Pennsylvania Power Attorney With Multiple Beneficiaries

Description

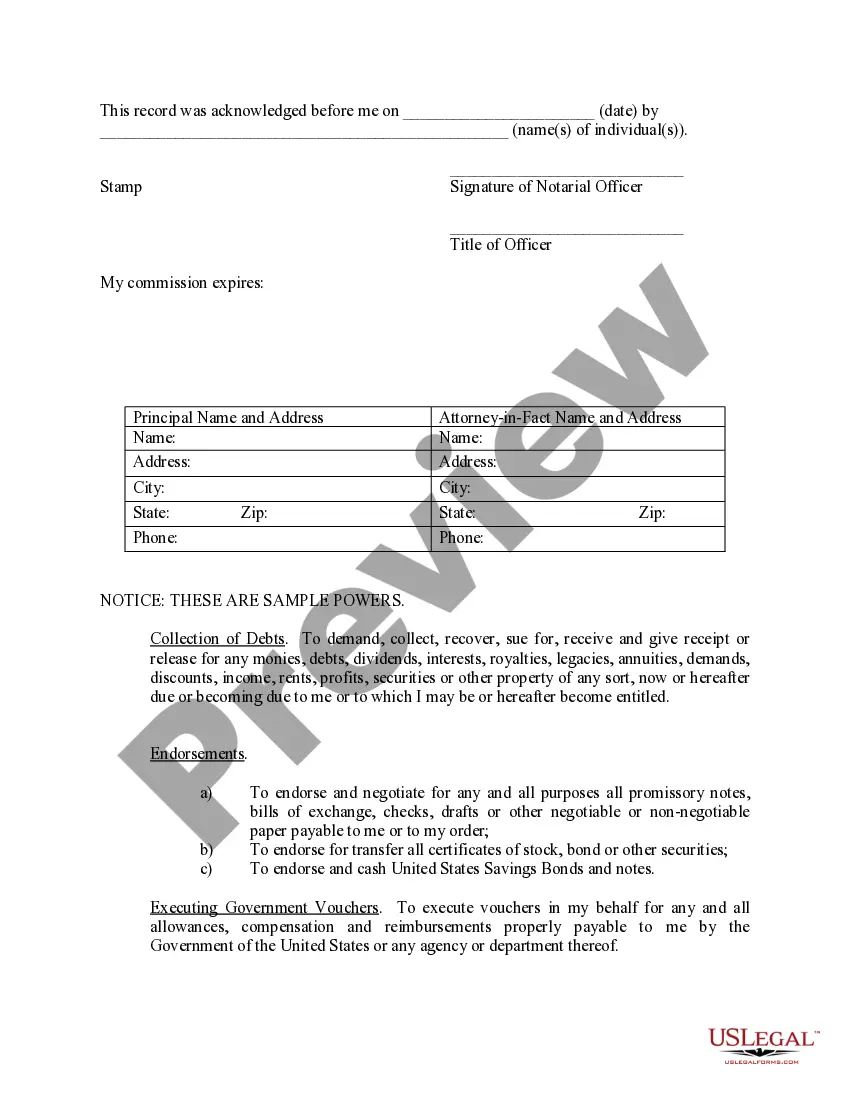

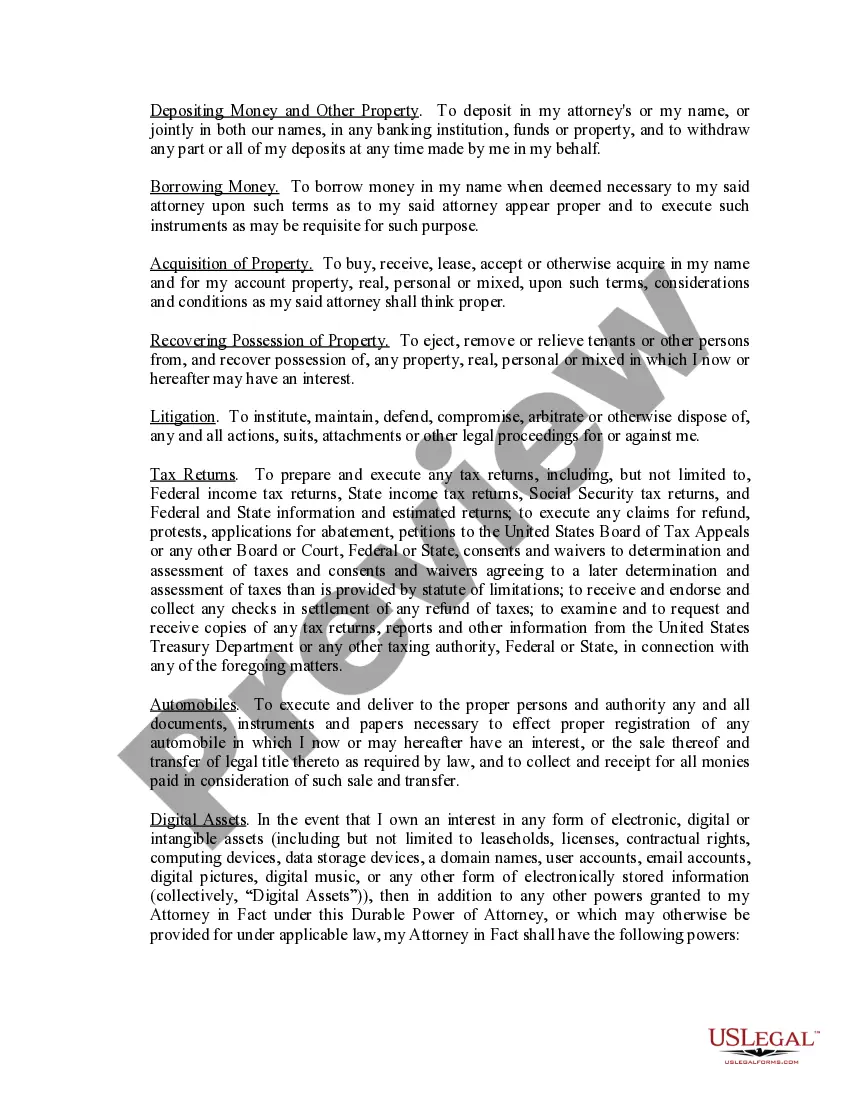

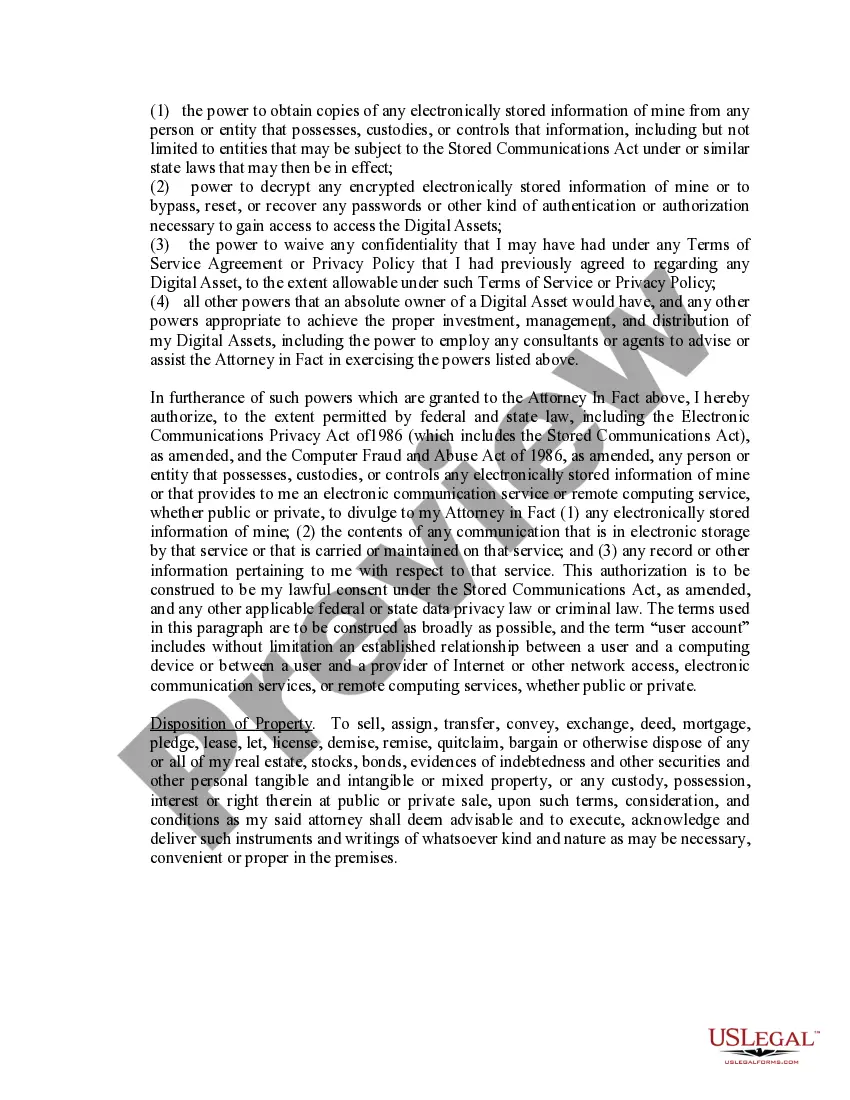

How to fill out Pennsylvania Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Using legal document samples that meet the federal and local regulations is a matter of necessity, and the internet offers many options to pick from. But what’s the point in wasting time searching for the right Pennsylvania Power Attorney With Multiple Beneficiaries sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life situation. They are simple to browse with all papers organized by state and purpose of use. Our specialists keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when acquiring a Pennsylvania Power Attorney With Multiple Beneficiaries from our website.

Getting a Pennsylvania Power Attorney With Multiple Beneficiaries is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the instructions below:

- Analyze the template utilizing the Preview option or through the text description to ensure it meets your needs.

- Locate a different sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Pennsylvania Power Attorney With Multiple Beneficiaries and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

I hereby acknowledge that when I act as agent: I shall act in ance with the principal's reasonable expectations to the extent actually known by me and, otherwise, in the principal's best interest, act in good faith and act only within the scope of authority granted to me by the principal in the power of attorney.

Powers of Attorney by Two or More Persons A power of attorney may be executed by two or more persons jointly in favour of one or more persons and when there are several persons as attorneys a complete authorisation in letter to be given by one of them for acting severally.

You can grant your agent the ability to make gifts of your property if you choose to do so or even change beneficiary designations if you choose to include such language. The pros and cons of these powers should be discussed in detail with your estate planning attorney.

Pennsylvania Power of Attorney Requirements Pennsylvania law requires the POA to include a Notice provision and before the Agent can act, the Agent must execute and affix to the POA an Acknowledgement. The Notice and the Acknowledgement must comply with Pennsylvania law.

You may select more than one person to act as your agent and you may name a successor agent if your original agent is unable or unwilling to continue to act as your agent.