Oregon Rental Application With Rent

Description

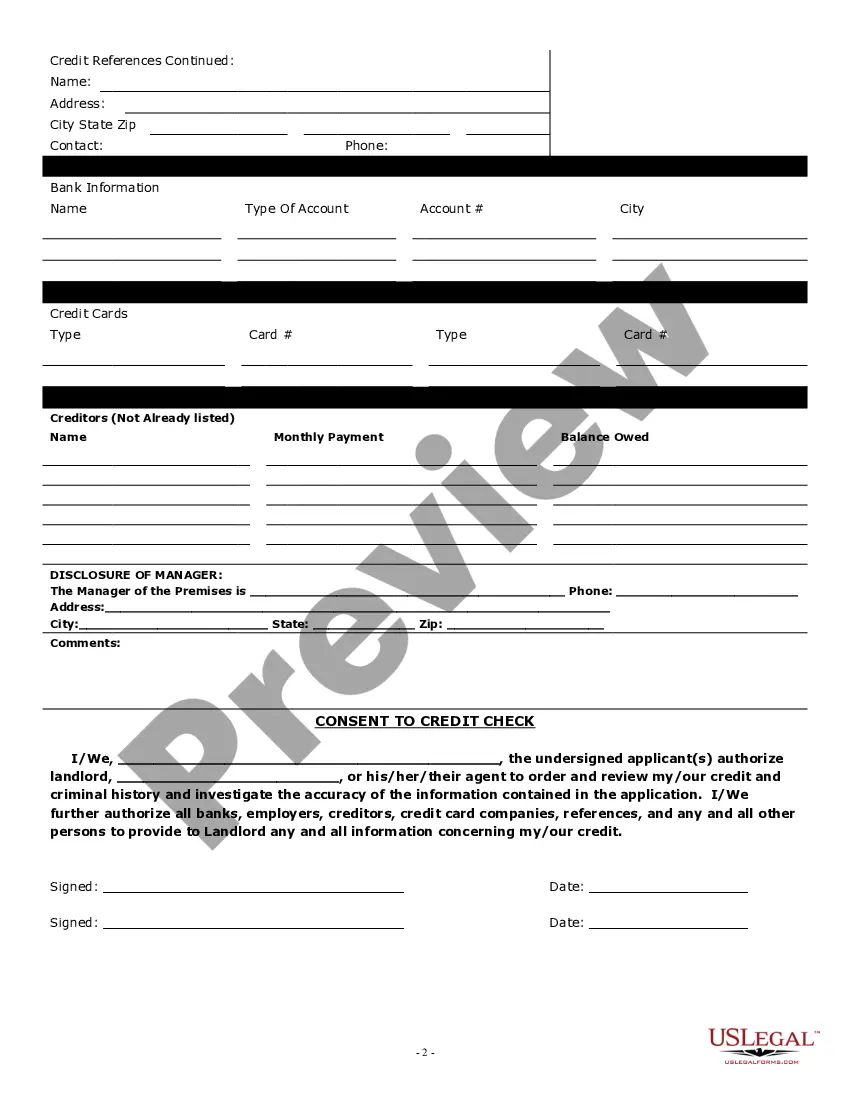

How to fill out Oregon Commercial Rental Lease Application Questionnaire?

Whether for business purposes or for personal affairs, everyone has to manage legal situations sooner or later in their life. Filling out legal documents requires careful attention, beginning from selecting the right form sample. For instance, if you pick a wrong edition of a Oregon Rental Application With Rent, it will be turned down when you send it. It is therefore essential to get a dependable source of legal documents like US Legal Forms.

If you have to obtain a Oregon Rental Application With Rent sample, stick to these simple steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Look through the form’s information to ensure it suits your situation, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect document, go back to the search function to locate the Oregon Rental Application With Rent sample you require.

- Download the template if it matches your needs.

- If you already have a US Legal Forms account, simply click Log in to access previously saved files in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Choose the file format you want and download the Oregon Rental Application With Rent.

- When it is saved, you can complete the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time seeking for the right template across the web. Utilize the library’s straightforward navigation to find the correct form for any situation.

Form popularity

FAQ

An Oregon month-to-month rental agreement is a lease that does not end unless notice of at least thirty (30) days is sent by either the landlord or tenant. A month-to-month lease continues in perpetuity unless amended or terminated by the landlord or tenant.

Dear (Landlord name), My name is (Your name) and I'm writing to you because I'm very interested in renting the home that's available at (Address or property name). I was particularly interested in this place because (Reasons you want to rent there).

INCOME CRITERIA Monthly gross income must be equal to 2 times stated rent*, or 2.5 times the monthly stated rent if the monthly rent amount is below the maximum monthly rent for a household earning no more than 80 percent of the median household income as published annually by the Portland Housing Bureau.

Dear (Landlord name), My name is (Your name), and I'm writing to you to express my interest in the home at (address or property name). I would love to live in this place because (reasons you want to rent the property). I currently am a tenant at (current address) but am ready to move because (reason for moving).

RPH will obtain a credit report and Criminal Background check and rental history for each applicant and co-signer 18 years of age or older. Reports supplied by applicants will not be accepted. Discharged bankruptcies are acceptable. A credit score below 625 could be denied or require additional deposit and co-signer.