you are a returning user, log in to your account and retrieve the required form template. Verify your subscription status and renew if needed.

- For first-time users, browse the library and explore the preview mode and form descriptions to select a document that fulfills your requirements and adheres to your local regulations.

- If your initial choice doesn't suit your needs, utilize the search feature to find alternative templates. Make your final selection.

- Proceed to purchase the document by clicking the 'Buy Now' button. Choose a subscription plan that fits your legal needs and create an account for access.

- Complete your transaction by entering your payment details or logging into your PayPal account.

- Once purchased, download the form to your device and complete it. You can also find it later in the 'My Forms' section of your account.

In conclusion, US Legal Forms empowers you with a comprehensive library and expert guidance, making it simpler to handle LLC-related tax documents. Start your journey today and experience hassle-free legal documentation.

Visit US Legal Forms now to explore your options and take control of your LLC tax obligations!

Form popularity

FAQ

The optimal tax classification for your LLC largely depends on your business activities and long-term financial goals. Many small business owners prefer the disregarded entity classification for its simplicity and ease of reporting. However, if you anticipate retaining earnings or seeking investment, opting for S-Corp or C-Corp status may offer additional tax benefits. Evaluating your options with a tax professional can help you make a strategic decision that benefits your business financially.

In many cases, yes, you can file LLC taxes with your personal taxes, especially if your LLC is treated as a disregarded entity. This means that profits and losses pass through directly to your personal return, simplifying your tax process. However, if your LLC elects to be taxed as a corporation, separate filings will be required. Staying informed about your LLC's tax obligations is essential for effective financial management.

Whether you should file separately or not hinges on how your LLC is classified for tax purposes. If it's deemed a disregarded entity, you can report its income on your personal tax return, streamlining the process. However, if your LLC is taxed as a corporation, you'll likely need to file a separate business tax return. Analyzing your specific situation with a tax advisor can provide clarity on the best filing approach.

An LLC, or Limited Liability Company, is a flexible business structure that combines elements of both corporation and partnership types. It offers limited liability protection, meaning your personal assets are generally protected from business debts or liabilities. For tax purposes, an LLC can be classified as a disregarded entity, partnership, or corporation, depending on your preferences and the number of owners. Understanding these classifications is vital for proper tax compliance and asset protection.

Typically, an LLC's income can be reported on your personal tax return if it's classified as a disregarded entity. Combining your personal and business income simplifies the tax process and may save you from additional filings. However, it's essential to assess your LLC's specific tax classification, as this may affect your filing method. Consulting with a tax expert can provide clarity on the best approach for your circumstances.

Your classification will depend on your long-term business goals and tax strategy. An LLC treated as a disregarded entity allows for more straightforward tax reporting, while the corporate classification may offer benefits like limited liability and favorable tax rates. Evaluating your specific situation with a tax professional can guide you toward the best choice. An informed decision ensures that your LLC aligns well with your financial objectives.

Yes, the IRS can pursue your LLC for personal taxes under certain circumstances. If you have failed to separate your personal finances from your LLC's financial activities, this could lead to personal liability. It's crucial to maintain clear boundaries between your personal and business expenses, especially when it comes to tax obligations. Understanding how LLCs work and their implications for taxes can help protect your personal assets.

Choosing the best tax classification for your LLC involves considering factors like income level and future growth. Most LLCs start as pass-through entities, which means profits are taxed only once. In contrast, some business owners may benefit from being taxed as a corporation. To make a well-informed choice regarding how an LLC were follows for tax purposes, consulting a tax professional can provide valuable insights.

The best tax status for an LLC often hinges on your long-term goals. Many owners find that electing S Corporation status offers significant tax benefits, particularly regarding self-employment taxes. However, other structures may better suit your business model and financial strategies. Understanding how an LLC were follows for tax purposes can empower you to select the most favorable status.

The type of LLC that pays the least taxes often depends on its structure and income. Generally, single-member LLCs filing as sole proprietorships tend to have simpler tax obligations. However, some multi-member LLCs electing S Corporation status might find tax advantages as well. It's important to analyze how an LLC were follows for tax purposes in your specific situation to determine the best approach.