Pennsylvania Does Not Recognize Grantor Trusts

Description

How to fill out Pennsylvania Amendment To Living Trust?

Drafting legal paperwork from scratch can sometimes be daunting. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re looking for a a more straightforward and more cost-effective way of preparing Pennsylvania Does Not Recognize Grantor Trusts or any other paperwork without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of over 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific templates carefully prepared for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly find and download the Pennsylvania Does Not Recognize Grantor Trusts. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and navigate the catalog. But before jumping directly to downloading Pennsylvania Does Not Recognize Grantor Trusts, follow these tips:

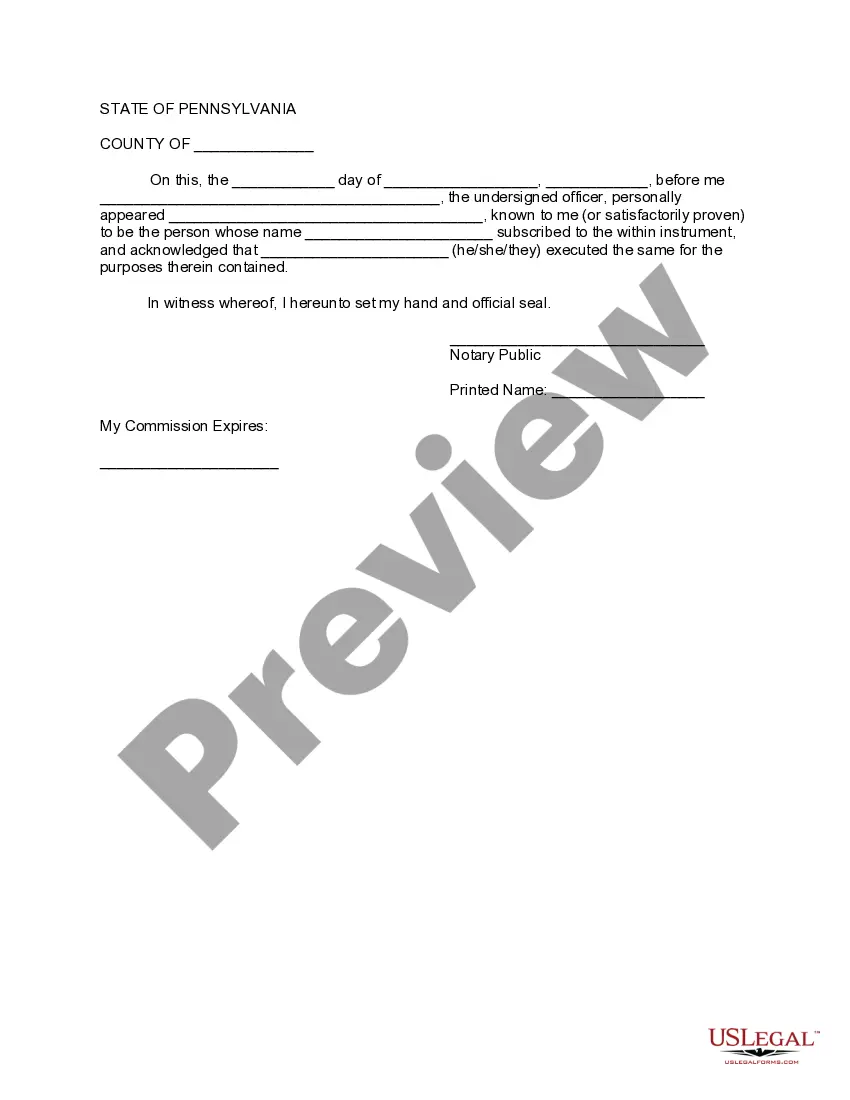

- Check the form preview and descriptions to make sure you have found the document you are looking for.

- Check if template you select conforms with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Pennsylvania Does Not Recognize Grantor Trusts.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and transform form completion into something easy and streamlined!

Form popularity

FAQ

Pennsylvania law differs from federal law regarding grantor trusts. Pennsylvania law imposes the income tax on grantor trusts ing to the same Pennsylvania personal income tax rules that apply to irrevocable trusts unless the grantor trust is a wholly revocable trust.

A non grantor trust is any trust that is not a grantor trust. This kind of trust affords no control or powers to the grantor. That means they're unable to revoke or change the terms of the trust or make changes to trust beneficiaries.

Most states ? but not all ? recognize the federal rules of grantor trust status for income tax purposes. Of note, Alabama, Tennessee, Pennsylvania, Louisiana, and the District of Columbia do not follow in all regards federal law with respect to grantor trust taxation.

The IRS treats all revocable living trusts as disregarded entities. [i] This means that even though a trust legally owns the taxable property or taxable income, it does not need to file a separate tax return. This is because the IRS disregards the trust entity.

Any trust that is not a grantor trust is considered a non-grantor trust. In this case, the person who set up the trust has no rights, interests, or powers over trust assets. Because they are taxed as a separate entity, non-grantor trusts are required to have their own TIN.