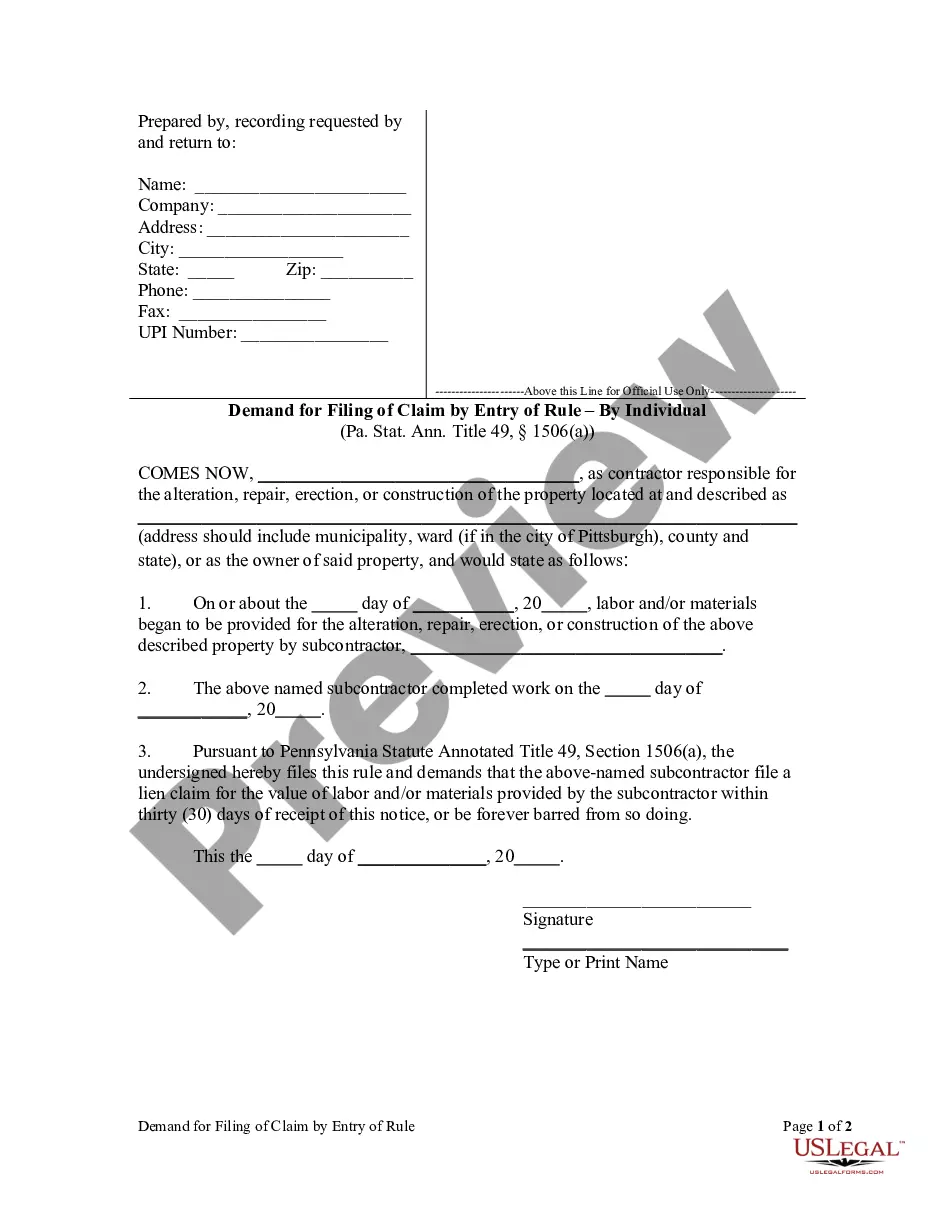

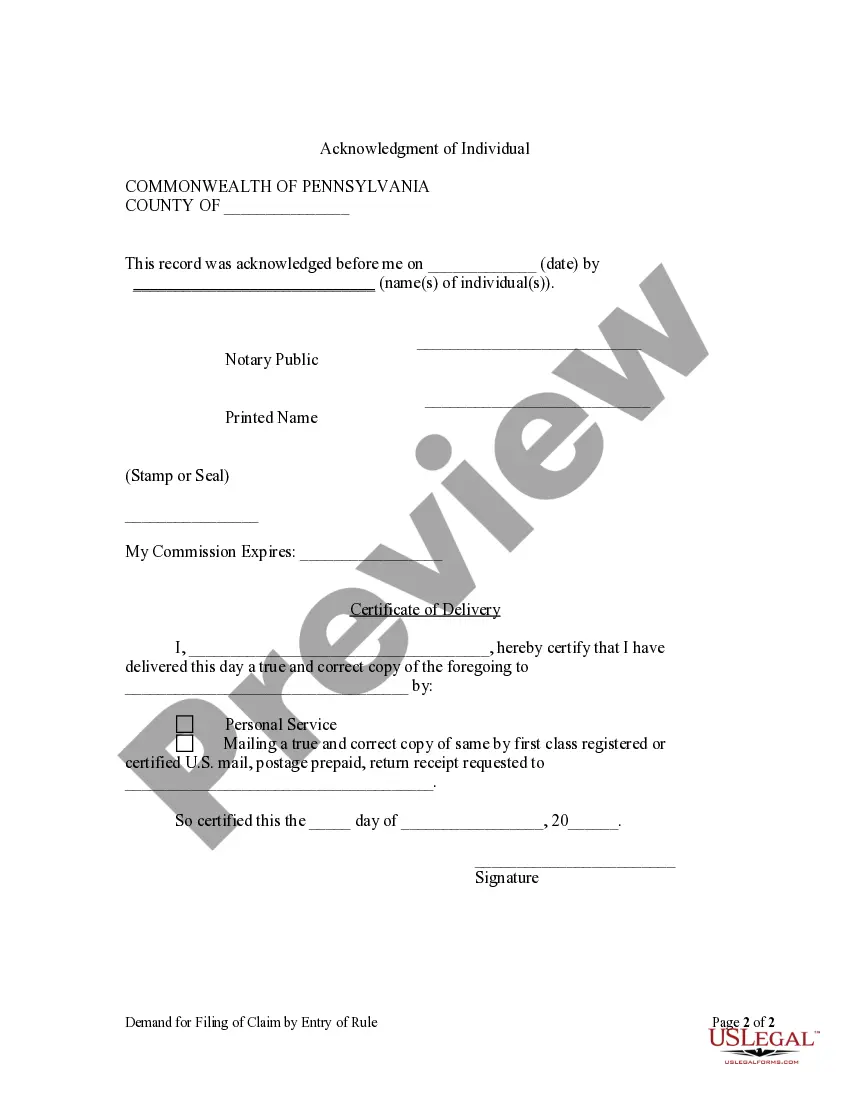

Pennsylvania law states that "At any time after the completion of the work by a subcontractor, any owner or contractor may file a rule or rules, as of course, in the court in which said claim may be filed; requiring the party named therein to file his claim within thirty (30) days after notice of said rule or be forever barred from so doing. The rule shall be entered by the prothonotary upon the judgment index and in the mechanic's lien docket. Failure to file a claim within the time specified shall operate to wholly defeat the right to do so. If a claim be filed, it shall be entered as of the court, term and number of the rule to file the same." This form serves to demand that the subcontractor proceed with his lien claim within thirty (30) days of receipt of the notice or be barred from filing the claim in the future.

Title: Understanding Pennsylvania Unemployment Biweekly Claims with State Farm Introduction: Pennsylvania's Unemployment Biweekly Claim is a vital process that ensures individuals who have recently lost their jobs receive financial assistance to help them during their period of unemployment. State Farm Insurance provides comprehensive coverage and support for individuals navigating this claim process. In this article, we will provide a detailed description of Pennsylvania unemployment biweekly claims with State Farm, including key information and procedures. Keywords: Pennsylvania unemployment biweekly claim, State Farm, unemployment benefits, unemployment compensation, claims process, financial assistance, job loss, coverage, support 1. Pennsylvania Unemployment Biweekly Claim Process: The Pennsylvania Unemployment Biweekly Claim is a recurring process where individuals file for unemployment benefits through the Pennsylvania Department of Labor & Industry, which works in collaboration with State Farm Insurance. This process involves submitting details of job loss, personal information, and