Legal Information Pa Withholding Tax

Description

How to fill out Pennsylvania Newly Divorced Individuals Package?

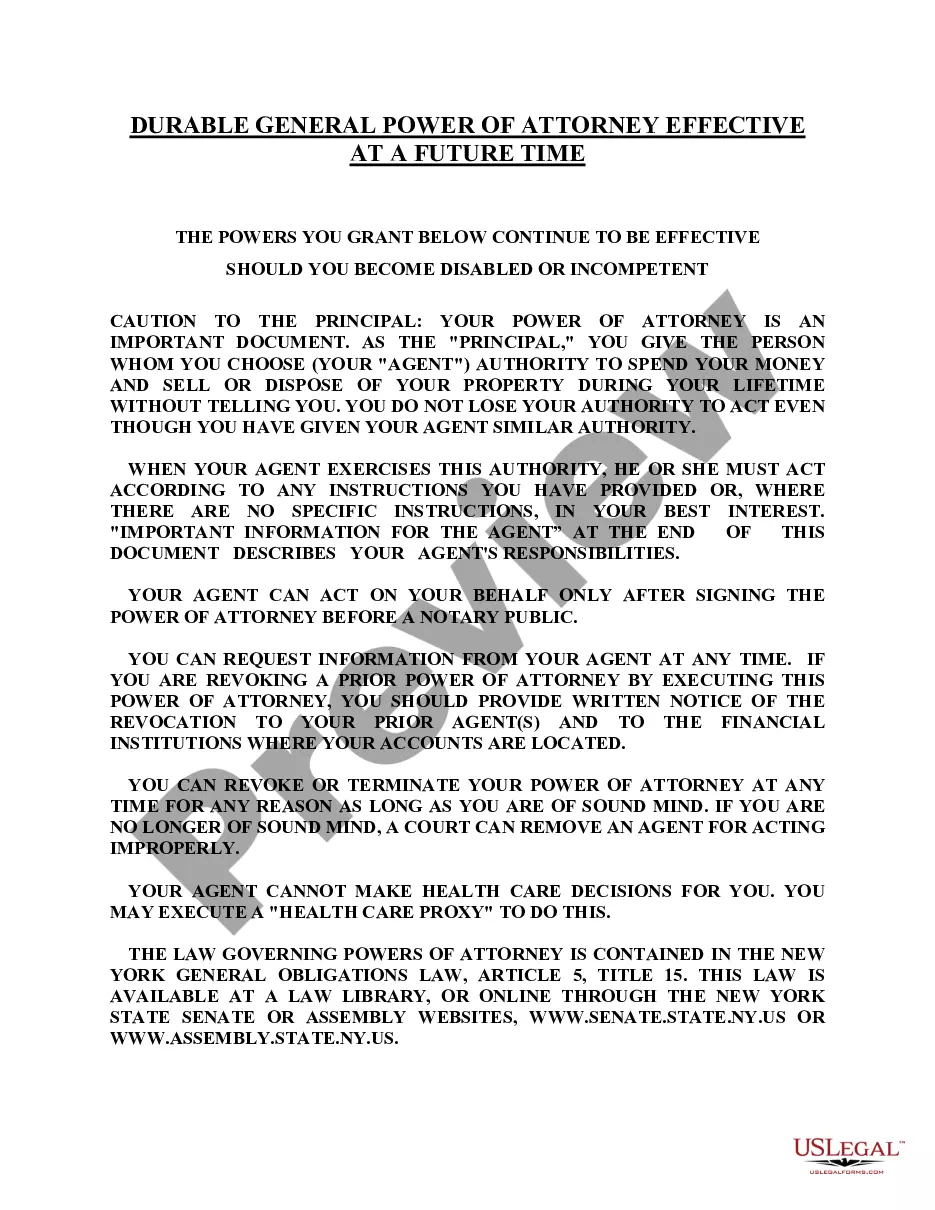

Utilizing legal document examples that adhere to federal and state statutes is essential, and the web provides numerous selections to choose from.

However, what’s the point of squandering time looking for the suitable Legal Information Pa Withholding Tax sample online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms stands as the premier online legal repository with over 85,000 fillable documents drafted by legal professionals for all kinds of professional and personal situations.

Examine the template using the Preview feature or through the text outline to confirm it fulfills your needs.

- They are user-friendly to navigate with all documents categorized by state and intended use.

- Our specialists stay updated with legal modifications, ensuring your forms are current and compliant when acquiring a Legal Information Pa Withholding Tax from our platform.

- Securing a Legal Information Pa Withholding Tax is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and store the document sample you require in the correct format.

- For new users, follow the steps below.

Form popularity

FAQ

Non-residents working in Pennsylvania must also adhere to the 3.07% withholding tax on their earnings. This rate applies regardless of where you live, as long as your work is performed within the state. Understanding this requirement is vital to ensuring compliance. For further guidance, you can explore legal information pa withholding tax resources.

Pennsylvania law protects homeowners by providing a statutory right to cure a defaulted mortgage through Act 6 and Act 91. Pennsylvania law allows homeowners to reinstate a mortgage that has defaulted up until one hour before a sheriff's sale.

PA Loan means the loans made under, and in ance with, the PA Credit Agreement. 'PA Obligations' shall mean all ?Obligations? owing by the PA Borrowers to PA Lender as defined in the PA Credit Agreement.? PA Loan means the loans made under, and in ance with, the PA Credit Agreement.

In general, however, Pennsylvania is considered to follow the lien theory of mortgages.

Banks may adopt various loan recovery processes depending on the reason for default. They can reclaim the amounts back through collaterals or by offering an extended moratorium. If both don't work, they may send a recovery agent.

Borrowers can collect their original documents from their bank branch or any other designated branch. The Reserve Bank of India (RBI) has directed banks and other financial institutions to release all the movable and immovable property documents within 30 days of the full repayment of loans.

It typically takes anywhere between 45 to 90 days, but it could be longer if you and the seller agree on a different timeframe. As the name suggests, home loan settlement means that on the agreed date, the sale is complete, and all details have been finalised (or ?settled?).

Recovery rate is the estimated percent of a loan or an obligation that will still be repaid to creditors in the event of a default or bankruptcy. In a firm's capital structure, the recovery rate on senior debt will generally carry a high recovery rate, while junior debt may be relegated to a rate as low as nearly zero.

With all your due respect, would like to inform you that this (your name) bearing account no??.. In your branch. I had taken House loan (Loan A/c No. X) which has been closed now, so I request you to kindly issue back my original papers which were mortgaged in place of loan.