Release Claim Lien With The Request

Description

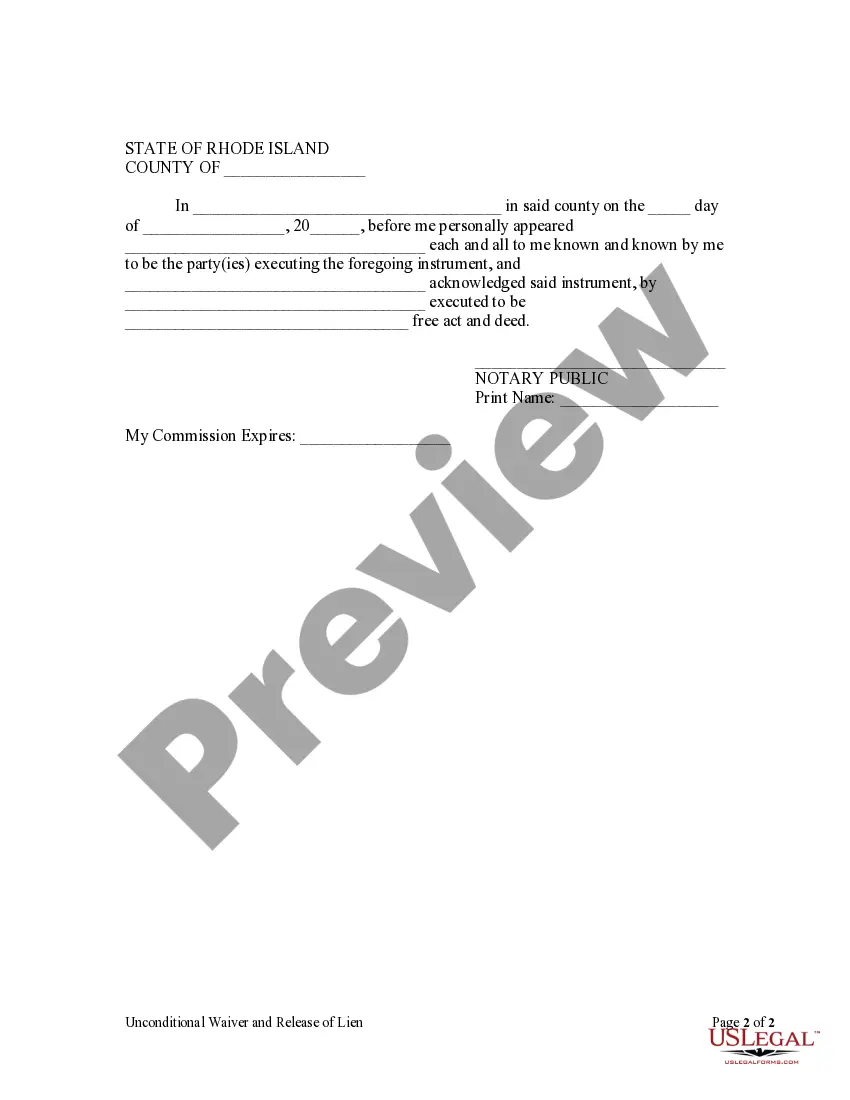

How to fill out Rhode Island Unconditional Waiver And Release Of Claim Of Lien Upon Final Payment?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is up-to-date; renew if necessary.

- Begin by checking the preview mode of the relevant form. Confirm it aligns with your specific legal requirements.

- If the chosen document doesn’t meet your needs, utilize the Search tab to find a suitable form that complies with your jurisdiction.

- Once you’ve selected the right document, click on the Buy Now button and choose your preferred subscription plan. Registration will be required for access.

- Complete your purchase by providing payment details through credit card or PayPal.

- Finally, download the form to your device. You can access it anytime through the My Forms section of your profile.

In conclusion, US Legal Forms provides a valuable resource for managing legal documents effectively. By following these steps, you can ensure your claim lien is released without hassle. Explore our library today and simplify your legal processes.

Start your journey with US Legal Forms and experience the ease of managing your legal documents.

Form popularity

FAQ

When a lien is released, it signifies that the creditor has relinquished their legal claim on a property, typically after the debt has been satisfied. To successfully release claim lien with the request, you need to follow specific procedures to ensure the release is documented properly. This process protects the property owner's rights and clears their title for any future transactions. By utilizing platforms like US Legal Forms, you can access the necessary documents and guidance to navigate this important step effectively.

To obtain the release of an IRS lock-in letter, you will need to respond to the IRS and provide any required documentation showing why a release is justified. Make sure to follow their instructions carefully. Using uslegalforms can help guide you through properly drafting your request to release claim lien with the request for faster results.

To get a lien released from the IRS, you must meet all obligations and submit a formal request for release. You can do this online or via mail, ensuring you include all necessary details. For a seamless experience, consider using uslegalforms to create an efficient request to release claim lien with the request.

To obtain an IRS lien payoff letter, you need to contact the IRS directly and request this documentation. Having your tax information handy will streamline the process. By using the services of uslegalforms, you can prepare a formal request and swiftly release claim lien with the request in a professional manner.

The speed of obtaining a lien release can vary, but typically, you can expect a response within a few weeks after submitting your request. If you use professional services or templates from uslegalforms, you might expedite your request. Always ensure you submit the correct documents to help release claim lien with the request efficiently.

When writing a letter to request lien release, clearly state your intent, include your personal details, and specify the lien involved. It’s important to provide any supporting documents and express why you believe the lien should be released. Be sure to include a request to release claim lien with the request for better clarity and response.

Yes, the IRS typically releases a lien automatically after 10 years from the date of assessment. However, you must meet all tax obligations during this time. To ensure your lien gets released, you could proactively release the claim lien with the request while following IRS regulations.

Requesting a lien release from the IRS involves submitting Form 668(Z), also known as the Request for Release of Federal Tax Lien. It's important to provide information about the taxpayer and any relevant details about the lien. After completing the form, send it to the appropriate IRS office. Following these steps will enable you to efficiently release claim lien with the request.

To complete a lien release, you first need to gather all necessary documentation that proves the lien has been satisfied. Next, fill out the appropriate lien release form accurately. Once filled, submit the lien release form to the relevant authority, ensuring that you include any required signatures. It is critical to ensure that all steps are followed to properly release claim lien with the request.

When writing a letter to release a lien, start by clearly stating your intent to request a lien release. Include details such as the property description, lien information, and confirmation that the debt is settled. Make sure to sign the letter and include your contact information. If you need guidance on drafting this letter, US Legal Forms provides templates and resources to assist you in creating a professional and effective request.