work search activities for the respective claim period. Keywords: Pennsylvania Department of Labor & Industry, unemployment benefits, unemployment compensation, filing, job loss, personal information, work search activities 2. Key Features of State Farm's Involvement: State Farm Insurance plays a crucial role in supporting and managing Pennsylvania's unemployment biweekly claims. As a partner, they help eligible individuals receive the financial assistance they are entitled to during periods of unemployment. State Farm ensures that the process remains smooth and transparent, offering guidance and resources to those in need. Keywords: financial assistance, eligible individuals, partner, support, transparency, guidance, resources 3. Different Types of Pennsylvania Unemployment Biweekly Claims: While there may not be different types of Pennsylvania unemployment biweekly claims specifically with State Farm, it is important to note that various claim categories do exist within the Pennsylvania unemployment system. These categories include regular unemployment compensation (UC), Pandemic Unemployment Assistance (PUA), Extended Benefits (EX), Shared Work, Trade Adjustment Assistance (TAA), and more. State Farm works with individuals applying for these different types of claims, offering customized support. Keywords: regular unemployment compensation, Pandemic Unemployment Assistance, Extended Benefits, Shared Work, Trade Adjustment Assistance, claim categories, customized support Conclusion: Pennsylvania's Unemployment Biweekly Claim process with State Farm ensures individuals facing job loss have access to vital financial assistance during their period of unemployment. State Farm Insurance partners with the Pennsylvania Department of Labor & Industry, facilitating a seamless and efficient claims process. By understanding the details and keywords related to Pennsylvania unemployment biweekly claims with State Farm, individuals can navigate the system confidently and access the support they need.