Llc Were Follows For Business

Description

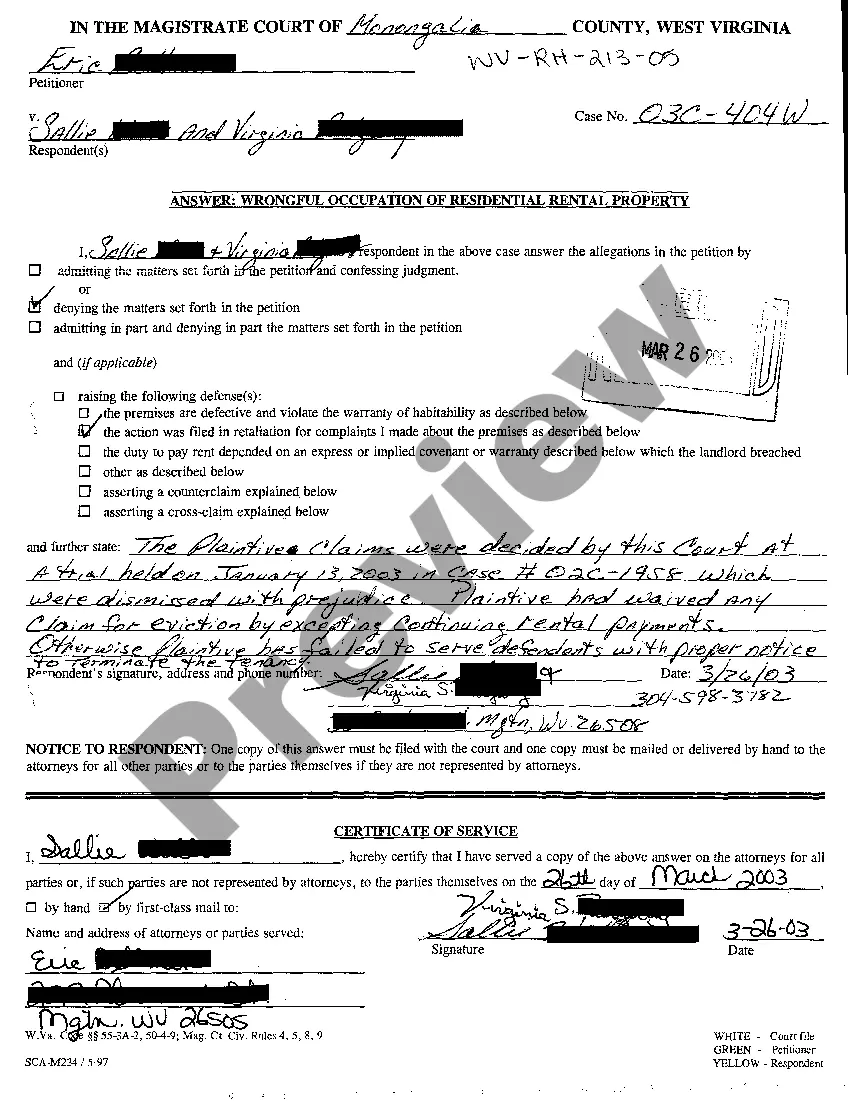

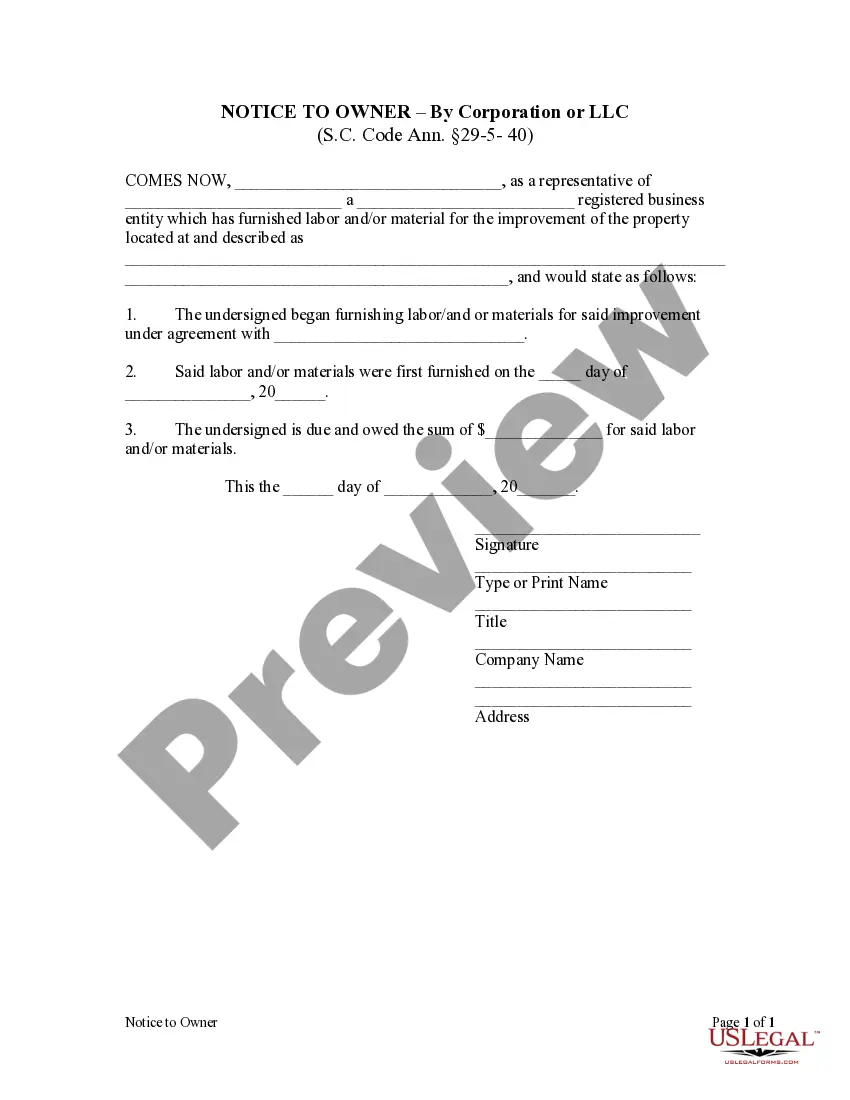

How to fill out South Carolina Notice To Owner By Corporation?

- For returning users, log into your account at US Legal Forms and locate the necessary form template. Ensure your subscription is active; if not, renew it as necessary.

- If this is your first visit, start by reviewing the Preview mode and carefully read the form descriptions to choose the one that aligns with your requirements.

- If you need a different template, use the Search bar to find options that meet jurisdictional standards.

- Select the Buy Now button and choose a subscription plan that suits you. You’ll need to create an account to access the full library.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Finally, download your form and save it to your device. You can access it later in your profile under the My Forms section.

US Legal Forms stands out with its robust collection of over 85,000 fillable legal forms. This breadth means you can find almost any document you need without hassle.

In conclusion, US Legal Forms is a powerful tool for individuals and attorneys, making legal paperwork expedient and accurate. Don’t wait, start exploring your options today!

Form popularity

FAQ

In New York, the approval process for an LLC typically takes about 1 to 2 weeks. However, it may vary depending on the workload of the state processing office. To speed up the process, consider using expedited services available through legal platforms. Setting up an LLC where it follows for business can significantly enhance your company's credibility and shield you from personal liability.

Yes, you can establish an LLC even after launching your business. Forming an LLC provides various benefits, such as personal liability protection and potential tax advantages. It's essential to follow the necessary legal steps to ensure your LLC is properly registered. Platforms like US Legal Forms can help guide you through this process, making it easier to set your LLC where it follows for business.

An LLC can be both good and bad depending on your business needs and goals. It offers limited liability protection, which can be a significant advantage for many businesses. However, the structure does involve filing requirements and potential self-employment taxes. Therefore, understanding how an LLC were follows for business can positively impact your situation is crucial.

Some individuals might prefer to operate as a sole proprietorship or partnership to maintain simplicity and avoid the complexities of an LLC. An LLC involves more regulations and paperwork, which can be daunting for new entrepreneurs. Furthermore, certain taxation options offered by an LLC might not align with everyone's financial goals. Hence, it's essential to evaluate whether an LLC were follows for business aligns with your personal objectives.

