Setting Up A Trust In Pa

Description

How to fill out Pennsylvania Amendment To Living Trust?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain situations may necessitate extensive research and significant financial investment.

If you're searching for a more direct and budget-friendly method of establishing Setting Up A Trust In Pa or any other documentation without hassle, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs.

However, before directly proceeding to download Setting Up A Trust In Pa, consider these recommendations: Review the form preview and descriptions to confirm that you've located the document you're seeking. Ensure the form you select adheres to the regulations and laws of your state and county. Choose the most suitable subscription option to acquire the Setting Up A Trust In Pa. Download the form, then complete, sign, and print it. US Legal Forms enjoys a solid reputation backed by over 25 years of experience. Join us today and transform form completion into a straightforward and efficient process!

- With just a few clicks, you can swiftly access state- and county-compliant forms meticulously prepared for you by our legal experts.

- Utilize our website whenever you seek a trusted and dependable service through which you can effortlessly find and obtain the Setting Up A Trust In Pa.

- If you're familiar with our services and have set up an account with us previously, just Log In to your account, select the form, and download it instantly or re-download it anytime in the My documents section.

- Not an account holder? No problem. Registering takes only minutes, allowing you to explore the library.

Form popularity

FAQ

The 2 year rule for trusts in Pennsylvania states that any transfers made to a trust within two years of the grantor's death may be subject to estate recovery. This means that if you are setting up a trust in PA, you should be mindful of timing to avoid complications. This rule is particularly relevant for Medicaid eligibility and long-term care planning. Consulting resources from US Legal Forms can help clarify how this rule might affect your trust.

While it is not legally required to have a lawyer when setting up a trust in PA, having professional guidance can simplify the process. A lawyer experienced in estate planning can help ensure your trust meets legal requirements and reflects your wishes. Moreover, they can provide valuable advice on tax implications and asset management. Using platforms like US Legal Forms can also help you navigate the paperwork efficiently.

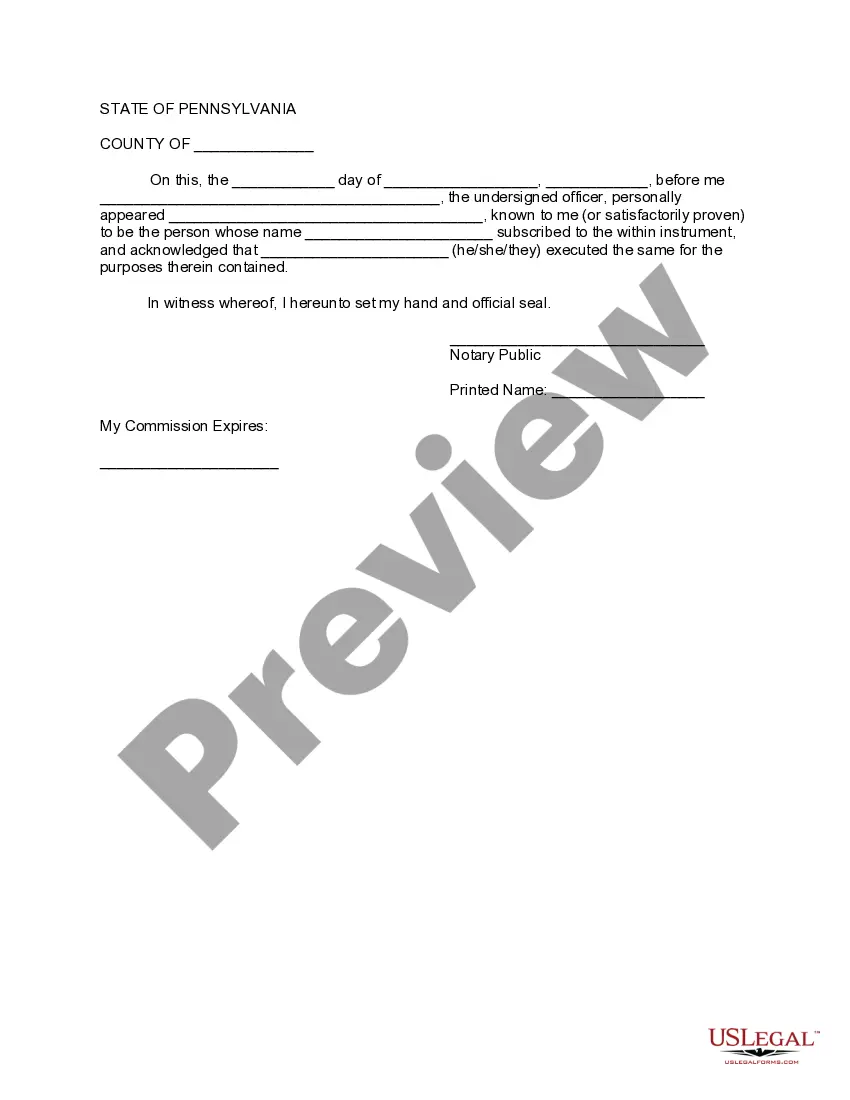

Setting up a trust in PA involves several steps to ensure it is legally valid. First, you need to create a trust document that outlines the terms and beneficiaries of the trust. After drafting, you will have to sign the document in the presence of a notary. Lastly, while registering a trust is not mandatory in Pennsylvania, you may want to consider funding your trust with assets and consulting a legal expert to ensure everything aligns with state laws. For additional guidance, uslegalforms offers resources and templates that simplify the process of setting up a trust in PA.

Yes, you can form a trust without an attorney, although it requires careful attention to detail. When setting up a trust in PA, you must comply with state laws and ensure that your trust document is properly executed. Using resources like uslegalforms can help you navigate this process by providing the necessary forms and instructions, empowering you to create a trust that meets your needs.

Setting up a trust in PA involves several key steps to ensure your assets are managed according to your wishes. First, you need to decide on the type of trust that best suits your needs, whether it's a revocable or irrevocable trust. Next, you will draft the trust document, detailing the terms and beneficiaries. To simplify this process, consider using uslegalforms, which provides templates and guidance tailored for setting up a trust in PA.

Yes, you can put your house in a trust in Pennsylvania. Setting up a trust in PA allows you to manage your property effectively while ensuring that your wishes are followed after your passing. By placing your house in a trust, you can avoid probate, streamline asset distribution, and provide clear instructions on how your property should be handled. Consider using US Legal Forms to help you navigate the trust creation process smoothly.

Some other examples of common trust purchases are a new TV for the Beneficiary's room, a hotel room rental on vacation, a class at a local community college, or non-government funded medical expenses such as massage therapy. Things may get a little bit more confusing when it comes to paying for food and shelter.

A will or a living trust are two valuable tools used for estate planning. A will is important to avoid having your estate distributed in ance with Pennsylvania's laws. A living trust can essentially operate as a vault to hold several types of assets that you transfer into it.

The cost of setting up a trust in Pennsylvania varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

Living trusts in Pennsylvania You can select anyone to be your trustee, but most people choose themselves. A successor trustee is also named to step in after your death, take over management of the trust, and distribute the assets to the beneficiaries ing to the terms you have established.