Or Landlord Withholding Security Deposit

Description

How to fill out Oregon Residential Landlord Tenant Rental Lease Forms And Agreements Package?

It’s widely acknowledged that you cannot become a legal expert instantly, nor can you easily understand how to swiftly create Or Landlord Withholding Security Deposit without possessing a unique skill set.

Drafting legal documents is a lengthy process that demands specific training and expertise.

So why not entrust the creation of the Or Landlord Withholding Security Deposit to the experts.

You can access your documents again from the My documents tab at any time.

If you’re a returning client, you can simply Log In, and locate and download the template from the same tab. Regardless of the intent behind your documents—whether financial, legal, or personal—our platform has you covered. Try US Legal Forms today!

- Find the document you require by utilizing the search bar at the top of the webpage.

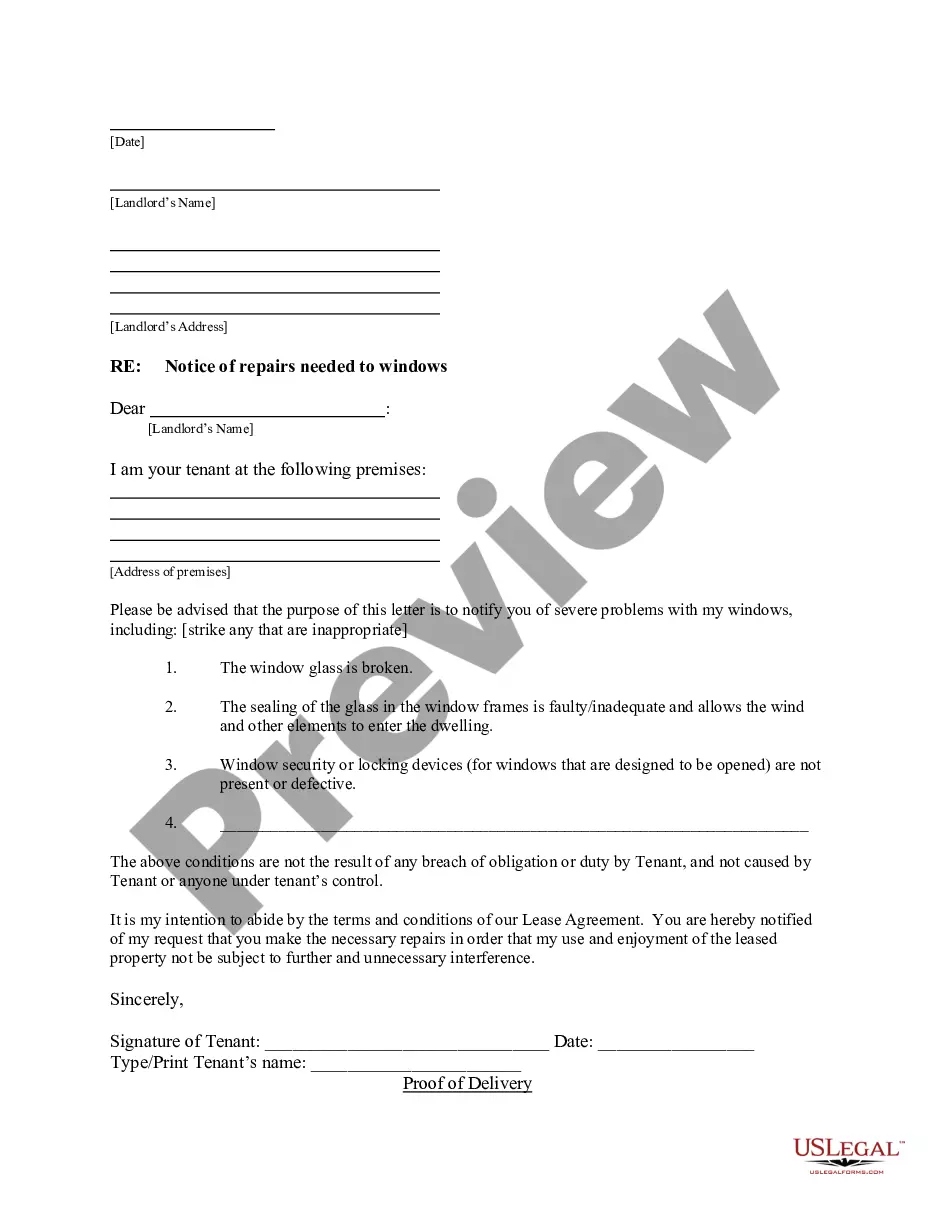

- View a preview (if this option is available) and read the accompanying description to ascertain if Or Landlord Withholding Security Deposit is what you need.

- Start your search anew if you need any additional template.

- Create a free account and choose a subscription plan to acquire the template.

- Select Buy now. Upon completion of the transaction, you can obtain the Or Landlord Withholding Security Deposit, fill it out, print it, and deliver or mail it to the relevant individuals or organizations.

Form popularity

FAQ

Deposits that are temporarily suspended from payment by the Deposit Insurer due, in part, to insufficient information during reimbursement.

Section 92.104 of the Texas Property Code describes what a landlord may deduct from a security deposit: Before returning a security deposit, the landlord may deduct from the deposit damages and charges for which the tenant is legally liable under the lease or as a result of breaching the lease.

The landlord must return a tenant's security deposit plus interest, less any damages rightfully withheld, within 45 days after the tenancy ends. If the landlord fails to do this without a good reason, you may sue for up to three times the withheld amount, plus reasonable attorney's fees.

A California bill turned law will limit how much landlords can charge for security deposits. Gov. Gavin Newsom signed Assembly Bill 12 into law, which states that security deposits can't be any larger than one month's rent, on Oct. 11. The law is slated to take effect on July 1, 2024.

Some landlords will charge tenants a nonrefundable fee, such as a fee for cleaning. Such fees are legal if clearly disclosed to the tenant as part of the leasing process. They represent part of the cost of leasing the unit and are different from a security deposit which is designed to ensure compliance with the lease.