Trust Vs Will In Pennsylvania

Description

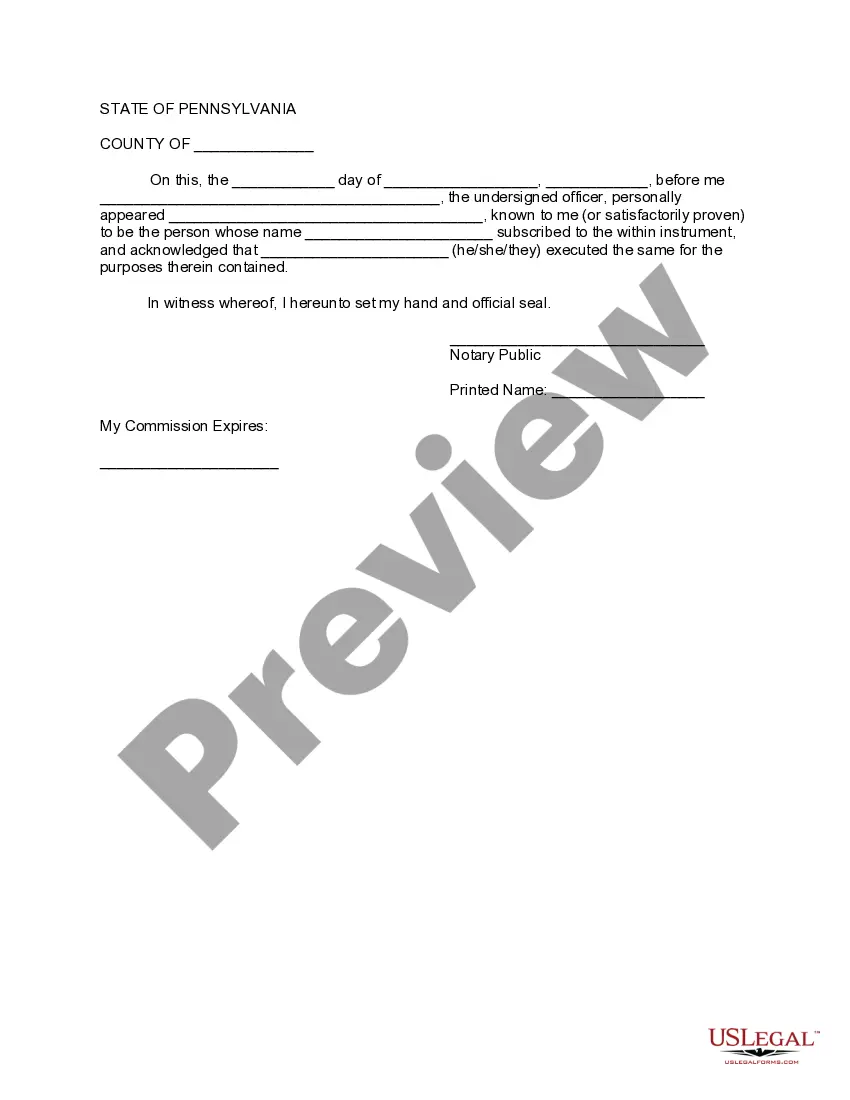

How to fill out Pennsylvania Amendment To Living Trust?

Drafting legal paperwork from scratch can sometimes be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more affordable way of creating Trust Vs Will In Pennsylvania or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of over 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-compliant forms diligently prepared for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can easily find and download the Trust Vs Will In Pennsylvania. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and navigate the catalog. But before jumping straight to downloading Trust Vs Will In Pennsylvania, follow these tips:

- Review the form preview and descriptions to make sure you are on the the document you are searching for.

- Check if form you select complies with the requirements of your state and county.

- Choose the right subscription option to get the Trust Vs Will In Pennsylvania.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us now and turn form completion into something easy and streamlined!

Form popularity

FAQ

Only assets owned solely by the decedent at the time of death are subject to probate. Jointly owned assets, assets with designated beneficiaries like life insurance or retirement accounts, and assets held in a trust typically avoid the probate process.

A will or a living trust are two valuable tools used for estate planning. A will is important to avoid having your estate distributed in ance with Pennsylvania's laws. A living trust can essentially operate as a vault to hold several types of assets that you transfer into it.

Living Trusts The grantor of the trust can act as both trustee and beneficiary, allowing for more control over the estate. In the event of death, assets held in a living trust can bypass probate. The beneficiary takes over the trust and does not need oversight by the court.

If you still wish to keep control of it through a single trustee, you may set up an irrevocable trust that will pass it tax-free. That type of trust should be distinguished from a revocable trust, which is still subject to inheritance tax.

To make a living trust in Pennsylvania, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.