Oregon Sale Real Or Withholding

Description

How to fill out Oregon Bargain And Sale Deed - Individual To Individual?

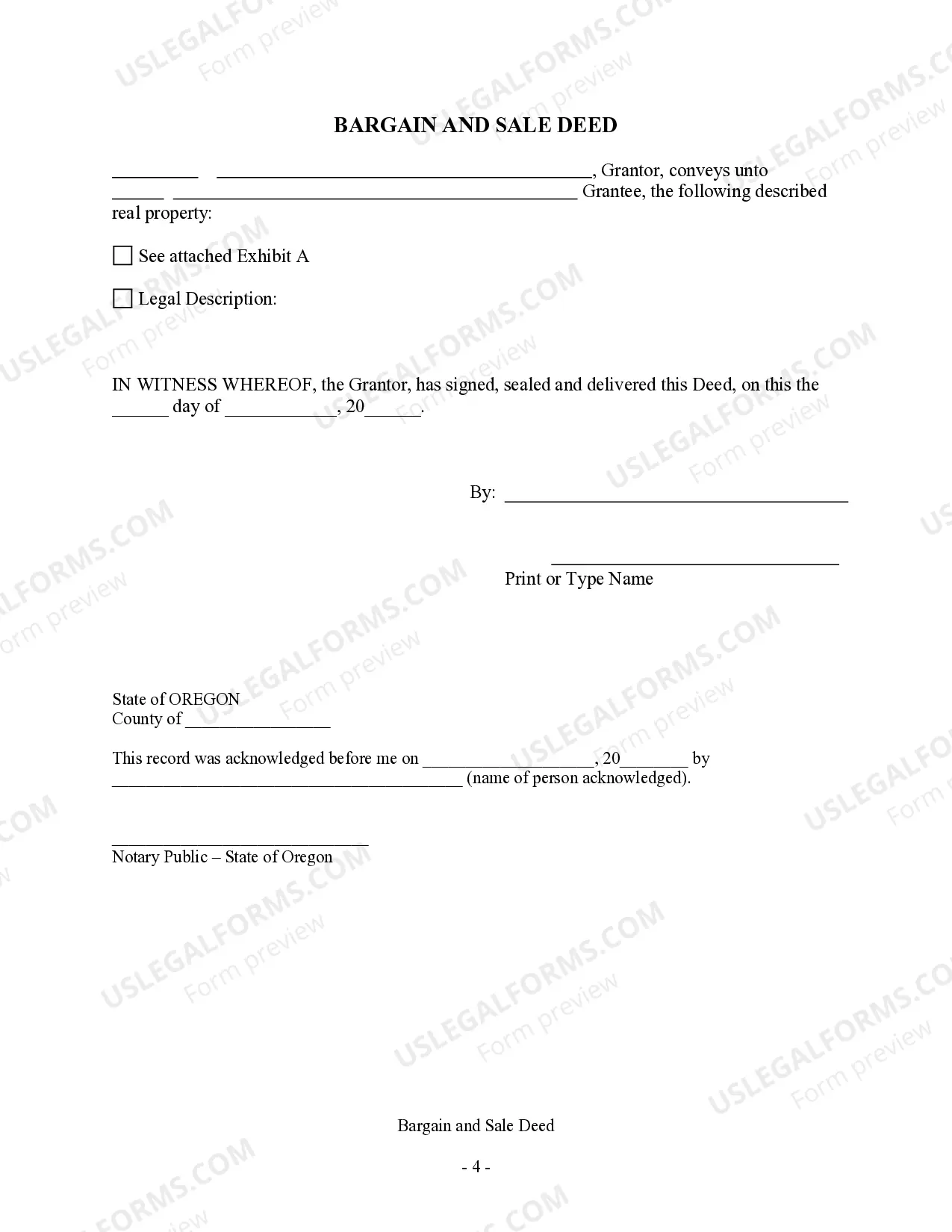

Whether for business purposes or for individual affairs, everyone has to handle legal situations sooner or later in their life. Completing legal paperwork requires careful attention, starting with picking the correct form sample. For example, if you pick a wrong version of the Oregon Sale Real Or Withholding, it will be declined once you submit it. It is therefore important to have a reliable source of legal documents like US Legal Forms.

If you need to get a Oregon Sale Real Or Withholding sample, follow these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Look through the form’s description to make sure it fits your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, go back to the search function to find the Oregon Sale Real Or Withholding sample you need.

- Get the template if it matches your requirements.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the profile registration form.

- Choose your transaction method: use a credit card or PayPal account.

- Choose the document format you want and download the Oregon Sale Real Or Withholding.

- After it is downloaded, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time seeking for the appropriate template across the web. Utilize the library’s simple navigation to get the correct template for any situation.

Form popularity

FAQ

Income Tax Brackets Head of HouseholdOregon Taxable IncomeRate$0 - $7,5004.75%$7,500 - $18,9006.75%$18,900 - $250,0008.75%1 more row

To claim exemption due to no tax liability, you must meet both of the following conditions: Last year you had the right to a refund of all Oregon tax withheld because you had no tax liability, and ? This year you expect a refund of all Oregon income tax withheld because you expect to have no tax liability.

Withholding Formula (Effective Pay Period 03, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $7,500$219.00 plus 4.75%Over $7,500 but not over $18,900$575.00 plus 6.75% of excess over $7,500Over $18,900$1,345.00 plus 8.75% of excess over $18,900

Oregon income tax withholding refers to the amount of Oregon personal income taxes that are withheld from the employees' paychecks to cover the anticipated Oregon tax liability for the year.

Four percent of the consideration (sales price); ? Eight percent of the gain that is includable in Oregon taxable income; or ? The net proceeds disbursed to the transferor.