An LLC may not be beneficial if your business anticipates high profits or plans to seek venture capital investment. In such cases, a different structure like a corporation might be more suitable. Additionally, some states have higher fees and taxes for LLCs, which can cut into your profits. Thus, carefully consider the specifics of your business before deciding if an LLC were follows for business.

To write a simple operating agreement for your LLC, begin by outlining the basic information, including the name of the LLC, member names, and their ownership percentages. Then, specify the management structure and decision-making processes. Keep your language straightforward and clear, focusing on the essential elements that will guide your LLC were follows for business. Using online resources, such as US Legal Forms, can streamline this process.

Filling out an LLC operating agreement involves detailing the key aspects of your business, such as ownership stakes, management processes, and distribution of profits. Start by clearly writing down the names of all members and their contributions. By carefully filling out this document, you ensure that your LLC were follows for business runs smoothly and meets the needs of all involved parties. Use platforms like US Legal Forms for guidance.

While not legally required in every state, having an operating agreement is highly recommended for any LLC. It serves as the primary document outlining the management and operational structure of the business. Without it, you may face uncertainties regarding how your LLC were follows for business operates. An operating agreement clarifies member roles and responsibilities, helping to avoid potential disputes.

The structure of an operating agreement typically includes sections on the business purpose, member contributions, profit distribution, management roles, and procedures for adding new members or handling disputes. This structured outline ensures clarity and protects the interests of all members. A well-drafted operating agreement guides how your LLC were follows for business and helps prevent future conflicts. Always consider consulting a professional for tailored guidance.

After setting up an LLC, you should focus on obtaining an Employer Identification Number (EIN), creating an operating agreement, opening a business bank account, and filing any necessary state reports. These steps are vital for legal compliance and operational efficiency. Following through ensures that your LLC were follows for business effectively. Each item helps solidify the foundation for your new venture.